Question: Note: The given information for this problem changes with each attempt. Please be sure to re-compute your work each time you submit an answer. A

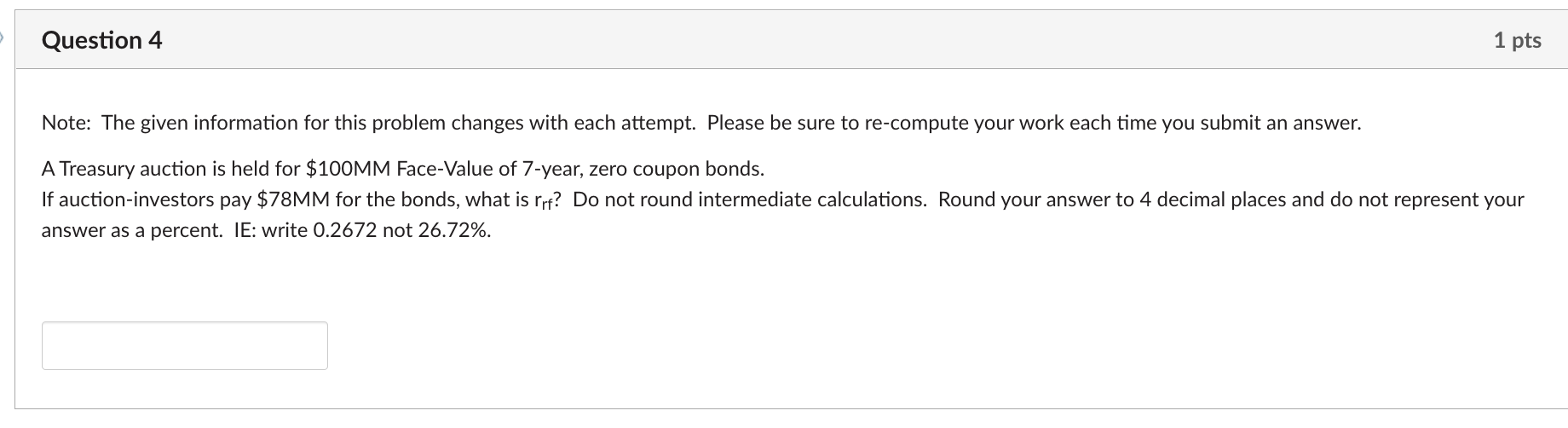

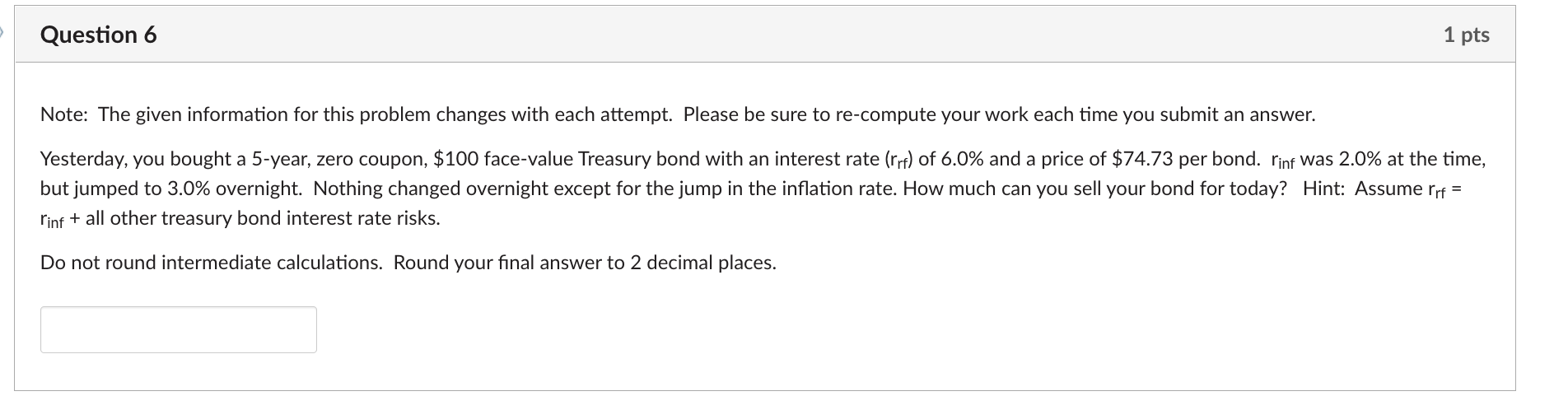

Note: The given information for this problem changes with each attempt. Please be sure to re-compute your work each time you submit an answer. A Treasury auction is held for $100MM Face-Value of 7 -year, zero coupon bonds. answer as a percent. IE: write 0.2672 not 26.72%. Note: The given information for this problem changes with each attempt. Please be sure to re-compute your work answer. Yesterday, you bought a 5-year, zero coupon, $100 face-value Treasury bond with an interest rate (rrf) of 6.0% and a price of $74.73 per bond. rinf was 2.0% at the time, but jumped to 3.0% overnight. Nothing changed overnight except for the jump in the inflation rate. How much can you sell your rinf+ all other treasury bond interest rate risks. Do not round intermediate calculations. Round your final answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts