Question: Note: the green boxes are accurate figures. If the given solution does not align with these, then it is incorrect Shamrock Company sponsors a defined

Note: the green boxes are accurate figures. If the given solution does not align with these, then it is incorrect

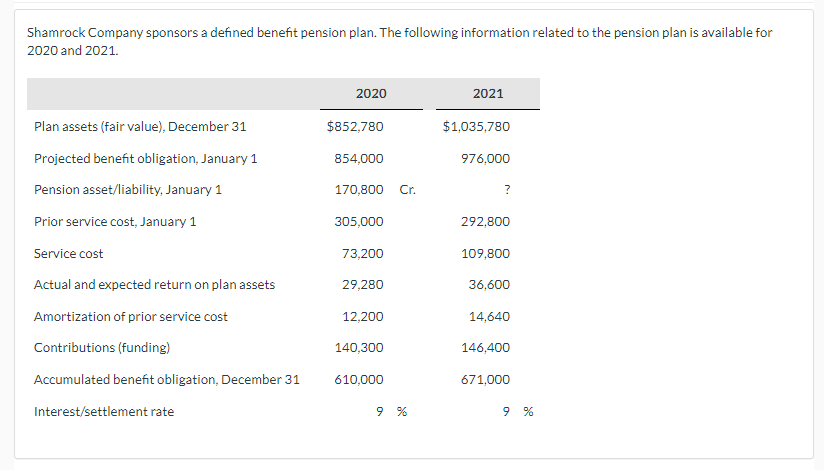

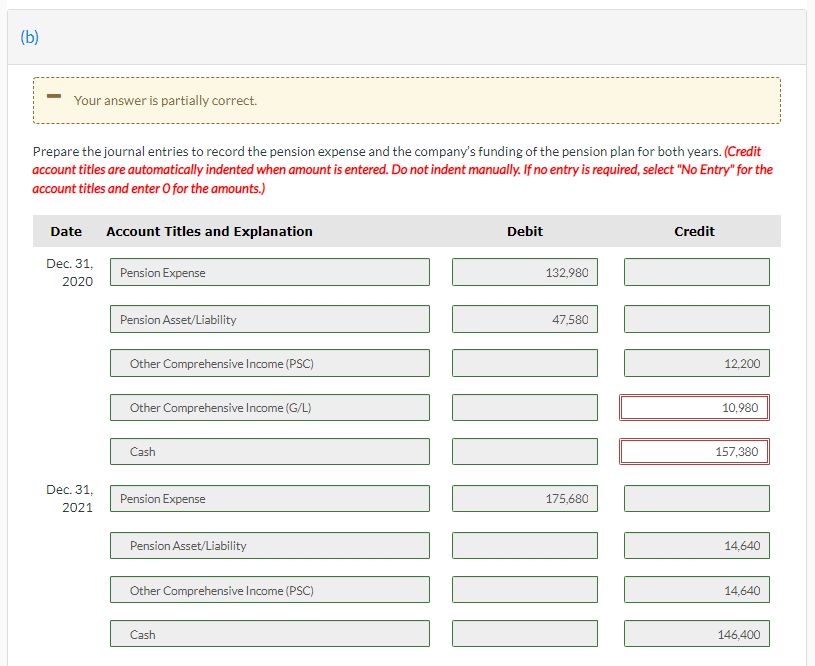

Shamrock Company sponsors a defined benefit pension plan. The following information related to the pension plan is available for 2020 and 2021. 2020 2021 Plan assets (fair value), December 31 $852,780 $1,035,780 Projected benefit obligation, January 1 854,000 976,000 Pension asset/liability, January 1 170,800 Cr. ? 305,000 292,800 Prior service cost, January 1 Service cost 73,200 109,800 29,280 36,600 12,200 14,640 Actual and expected return on plan assets Amortization of prior service cost Contributions (funding) Accumulated benefit obligation, December 31 140,300 146,400 610,000 671,000 Interest/settlement rate 9 % 9 % (b) Your answer is partially correct. Prepare the journal entries to record the pension expense and the company's funding of the pension plan for both years. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Pension Expense 132,980 Pension Asset/Liability 47.580 Other Comprehensive Income (PSC) 12,200 Other Comprehensive Income (G/L) 10,980 19 Cash 157,380 Dec. 31, 2021 Pension Expense 175,680 Pension Asset/Liability 14,640 Other Comprehensive Income (PSC) 14.640 Cash 146,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts