Question: (Note: There are 4 more like the second picture) Using the Trial Balance provided for Simone Dry Cleaners as of the close of business March

(Note: There are 4 more like the second picture)

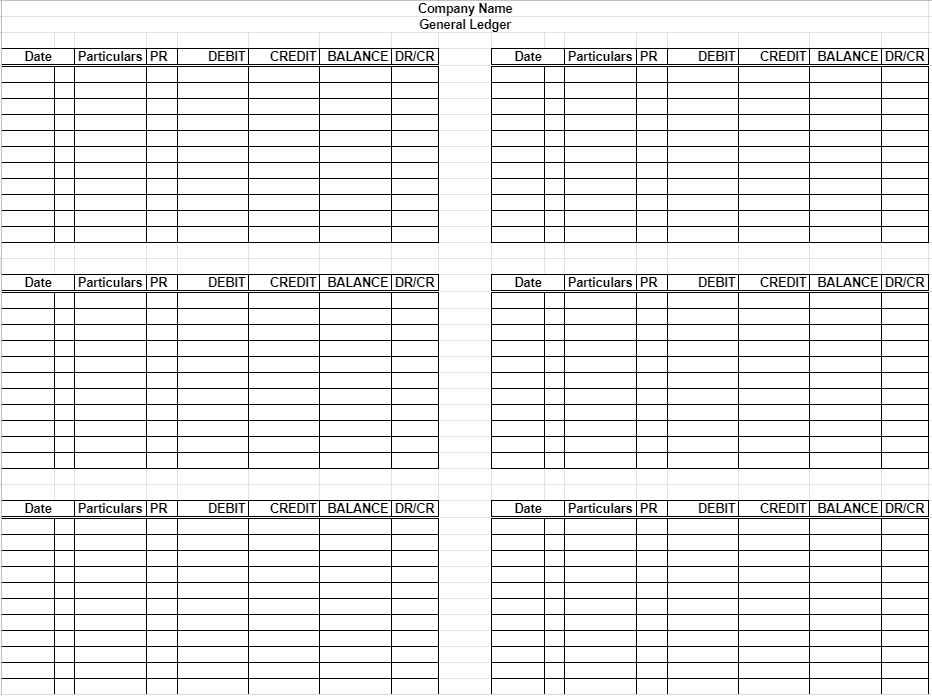

Using the Trial Balance provided for Simone Dry Cleaners as of the close of business March 31, 2020, open the ledger for Simone Dry Cleaners for the month of April, 2020. Provide appropriate numbers for each account

| Account | Debit | Credit |

|---|---|---|

| Cash | $53,652 | |

| Accounts Receivable | 9,870 | |

| Office Supplies | 900 | |

| Cleaning Supplies | 12,350 | |

| Equipment | 34,508 | |

| Vans | 93,490 | |

| Accounts Payable | $5,370 | |

| Short Term Bank Loan | 12,469 | |

| Long Term Trust Co. Loan | 112,221 | |

| D. Simone, Capital | 71,793 | |

| D. Simone, Drawings | 4,800 | |

| Cleaning Revenue | 98,740 | |

| Advertising Expense | 2,820 | |

| Donations Expense | 2,300 | |

| Office Cleaning Expense | 9,400 | |

| Rent Expense | 18,400 | |

| Utilities Expense | 18,408 | |

| Van Expense | 8,905 | |

| Wages Expense | 29,080 | |

| Interest Expense | 1,040 | |

| General Expense | 670 | |

| $300,593 | $300,593 |

In the table below, go through each activity, and enter an appropriate Source Document type and number (for example, CH #5 for a cash disbursement). Be sure to remember that any source documents issued by the company must be numbered sequentially.

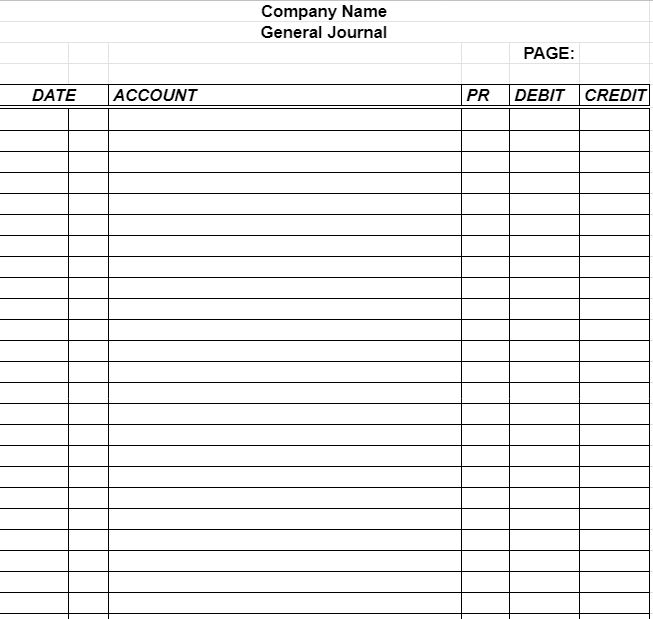

Journalize the transactions for the month of April, 2020 for Simone Cleaners.

| Date | Activity | Source # |

|---|---|---|

| 3 | Owner invested an additional $4,300 in business. | |

| 3 | Purchased $4,200 worth of cleaning supplies on account from Eastern Dry Cleaning Suppliers Ltd. | |

| 3 | Paid $3,070 for the rent for the month. | |

| 4 | Paid the electricity expense, $12,435. | |

| 5 | Donated $250 to the local amateur hockey club for their end-of-season banquet. | |

| 5 | Paid the weekly wages of $6,462. | |

| 6 | Paid for radio advertising, $450. | |

| 7 | Paid $1,400 on account to Eastern Dry Cleaning Suppliers Ltd. | |

| 7 | Received $480 on account from Cara Caterers. | |

| 7 | Cleaning services sold on account to Cara Caterers for the week were $430, and for cash were $25,904. | |

| 10 | Paid $1,309 for gas and tune ups for the vans. | |

| 11 | Paid $1,400 for television ads. | |

| 12 | Purchased postage stamps for $45. | |

| 12 | Paid the weekly wages, $6,462. | |

| 12 | Received $220 on account from Cara Caterers | |

| 13 | Signed a contract to perform the cleaning for the new Best City Hotel, $2,300. | |

| 14 | Paid the owner $45 for office supplies purchased with the owner's own funds. | |

| 14 | Cleaning services sold on account to Cara Caterers for the week were $430, and for cash were $22,804. | |

| 17 | Paid $4,800 on the Trust Company loan. This represents interest of $935 and the rest reduces the loan itself. | |

| 18 | Paid $140 to the local municipality for renewal of the business of the business license. | |

| 19 | Paid the weekly wages of $6,462. | |

| 20 | Cleaning services sold on account to Cara Caterers for the week were $430, and for cash were $27,211. | |

| 20 | Paid $4,500 for a fax machine. | |

| 21 | Paid $132 for dryer repairs. | |

| 22 | Purchased $1,390 worth of cleaning supplies on account. | |

| 24 | Paid $225 fee for the owner to attend a business conference. | |

| 25 | Paid $1,982 on account to Dow Chemicals. | |

| 26 | Paid the weekly wages of $6,462. | |

| 27 | Cleaning services sold on account to Cara Caterers for the week were $430, and for cash were $29,222. | |

| 27 | Received $1,200 from the local hockey team for uniform cleaning. | |

| 28 | Paid $3,200 to the owner for his personal use. | |

| 28 | Paid $940 for monthly office cleaning. |

Post these journal entries to the General Ledger for Simone Dry Cleaners. Be sure to complete all the posting references.

Prepare a Trial Balance on a new Tab for April 30, 2020.

Prepare an Income Statement for the month of April, and a Balance Sheet as of April 30, in Report Form, with an Expanded Equity Section.

Please provide clear and readable answers, I will upvote!

Company Name General Ledger \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \multicolumn{2}{c|}{ Date } & Particulars & PR & DEBIT & CREDIT & BALANCE & DR/CR \\ \hline \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} Company Name General Ledger \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \multicolumn{2}{c|}{ Date } & Particulars & PR & DEBIT & CREDIT & BALANCE & DR/CR \\ \hline \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts