Question: Note: This is a case study question Question Question Lizer is a reputable pharmaceutical firm in new drugs and vaccine development. Its market value today

Note: This is a case study question

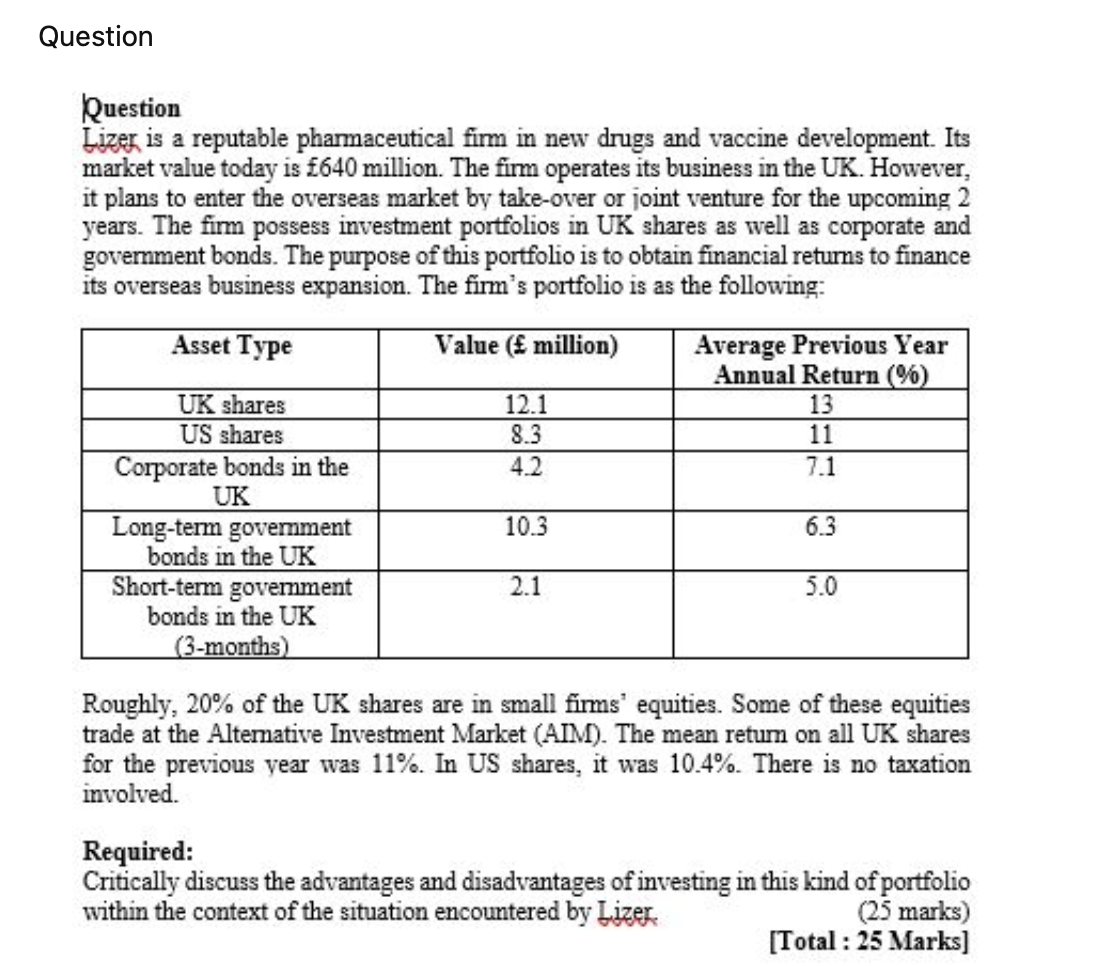

Question Question Lizer is a reputable pharmaceutical firm in new drugs and vaccine development. Its market value today is 640 million. The firm operates its business in the UK. However, it plans to enter the overseas market by take-over or joint venture for the upcoming 2 years. The firm possess investment portfolios in UK shares as well as corporate and government bonds. The purpose of this portfolio is to obtain financial returns to finance its overseas business expansion. The firm's portfolio is as the following: Asset Type Value ( million) 12.1 8.3 4.2 Average Previous Year Annual Return (%) 13 11 7.1 UK shares US shares Corporate bonds in the UK Long-term government bonds in the UK Short-term government bonds in the UK (3-months) 10.3 6.3 2.1 5.0 Roughly, 20% of the UK shares are in small firs' equities. Some of these equities trade at the Altemative Investment Market (AIM). The mean retum on all UK shares for the previous year was 11%. In US shares, it was 10.4%. There is no taxation involved. Required: Critically discuss the advantages and disadvantages of investing in this kind of portfolio within the context of the situation encountered by Lizer (25 marks) [Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts