Question: Note: This is a question form the capital budgeting chapter (Ch. 10)! Assume that you are looking at an investment opportunity that offers an annual

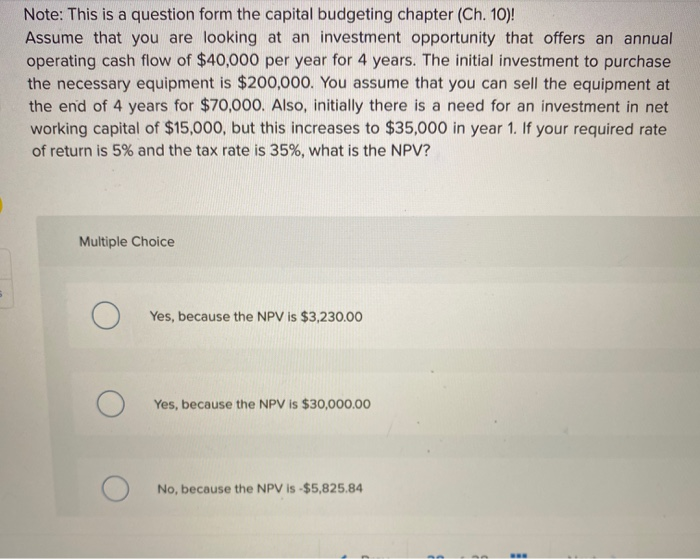

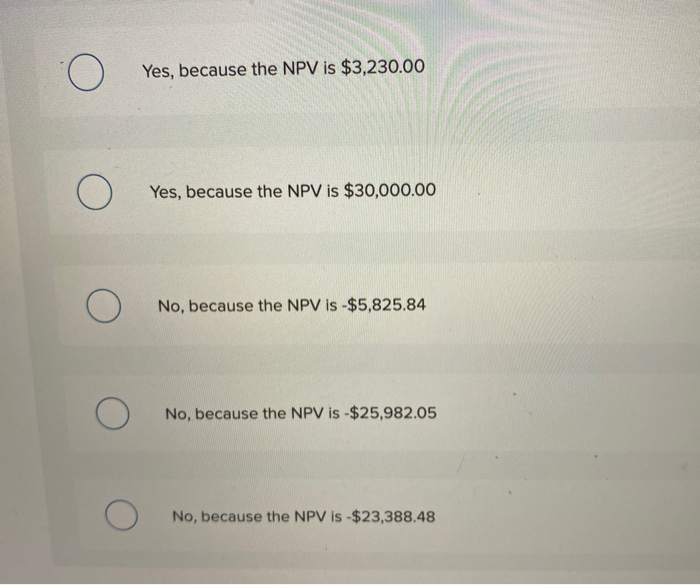

Note: This is a question form the capital budgeting chapter (Ch. 10)! Assume that you are looking at an investment opportunity that offers an annual operating cash flow of $40,000 per year for 4 years. The initial investment to purchase the necessary equipment is $200,000. You assume that you can sell the equipment at the end of 4 years for $70,000. Also, initially there is a need for an investment in net working capital of $15,000, but this increases to $35,000 in year 1. If your required rate of return is 5% and the tax rate is 35%, what is the NPV? Multiple Choice Yes, because the NPV is $3,230,00 Yes, because the NPV is $30,000.00 No, because the NPV is $5,825.84 C) Yes, because the NPV is $3,230.00 Yes, because the NPV is $30,000.00 No, because the NPV is -$5,825.84 No, because the NPV is -$25,982.05 No, because the NPV is -$23,388.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts