Question: Note: This problem is different than already posted results. Case Overview: You are an intelligent ten-year-old child (4th grader) who wants to start a lemonade

Note: This problem is different than already posted results.

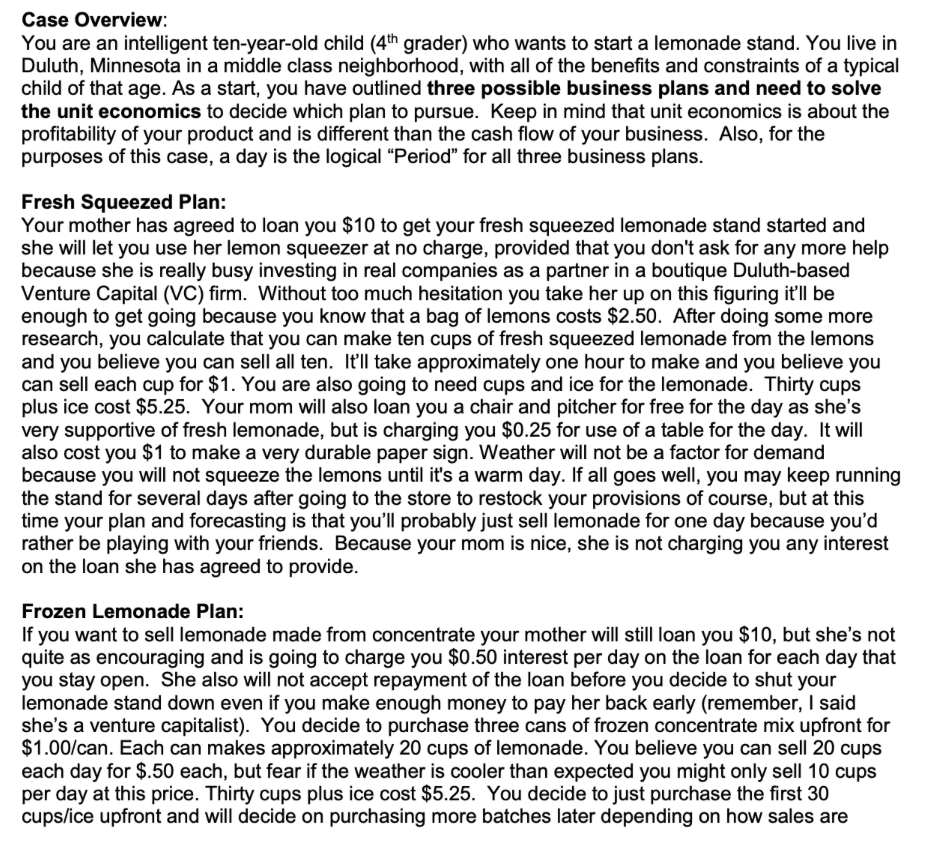

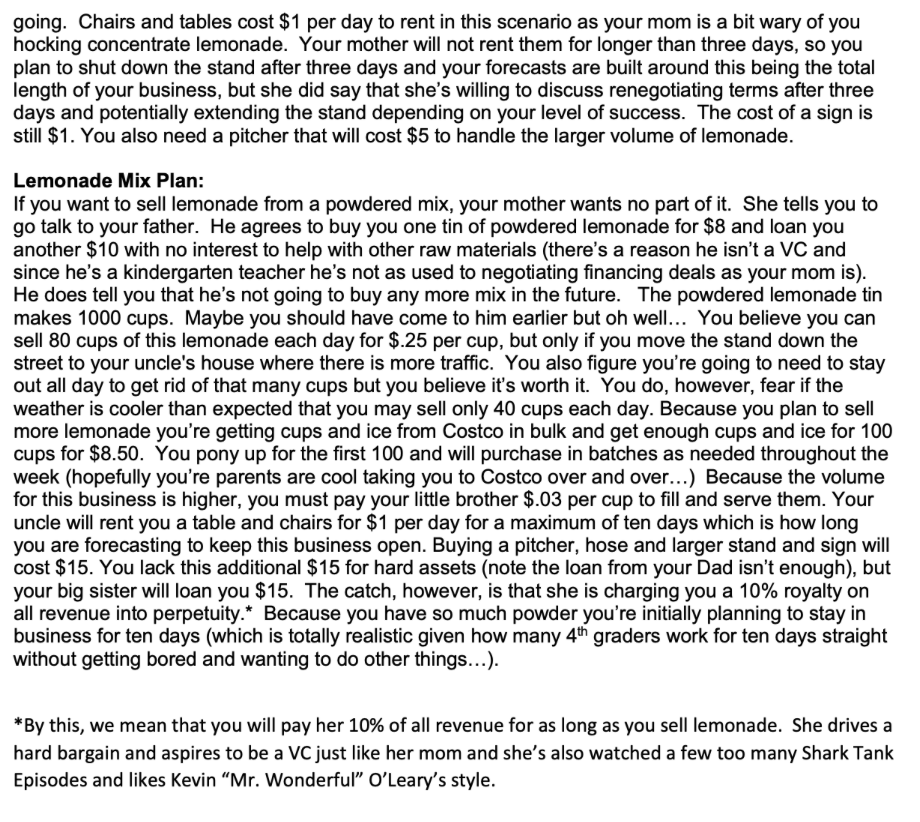

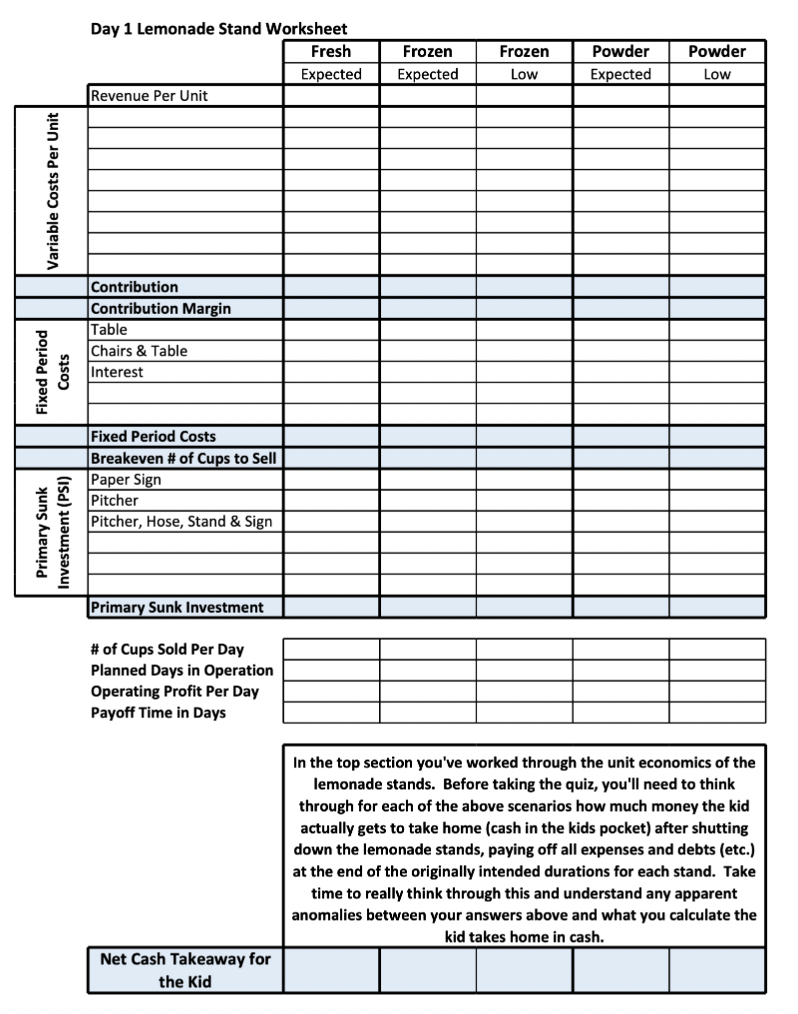

Case Overview: You are an intelligent ten-year-old child (4th grader) who wants to start a lemonade stand. You live in Duluth, Minnesota in a middle class neighborhood, with all of the benefits and constraints of a typical child of that age. As a start, you have outlined three possible business plans and need to solve the unit economics to decide which plan to pursue. Keep in mind that unit economics is about the profitability of your product and is different than the cash flow of your business. Also, for the purposes of this case, a day is the logical Period for all three business plans. Fresh Squeezed Plan: Your mother has agreed to loan you $10 to get your fresh squeezed lemonade stand started and she will let you use her lemon squeezer at no charge, provided that you don't ask for any more help because she is really busy investing in real companies as a partner in a boutique Duluth-based Venture Capital (VC) firm. Without too much hesitation you take her up on this figuring it'll be enough to get going because you know that a bag of lemons costs $2.50. After doing some more research, you calculate that you can make ten cups of fresh squeezed lemonade from the lemons and you believe you can sell all ten. It'll take approximately one hour to make and you believe you can sell each cup for $1. You are also going to need cups and ice for the lemonade. Thirty cups plus ice cost $5.25. Your mom will also loan you a chair and pitcher for free for the day as she's very supportive of fresh lemonade, but is charging you $0.25 for use of a table for the day. It will also cost you $1 to make a very durable paper sign. Weather will not be a factor for demand because you will not squeeze the lemons until it's a warm day. If all goes well, you may keep running the stand for several days after going to the store to restock your provisions of course, but at this time your plan and forecasting is that you'll probably just sell lemonade for one day because you'd rather be playing with your friends. Because your mom is nice, she is not charging you any interest on the loan she has agreed to provide. Frozen Lemonade Plan: If you want to sell lemonade made from concentrate your mother will still loan you $10, but she's not quite as encouraging and is going to charge you $0.50 interest per day on the loan for each day that you stay open. She also will not accept repayment of the loan before you decide to shut your lemonade stand down even if you make enough money to pay her back early (remember, I said she's a venture capitalist). You decide to purchase three cans of frozen concentrate mix upfront for $1.00/can. Each can makes approximately 20 cups of lemonade. You believe you can sell 20 cups each day for $.50 each, but fear if the weather is cooler than expected you might only sell 10 cups per day at this price. Thirty cups plus ice cost $5.25. You decide to just purchase the first 30 cups/ice upfront and will decide on purchasing more batches later depending on how sales are going. Chairs and tables cost $1 per day to rent in this scenario as your mom is a bit wary of you hocking concentrate lemonade. Your mother will not rent them for longer than three days, so you plan to shut down the stand after three days and your forecasts are built around this being the total length of your business, but she did say that she's willing to discuss renegotiating terms after three days and potentially extending the stand depending on your level of success. The cost of a sign is still $1. You also need a pitcher that will cost $5 to handle the larger volume of lemonade. Lemonade Mix Plan: If you want to sell lemonade from a powdered mix, your mother wants no part of it. She tells you to go talk to your father. He agrees to buy you one tin of powdered lemonade for $8 and loan you another $10 with no interest to help with other raw materials (there's a reason he isn't a VC and since he's a kindergarten teacher he's not as used to negotiating financing deals as your mom is). He does tell you that he's not going to buy any more mix in the future. The powdered lemonade tin makes 1000 cups. Maybe you should have come to him earlier but oh well... You believe you can sell 80 cups of this lemonade each day for $.25 per cup, but only if you move the stand down the street to your uncle's house where there is more traffic. You also figure you're going to need to stay out all day to get rid of that many cups but you believe it's worth it. You do, however, fear if the weather is cooler than expected that you may sell only 40 cups each day. Because you plan to sell more lemonade you're getting cups and ice from Costco in bulk and get enough cups and ice for 100 cups for $8.50. You pony up for the first 100 and will purchase in batches as needed throughout the week (hopefully you're parents are cool taking you to Costco over and over...) Because the volume for this business is higher, you must pay your little brother $.03 per cup to fill and serve them. Your uncle will rent you a table and chairs for $1 per day for a maximum of ten days which is how long you are forecasting to keep this business open. Buying a pitcher, hose and larger stand and sign will cost $15. You lack this additional $15 for hard assets (note the loan from your Dad isn't enough), but your big sister will loan you $15. The catch, however, is that she is charging you a 10% royalty on all revenue into perpetuity.* Because you have so much powder you're initially planning to stay in business for ten days (which is totally realistic given how many 4th graders work for ten days straight without getting bored and wanting to do other things...). * By this, we mean that you will pay her 10% of all revenue for as long as you sell lemonade. She drives a hard bargain and aspires to be a VC just like her mom and she's also watched a few too many Shark Tank Episodes and likes Kevin Mr. Wonderful O'Leary's style. Day 1 Lemonade Stand Worksheet Fresh Expected Revenue Per Unit Frozen Expected Frozen Low Powder Expected Powder Low Variable Costs Per Unit Contribution Contribution Margin Table Chairs & Table Interest Fixed Period Costs Fixed Period Costs Breakeven # of Cups to Sell Paper Sign Pitcher Pitcher, Hose, Stand & Sign Primary Sunk Investment (PSI) Primary Sunk Investment # of Cups Sold Per Day Planned Days in Operation Operating Profit Per Day Payoff Time in Days In the top section you've worked through the unit economics of the lemonade stands. Before taking the quiz, you'll need to think through for each of the above scenarios how much money the kid actually gets to take home (cash in the kids pocket) after shutting down the lemonade stands, paying off all expenses and debts (etc.) at the end of the originally intended durations for each stand. Take time to really think through this and understand any apparent anomalies between your answers above and what you calculate the kid takes home in cash. Net Cash Takeaway for the Kid Case Overview: You are an intelligent ten-year-old child (4th grader) who wants to start a lemonade stand. You live in Duluth, Minnesota in a middle class neighborhood, with all of the benefits and constraints of a typical child of that age. As a start, you have outlined three possible business plans and need to solve the unit economics to decide which plan to pursue. Keep in mind that unit economics is about the profitability of your product and is different than the cash flow of your business. Also, for the purposes of this case, a day is the logical Period for all three business plans. Fresh Squeezed Plan: Your mother has agreed to loan you $10 to get your fresh squeezed lemonade stand started and she will let you use her lemon squeezer at no charge, provided that you don't ask for any more help because she is really busy investing in real companies as a partner in a boutique Duluth-based Venture Capital (VC) firm. Without too much hesitation you take her up on this figuring it'll be enough to get going because you know that a bag of lemons costs $2.50. After doing some more research, you calculate that you can make ten cups of fresh squeezed lemonade from the lemons and you believe you can sell all ten. It'll take approximately one hour to make and you believe you can sell each cup for $1. You are also going to need cups and ice for the lemonade. Thirty cups plus ice cost $5.25. Your mom will also loan you a chair and pitcher for free for the day as she's very supportive of fresh lemonade, but is charging you $0.25 for use of a table for the day. It will also cost you $1 to make a very durable paper sign. Weather will not be a factor for demand because you will not squeeze the lemons until it's a warm day. If all goes well, you may keep running the stand for several days after going to the store to restock your provisions of course, but at this time your plan and forecasting is that you'll probably just sell lemonade for one day because you'd rather be playing with your friends. Because your mom is nice, she is not charging you any interest on the loan she has agreed to provide. Frozen Lemonade Plan: If you want to sell lemonade made from concentrate your mother will still loan you $10, but she's not quite as encouraging and is going to charge you $0.50 interest per day on the loan for each day that you stay open. She also will not accept repayment of the loan before you decide to shut your lemonade stand down even if you make enough money to pay her back early (remember, I said she's a venture capitalist). You decide to purchase three cans of frozen concentrate mix upfront for $1.00/can. Each can makes approximately 20 cups of lemonade. You believe you can sell 20 cups each day for $.50 each, but fear if the weather is cooler than expected you might only sell 10 cups per day at this price. Thirty cups plus ice cost $5.25. You decide to just purchase the first 30 cups/ice upfront and will decide on purchasing more batches later depending on how sales are going. Chairs and tables cost $1 per day to rent in this scenario as your mom is a bit wary of you hocking concentrate lemonade. Your mother will not rent them for longer than three days, so you plan to shut down the stand after three days and your forecasts are built around this being the total length of your business, but she did say that she's willing to discuss renegotiating terms after three days and potentially extending the stand depending on your level of success. The cost of a sign is still $1. You also need a pitcher that will cost $5 to handle the larger volume of lemonade. Lemonade Mix Plan: If you want to sell lemonade from a powdered mix, your mother wants no part of it. She tells you to go talk to your father. He agrees to buy you one tin of powdered lemonade for $8 and loan you another $10 with no interest to help with other raw materials (there's a reason he isn't a VC and since he's a kindergarten teacher he's not as used to negotiating financing deals as your mom is). He does tell you that he's not going to buy any more mix in the future. The powdered lemonade tin makes 1000 cups. Maybe you should have come to him earlier but oh well... You believe you can sell 80 cups of this lemonade each day for $.25 per cup, but only if you move the stand down the street to your uncle's house where there is more traffic. You also figure you're going to need to stay out all day to get rid of that many cups but you believe it's worth it. You do, however, fear if the weather is cooler than expected that you may sell only 40 cups each day. Because you plan to sell more lemonade you're getting cups and ice from Costco in bulk and get enough cups and ice for 100 cups for $8.50. You pony up for the first 100 and will purchase in batches as needed throughout the week (hopefully you're parents are cool taking you to Costco over and over...) Because the volume for this business is higher, you must pay your little brother $.03 per cup to fill and serve them. Your uncle will rent you a table and chairs for $1 per day for a maximum of ten days which is how long you are forecasting to keep this business open. Buying a pitcher, hose and larger stand and sign will cost $15. You lack this additional $15 for hard assets (note the loan from your Dad isn't enough), but your big sister will loan you $15. The catch, however, is that she is charging you a 10% royalty on all revenue into perpetuity.* Because you have so much powder you're initially planning to stay in business for ten days (which is totally realistic given how many 4th graders work for ten days straight without getting bored and wanting to do other things...). * By this, we mean that you will pay her 10% of all revenue for as long as you sell lemonade. She drives a hard bargain and aspires to be a VC just like her mom and she's also watched a few too many Shark Tank Episodes and likes Kevin Mr. Wonderful O'Leary's style. Day 1 Lemonade Stand Worksheet Fresh Expected Revenue Per Unit Frozen Expected Frozen Low Powder Expected Powder Low Variable Costs Per Unit Contribution Contribution Margin Table Chairs & Table Interest Fixed Period Costs Fixed Period Costs Breakeven # of Cups to Sell Paper Sign Pitcher Pitcher, Hose, Stand & Sign Primary Sunk Investment (PSI) Primary Sunk Investment # of Cups Sold Per Day Planned Days in Operation Operating Profit Per Day Payoff Time in Days In the top section you've worked through the unit economics of the lemonade stands. Before taking the quiz, you'll need to think through for each of the above scenarios how much money the kid actually gets to take home (cash in the kids pocket) after shutting down the lemonade stands, paying off all expenses and debts (etc.) at the end of the originally intended durations for each stand. Take time to really think through this and understand any apparent anomalies between your answers above and what you calculate the kid takes home in cash. Net Cash Takeaway for the Kid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts