Question: Note: This problem is for the 2 0 2 3 tax year. On November 1 , 2 0 1 2 , Janet Morton and Kim

Note: This problem is for the tax year.

On November Janet Morton and Kim Wong formed Pet Kingdom, Inc., to sell pets and pet supplies. Pertinent information regarding Pet Kingdom is summarized as follows:

Pet Kingdom's business address is Northwest Parkway, Dallas, TX ; its telephone number is ; and its email address is petkingdom@pki.com.

The employer identification number is and the principal business activity code is

Janet and Kim each own of the common stock; Janet is president and Kim is vice president of the company. No other class of stock is authorized.

Both Janet and Kim are fulltime employees of Pet Kingdom. Janet's Social Security number is and Kim's Social Security number is

Pet Kingdom is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market method. Pet Kingdom uses the straightline method of depreciation for book purposes and accelerated depreciation MACRS for tax purposes.

During the corporation distributed cash dividends of $

The corporation did not own or use any digital assets during the year.

Pet Kingdom's financial statements for are shown below.

Income StatementIncomeGross sales$Sales returns and allowancesNet sales$Cost of goods soldGross profit$Dividends received from stockinvestments in lessthan

owned US corporationsInterest income:State bonds$Certificates of depositTotal income$ExpensesSalariesofficers:Janet Morton$Kim Wong$Salariesclerical and salesTaxes state local, and payrollRepairs and maintenanceInterest expense:Loan to purchase state bonds$Other business loansAdvertisingRental expenseDepreciationCharitable contributions cashEmployee benefit programsPremiums on term life insurancepolicies on lives of Janet Morton and

Kim Wong; Pet Kingdom is the

designated beneficiaryTotal expensesNet income before taxes$Federal income taxNet income per books$ Depreciation for tax purposes is $ You are not provided enough detailed data to complete a Form depreciation If you solve this problem using Intuit ProConnect, enter the amount of depreciation on line of Form

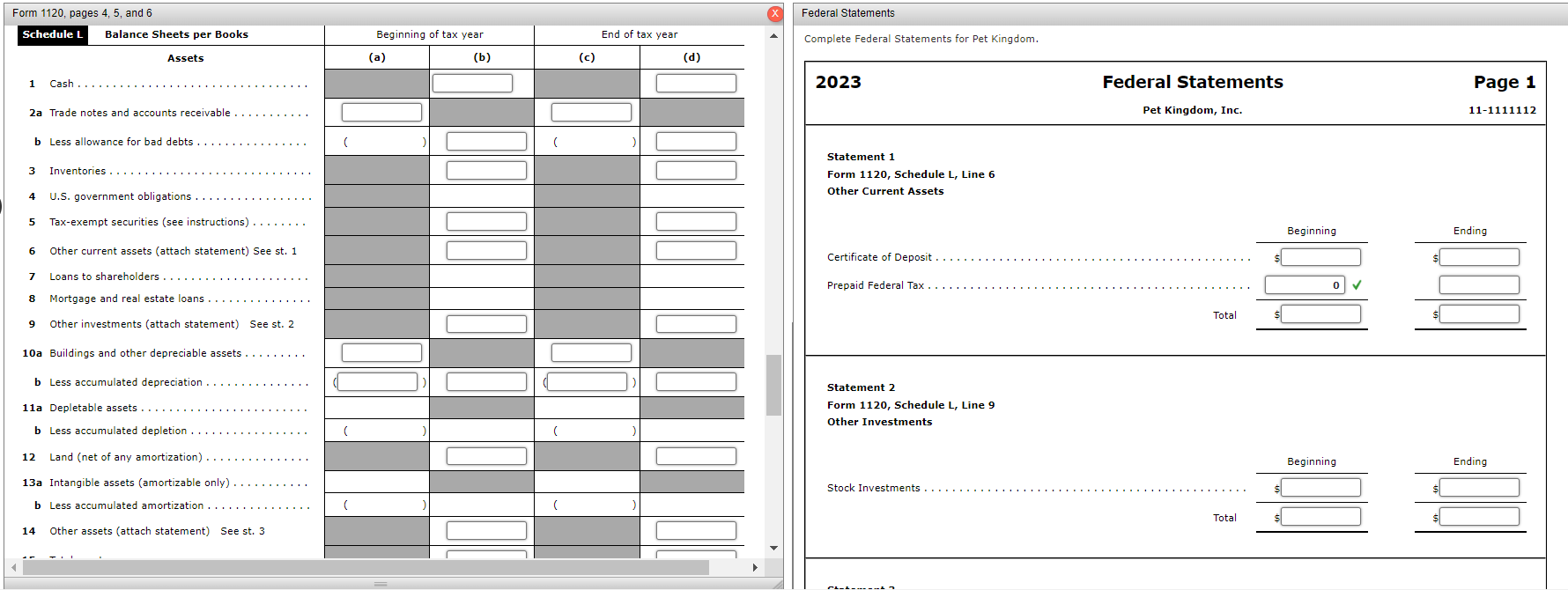

Balance SheetAssetsJanuary December Cash$$Trade notes and accounts receivableInventoriesStock investmentState bondsCertificates of depositPrepaid Federal taxBuildings and other depreciable assetsAccumulated depreciationLandOther assetsTotal assets$$Liabilities and EquityJanuary December Accounts payable$$Other current liabilitiesMortgagesCapital stockRetained earningsTotal liabilities and equity$$

Required:

During Pet Kingdom made estimated tax payments of $ each quarter to the IRS. Prepare Pet Kingdom's corporate tax return for tax year using Form and any other appropriate forms and schedules

If an amount box does not require an entry or the answer is zero, enter

Enter all amounts as positive numbers, unless otherwise instructed.

If required, round amounts to the nearest dollar.

Make realistic assumptions about any missing data. Federal Statements

Complete Federal Statements for Pet Kingdom.

Statement

Form Schedule L Line

Other Investments Form E

Prepare Form E for Pet Kingdom for tax year

Note: Complete Form E only if total receipts are $ or more. See instructions for definition of total receipts.

begintabularcccccc

hline multirowa Name of officer & multirowtb Social security number & multirowtc Percent of time devoted to business & multicolumnlPercent of stock owned & multirowtf Amount of compensation

hline & & & d Common & e Preferred &

hline Janet Morton & &

square

& square & begintabularrr

hline & checkmark

&

endtabular &

hline Kim Wong & & & & beginarrayrr& checkmark & endarray &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock