Question: Note: This problem is for the 2 0 2 3 tax year. John Parsons ( 1 2 3 - 4 5 - 6 7 8

Note: This problem is for the tax year.

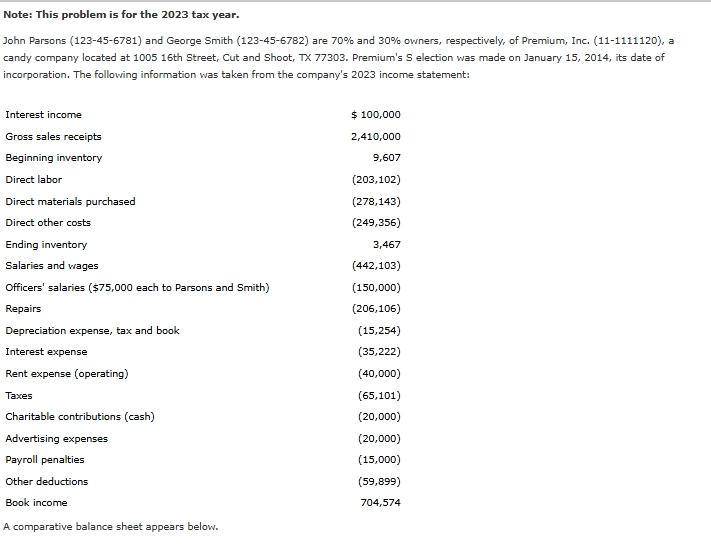

John Parsons and George Smith are and owners, respectively, of Premium, Inc. a candy company located at th Street, Cut and Shoot, TX Premium's S election was made on January its date of incorporation. The following information was taken from the company's income statement:

A comparative balance sheet appears below. Instructions

The corporation did not own or use any digital assets during the year. Premium's accounting firm provides the following additional information:

Distributions to shareholders not reported on Form DIV and Required:

Complete the Form S for Premium, Inc., Additional Information Continuation Statement, and Schedule Ks for John Parsons and George Smith, th Street, Cut and Shoot, TX

If an amount box does not require an entry or the answer is zero, enter

Enter all amounts as positive numbers, unless otherwise instructed.

If required, round amounts to the nearest dollar.

Make realistic assumptions about any missing data.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock