Question: Note: This problem is for the 2018 tax year. Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2016. Alfred

Note: This problem is for the 2018 tax year.

Alfred E. Old and Beulah A. Crane, each age 42, married on September 7, 2016. Alfred and Beulah will file a joint return for 2018. Alfred's Social Security number is 111-11-1112. Beulah's Social Security number is 123-45-6789, and she adopted "Old" as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304.

Alfred was divorced from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2018. In addition, in January 2018, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes. Sarah's Social Security number is 123-45-6788.

Alfred's salary for 2018 is $150,000, and his employer, Cherry, Inc. (Federal I.D. No. 98-7654321), provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes.

Beulah recently graduated from law school and is employed by Legal Aid Society, Inc. (Federal I.D. No. 11-1111111), as a public defender. She receives a salary of $42,000 in 2018. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes.

Beulah has $500 in qualified dividends on Yellow Corporation stock she inherited. Alfred and Beulah receive a $1,900 refund on their 2017 state income taxes. They itemized deductions on their 2017 Federal income tax return (total of $15,000). Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2018. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Both spouses had health insurance for all months of 2018 and do not want to contribute to the Presidential Election Campaign.

Required:

Compute Alfred and Beulah's net tax payable (or refund due) for 2018, on a joint return, by providing the following information that would be reported on Form 1040

- Enter all amounts as positive numbers.

- If is zero, enter "0".

- Make realistic assumptions about any missing data.

- If required round your final answers to the nearest dollar.

-

Use the 2018 Tax Rate Schedules to compute the tax.

Note: Because the tax rate schedules are used instead of the tax tables, the amount of tax computed may vary slightly from the amount listed in the tables. This variation occurs because the tax for a particular income range in the tax table is based on the midpoint amount.

2018 Tax Rate Schedules SingleSchedule X Head of householdSchedule Z If taxable income is: Over But not over The tax is: of the amount over If taxable income is: Over But not over The tax is: of the amount over $0 $9,525 . . . . . . 10% $0 $0 $13,600 . . . . . . 10% $0 9,525 38,700 $952.50 + 12% 9,525 13,600 51,800 $1,360.00 + 12% 13,600 38,700 82,500 4,453.50 + 22% 38,700 51,800 82,500 5,944.00 + 22% 51,800 82,500 157,500 14,089.50 + 24% 82,500 82,500 157,500 12,698.00 + 24% 82,500 157,500 200,000 32,089.50 + 32% 157,500 157,500 200,000 30,698.00 + 32% 157,500 200,000 500,000 45,689.50 + 35% 200,000 200,000 500,000 44,298.00 + 35% 200,000 500,000 . . . . . . 150,689.50 + 37% 500,000 500,000 . . . . . . 149,298.00 + 37% 500,000 Married filing jointly or Qualifying widow(er)Schedule Y-1 Married filing separatelySchedule Y-2 If taxable income is: Over But not over The tax is: of the amount over If taxable income is: Over But not over The tax is: of the amount over $0 $19,050 . . . . . . 10% $0 $0 $9,525 . . . . . . 10% $0 19,050 77,400 $1,905.00 + 12% 19,050 9,525 38,700 $952.50 + 12% 9,525 77,400 165,000 8,907.00 + 22% 77,400 38,700 82,500 4,453.50 + 22% 38,700 165,000 315,000 28,179.00 + 24% 165,000 82,500 157,500 14,089.50 + 24% 82,500 315,000 400,000 64,179.00 + 32% 315,000 157,500 200,000 32,089.50 + 32% 157,500 400,000 600,000 91,379.00 + 35% 400,000 200,000 300,000 45,689.50 + 35% 200,000 600,000 . . . . . . 161,379.00 + 37% 600,000 300,000 . . . . . . 80,689.50 + 37% 300,000

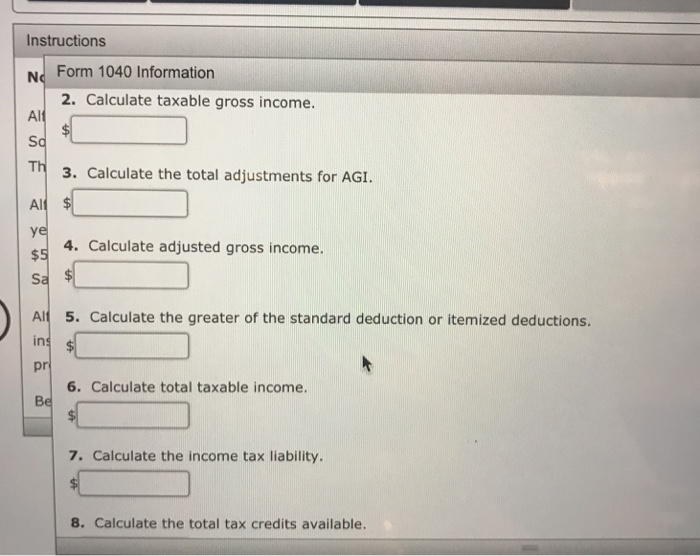

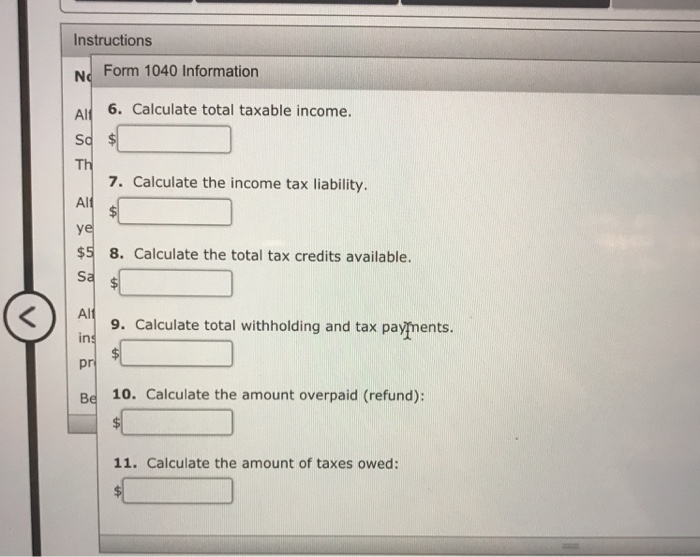

Instructions N Form 1040 Information 2. Calculate taxable gross income. Alt Th 3. Calculate the total adjustments for AGI. AI ye S4. Calculate adjusted gross income. Alt ins pr 5. Calculate the greater of the standard deduction or itemized deductions 6. Calculate total taxable income. 7. Calculate the income tax liability 8. Calculate the total tax credits available. Instructions Nd Form 1040 Information A 6. Calculate total taxable income. Sq $ Th Al ye $5 8. Calculate the total tax credits available. 7. Calculate the income tax liability All 9. Calculate total withholding and tax payments. in pr Be 10. Calculate the amount overpaid (refund): 11. Calculate the amount of taxes owed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts