Question: Note: This problem is for the 2019 tax year. Natalie Bryan, a widow who lives at 425 Flathead Way, Kalispell, Montana 59901, has three adult

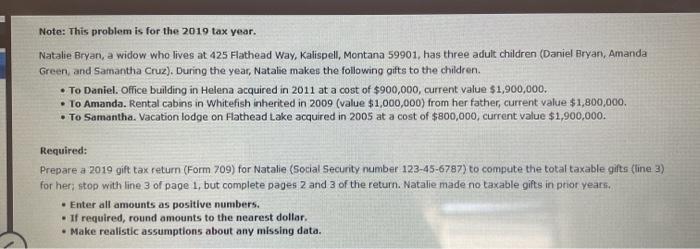

Note: This problem is for the 2019 tax year. Natalie Bryan, a widow who lives at 425 Flathead Way, Kalispell, Montana 59901, has three adult children (Daniel Bryan, Amanda Green and Samantha Cruz). During the year, Natalie makes the following gifts to the children. To Daniel. Office building in Helena acquired in 2011 at a cost of $900,000, current value $1,900,000. To Amanda. Rental cabins in Whitefish inherited in 2009 (value $1,000,000) from her father, current value $1,800,000. To Samantha. Vacation lodge on Fathead Lake acquired in 2005 at a cost of $800,000, current value $1,900,000. Required: Prepare a 2019 gift tax return (Form 709) for Natalie (Social Security number 123-45-6787) to compute the total taxable gits (line 3) for her stop with line 3 of page 1, but complete pages 2 and 3 of the return. Natalie made no taxable gifts in prior years. .Enter all amounts as positive numbers. . If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data. Note: This problem is for the 2019 tax year. Natalie Bryan, a widow who lives at 425 Flathead Way, Kalispell, Montana 59901, has three adult children (Daniel Bryan, Amanda Green and Samantha Cruz). During the year, Natalie makes the following gifts to the children. To Daniel. Office building in Helena acquired in 2011 at a cost of $900,000, current value $1,900,000. To Amanda. Rental cabins in Whitefish inherited in 2009 (value $1,000,000) from her father, current value $1,800,000. To Samantha. Vacation lodge on Fathead Lake acquired in 2005 at a cost of $800,000, current value $1,900,000. Required: Prepare a 2019 gift tax return (Form 709) for Natalie (Social Security number 123-45-6787) to compute the total taxable gits (line 3) for her stop with line 3 of page 1, but complete pages 2 and 3 of the return. Natalie made no taxable gifts in prior years. .Enter all amounts as positive numbers. . If required, round amounts to the nearest dollar. Make realistic assumptions about any missing data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts