Question: Note: This problem is for the 2020 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant

Note: This problem is for the 2020 tax year.

Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth was born on July 4, 1974, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. Beth received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored.

The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2020.

| Line | Description | Amount |

| 1 | Wages, tips, other compensation | $65,000.00 |

| 2 | Federal income tax withheld | 9,500.00 |

| 3 | Social Security wages | 65,000.00 |

| 4 | Social Security tax withheld | 4,030.00 |

| 5 | Medicare wages and tips | 65,000.00 |

| 6 | Medicare tax withheld | 942.50 |

| 15 | State | Arizona |

| 16 | State wages, tips, etc. | 65,000.00 |

| 17 | State income tax withheld | 1,954.00 |

During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on a Form 1099-INT. She received qualified dividends of $800 from Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation. Each corporation reported Beth's dividend payments on a Form 1099-DIV.

Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2020. On her 2019 Federal income tax return, she claimed the standard deduction.

Fees earned from her part-time tax practice in 2020 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service.

On February 8, 2020, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2020, Beth sold the stock for $14 a share.

Beth bought a used sport utility vehicle for $6,000 on June 5, 2020. She purchased the vehicle from her brother-in-law, who was unemployed and was in need of cash. On November 2, 2020, she sold the vehicle to a friend for $6,500.

On January 2, 2020, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2020, for $55 a share.

During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business.

| Cost of personal computer | $7,000 |

| Cost of printer | 2,000 |

| Furniture | 3,000 |

| Supplies | 650 |

| Fee paid to computer consultant | 3,500 |

Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of 179. These items were placed in service on January 15, 2020, and used 100% in her business.

Although her employer suggested that Beth attend an in-person conference on current developments in corporate taxation, Beth was not reimbursed for the travel expenses of $1,420 she incurred in attending the meeting. The $1,420 included $200 for the cost of meals.

During the year, Beth paid $300 for prescription medicines and $2,875 for doctor bills and hospital bills. Medical insurance premiums were paid by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and credit card interest was $320. Beth contributed $2,080 to various qualifying charities during the year. Professional dues and subscriptions totaled $350.

Beth paid estimated taxes of $1,000.

Required:

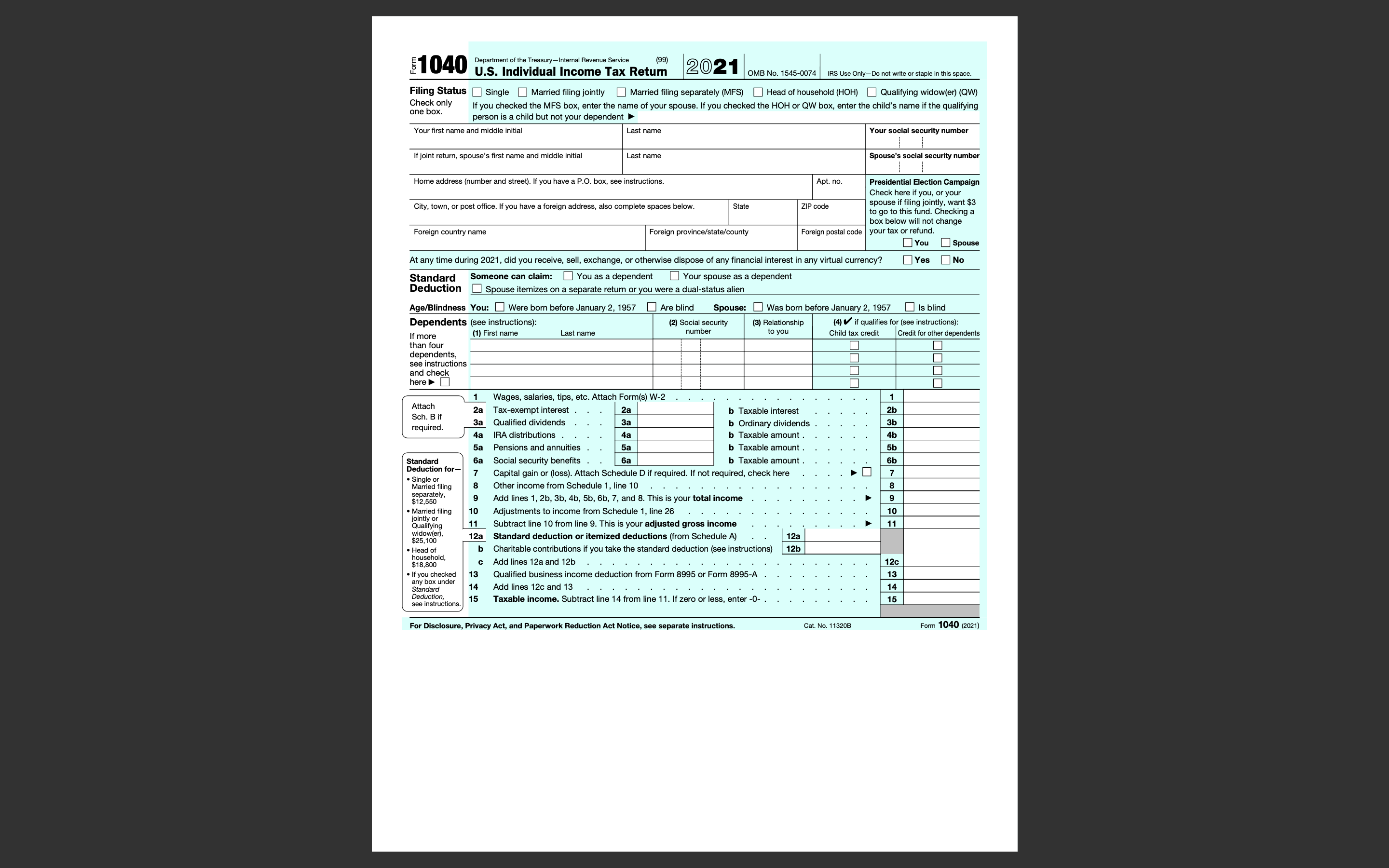

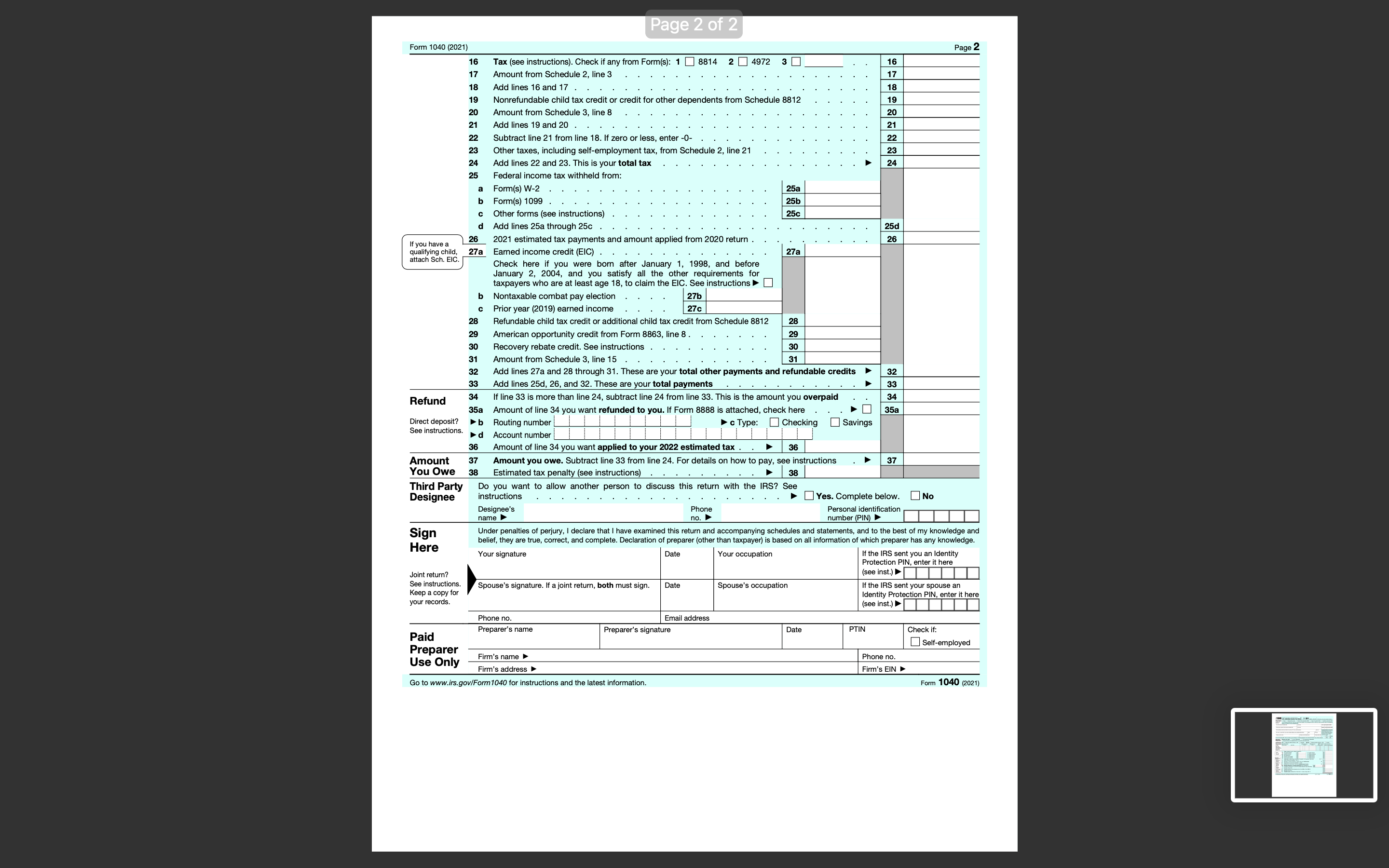

Compute Beth Jordan's 2020 Federal income tax payable (or refund due), and complete her 2020 tax return using appropriate forms and schedules and the Qualified Dividends and Capital Gain Tax Worksheet.

- Make realistic assumptions about any missing data.

- If an amount box does not require an entry or the answer is zero, enter "0".

- Enter all amounts as positive numbers, unless instructed otherwise.

- It may be necessary to complete the tax schedules before completing Form 1040.

- When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar.

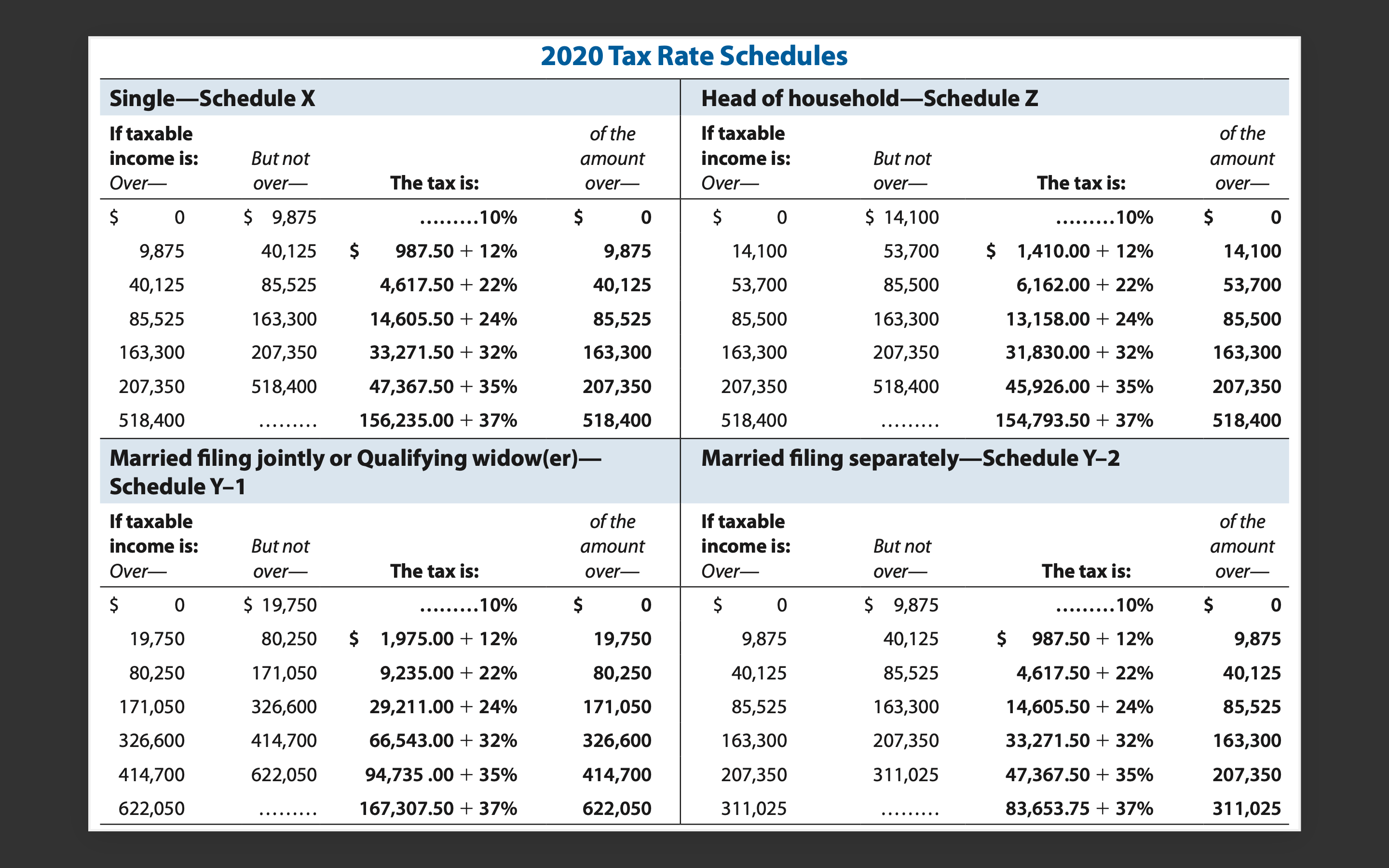

- Use the 2020 Tax Rate Schedule provided. Do not use the Tax Tables.

2020 Tax Rate Schedules SingleSchedule X Head of householdSchedule Z If taxable of the If taxable income is: But not amount income is: But not Over over The tax is: over Over over The tax is: $ 0 $ 9,875 ......... 10% $ 0 $ 0 $ 14,100 ......... 10% 9,875 40,125 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 + 12% 14,100 40,125 85,525 4,617.50 -- 22% 40,125 53,700 85,500 6,162.00 + 22% 53,700 85,525 163,300 14,605.50 -- 24% 85,525 85,500 163,300 13,158.00 + 24% 85,500 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 207,350 518,400 156,235.00 + 37% 518,400 518,400 1 54,793.50 + 37% 51 8,400 Married ling jointly or Qualifying widow(er) Married ling separatelySchedule Y2 Schedule Y1 If taxable of the If taxable income is: But not amount income is: But not Over over The tax is: over Over over The tax is: $ 0 $ 19,750 .........10% $ 0 $ 0 $ 9,875 .........10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 9,875 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 40,125 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 85,525 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 163,300 414,700 622,050 94,735 .00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 207,350 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 311,025 $1040 Department of the Treasury - Internal Revenue Service U.S. Individual Income Tax Return (99) 2021 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status ( Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent Your first name and middle initia Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. Apt. no Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code | your tax or refund. You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 Is blind Dependents (see instructions): 2) Social security (3) Relationship (4) if qualifies for (see instructions): If more (1) First name Last name to you Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach Sch . B if 2a Tax-exempt interest 2a Taxable interest 2b required. 3a Qualified dividends 3a b Ordinary dividends 3b 4a IRA distributions Taxable amount . 4b 5a Pensions and annuities 5a b Taxable amount . 5b standard 6a Social security benefits . 6a b Taxable amount . 6b Deduction for- Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 . Single or Married filing 8 Other income from Schedule 1, line 10 . 8 9 $12,550 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 9 Married filing 10 Adjustments to income from Schedule 1, line 26 10 jointly or 1 1 Qualifying Subtract line 10 from line 9. This is your adjusted gross income widow(er), $25 100 12a Standard deduction or itemized deduct s (from Schedule A) 12a Head of Charitable contributions if you take the standard deduction (see instructions) 12b household $18 800 c Add lines 12a and 12b . . . 120 If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction, 15 . . . see instructions. Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2021)Page 2 of 2 Form 1040 (2021) Page 2 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 Amount from Schedule 2, line 3 17 Add lines 16 and 17 . 18 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 19 20 Amount from Schedule 3, line 8 21 Add lines 19 and 20 . . 22 Subtract line 21 from line 18. If zero or less, enter -0- 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from: Form(s) W-2 25a Form(s) 1099 25b Other forms (see instructions) 25c d Add lines 25a through 25c . 250 If you have a 26 2021 estimated tax payments and amount applied from 2020 return . 26 qualifying child, Earned income credit 27a attach Sch. EIC. Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions Nontaxable combat pay election 27b c Prior year (2019) earned income 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812 28 American opportunity credit from Form 8863, line 8 . Recovery rebate credit. See instructions . 30 Amount from Schedule 3, line 15 31 Add lines 27a and 28 through 31. These are your total other payments and refundable credits 32 Add lines 25d, 26, and 32. These are your total payments 33 Refund If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings See instructions. d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax . 36 Amount Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 37 You Owe 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign ties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) See instructions. Spouse's signature. If a joint return, both must sign. Date Keep a copy for Spouse's occupation If the IRS sent your spouse an your records. Identity Protection PIN, enter it see inst.) Phone no. Email address Preparer's name Date PTIN Check if: Paid Preparer's signature Self-employed Preparer Use Only Firm's name Phone no . Firm's address Firm's EIN Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2021)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts