Question: [Note] This question and the next question (or the previous question) are based on the same data! Kapoor Company uses job-order costing. On July 1,

![[Note] This question and the next question (or the previous question)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e609c159d7f_80866e609c0d6a4a.jpg)

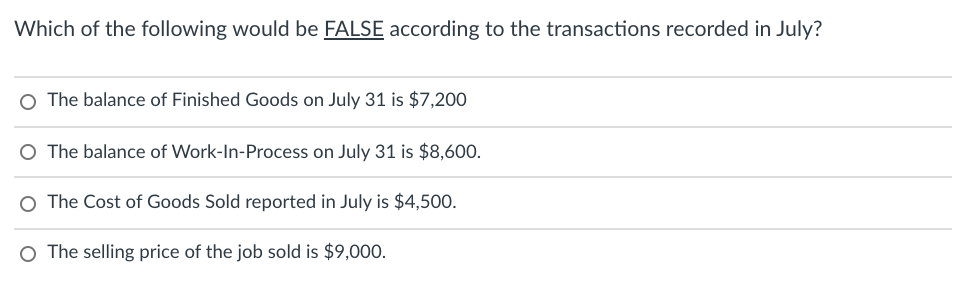

[Note] This question and the next question (or the previous question) are based on the same data! Kapoor Company uses job-order costing. On July 1, Kapoor's Work-In-Process inventory account consisted of three jobs with the following information: Job 101 $1,500 Job 102 $320 Job 103 $2,400 Balance as of July 1st During July, Kapoor had the following transactions to record: (a) Materials purchased on account, $7,250 (b) Materials requisitioned: Job 101, $1,200; Job 102, $3,000; and Job 103, $2,560. (c) Job tickets were collected and summarized: Job 101, 150 hours at $12 per hour; Job 102, 220 hours at $14 per hour; and Job 103, 80 hours at $18 per hour. (d) Overhead is applied on the basis of direct labor hours and the predetermined overhead rate is $10 per direct labor hour. (e) Actual overhead incurred during the period was $4,800. (f) Job 101 was shipped and the customer was billed for 150% of the cost. (g) Job 103 was finished but not sold yet. Which of the following would be TRUE regarding Kapoor's overhead-related information in July? The amount of overhead variance was $300. O The Manufacturing Overhead account should have a credit balance before its closing. The applied overhead was $5,100. The overhead cost was over-applied during the period. Which of the following would be FALSE according to the transactions recorded in July? O The balance of Finished Goods on July 31 is $7,200 The balance of Work-In-Process on July 31 is $8,600. The Cost of Goods Sold reported in July is $4,500. O The selling price of the job sold is $9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts