Question: Note : This question for the following document has been posted now 3 times. I was credited back for the question, because it has yet

Note : This question for the following document has been posted now 3 times. I was credited back for the question, because it has yet to be fully answered. So I am posting again in hopes someone can answer all of the tabs. The tabs include: unadjusted trial balance where the first set of directions are located, transactions, general journal, general ledger, and adjusted trial balance.

OBJECTIVE: Evaluate the impact of accrual accounting concepts on the resulting financial statement.

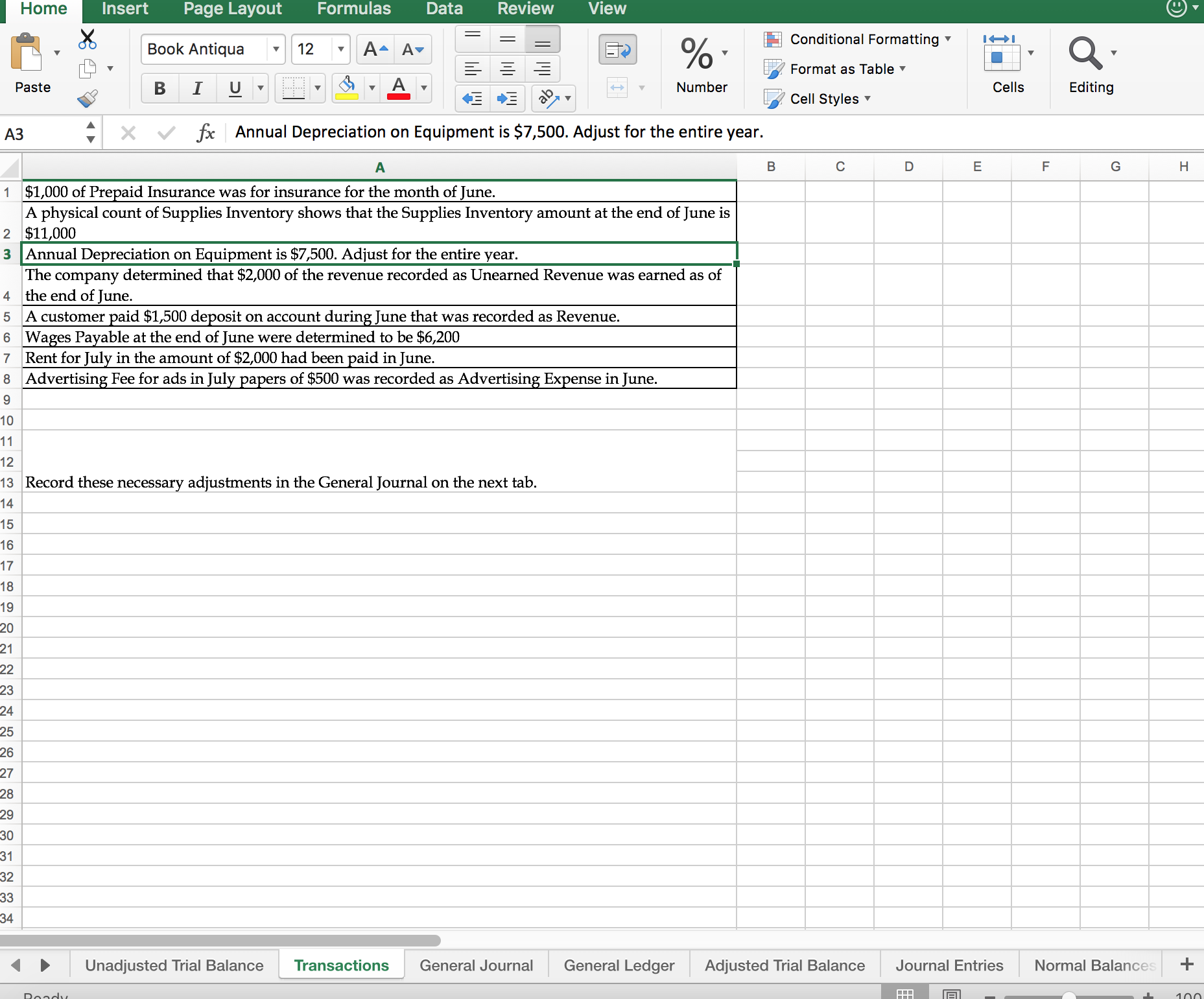

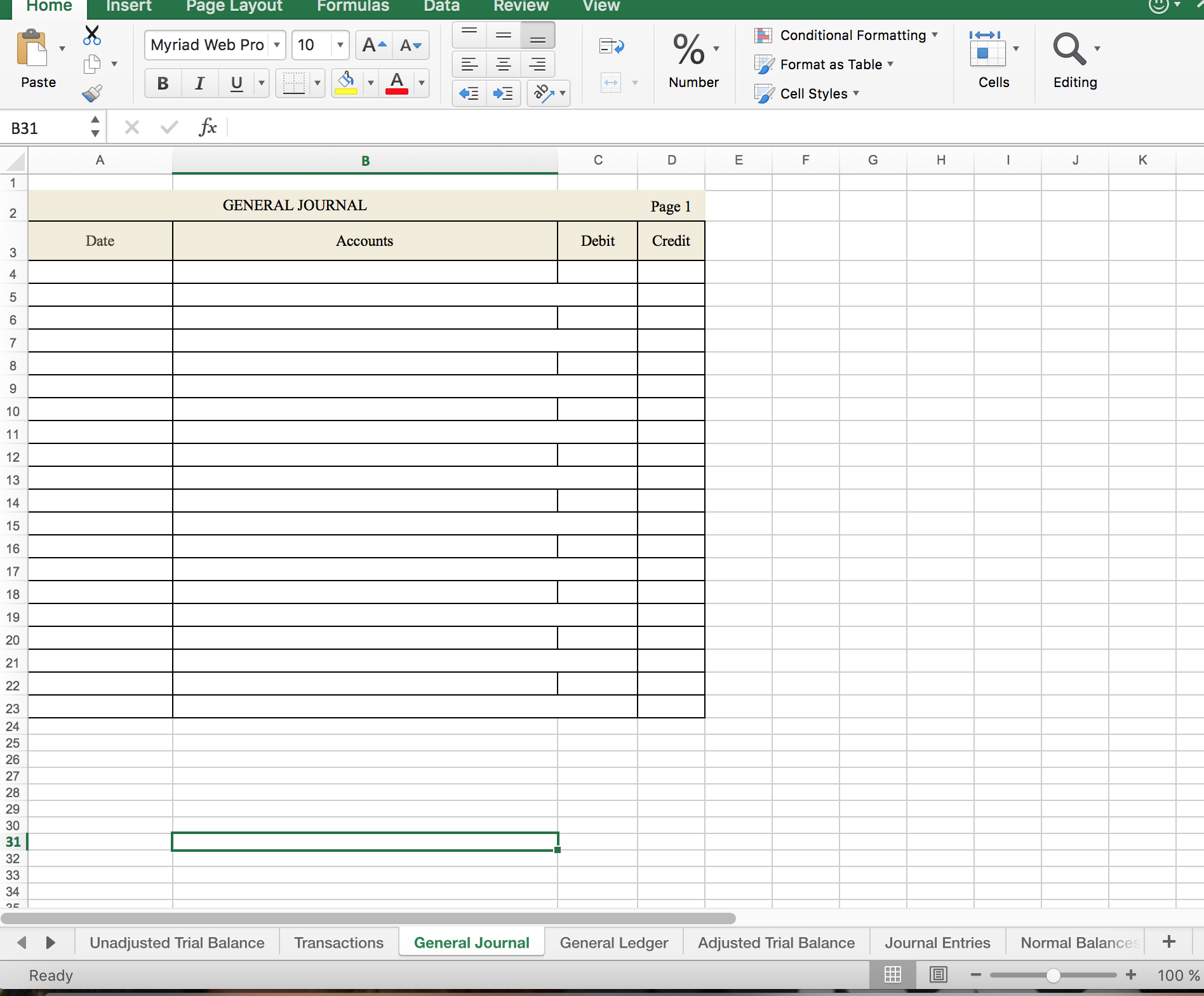

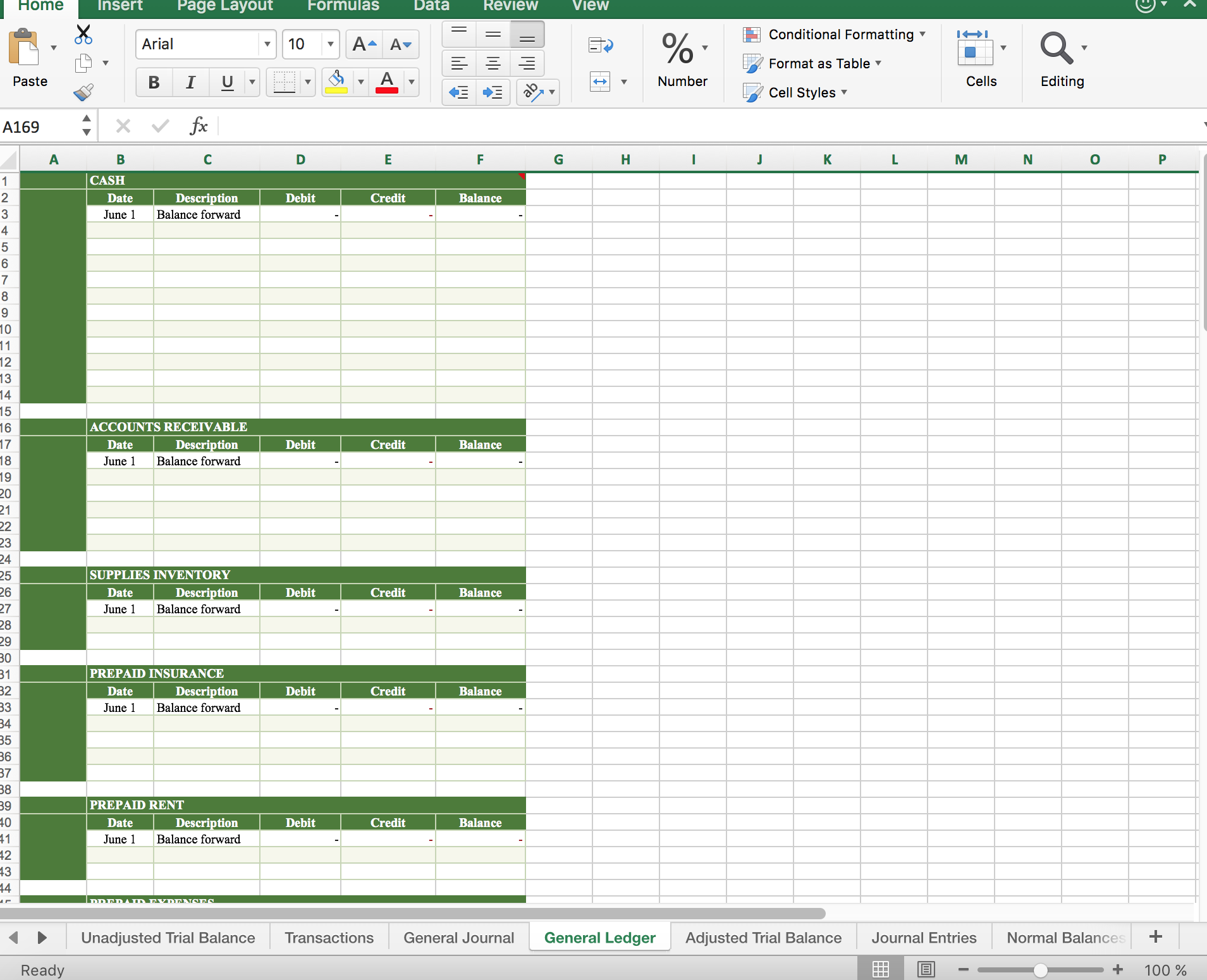

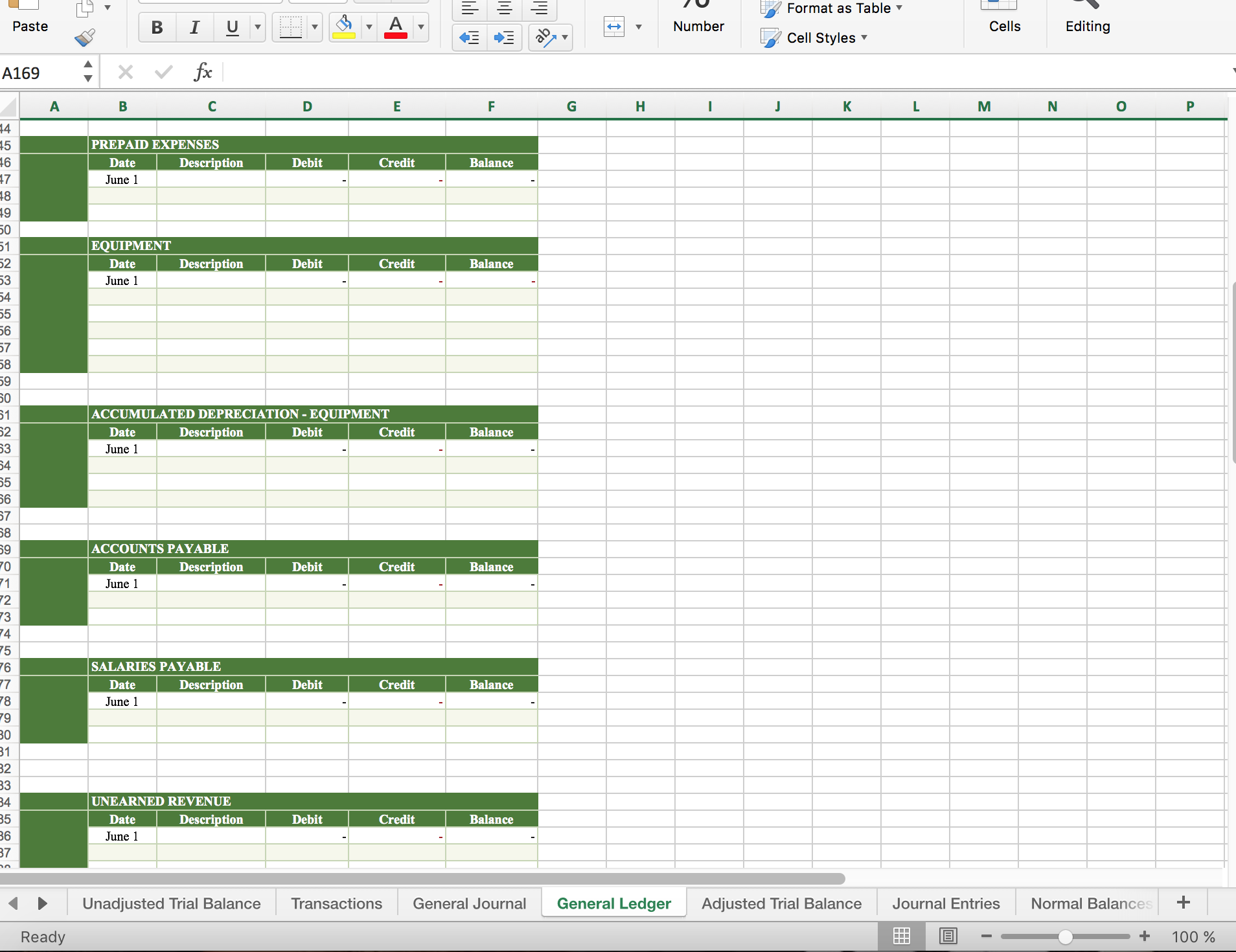

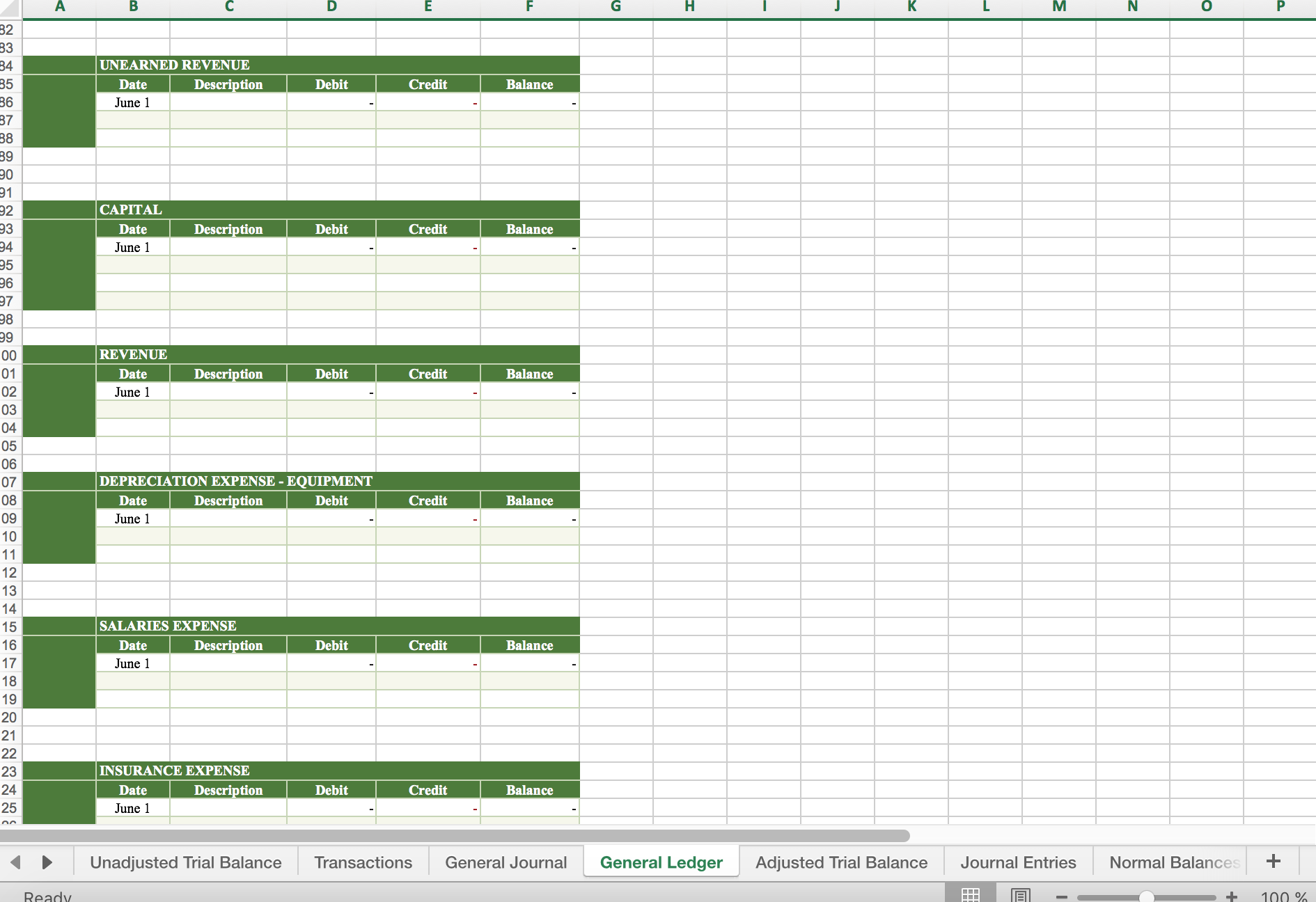

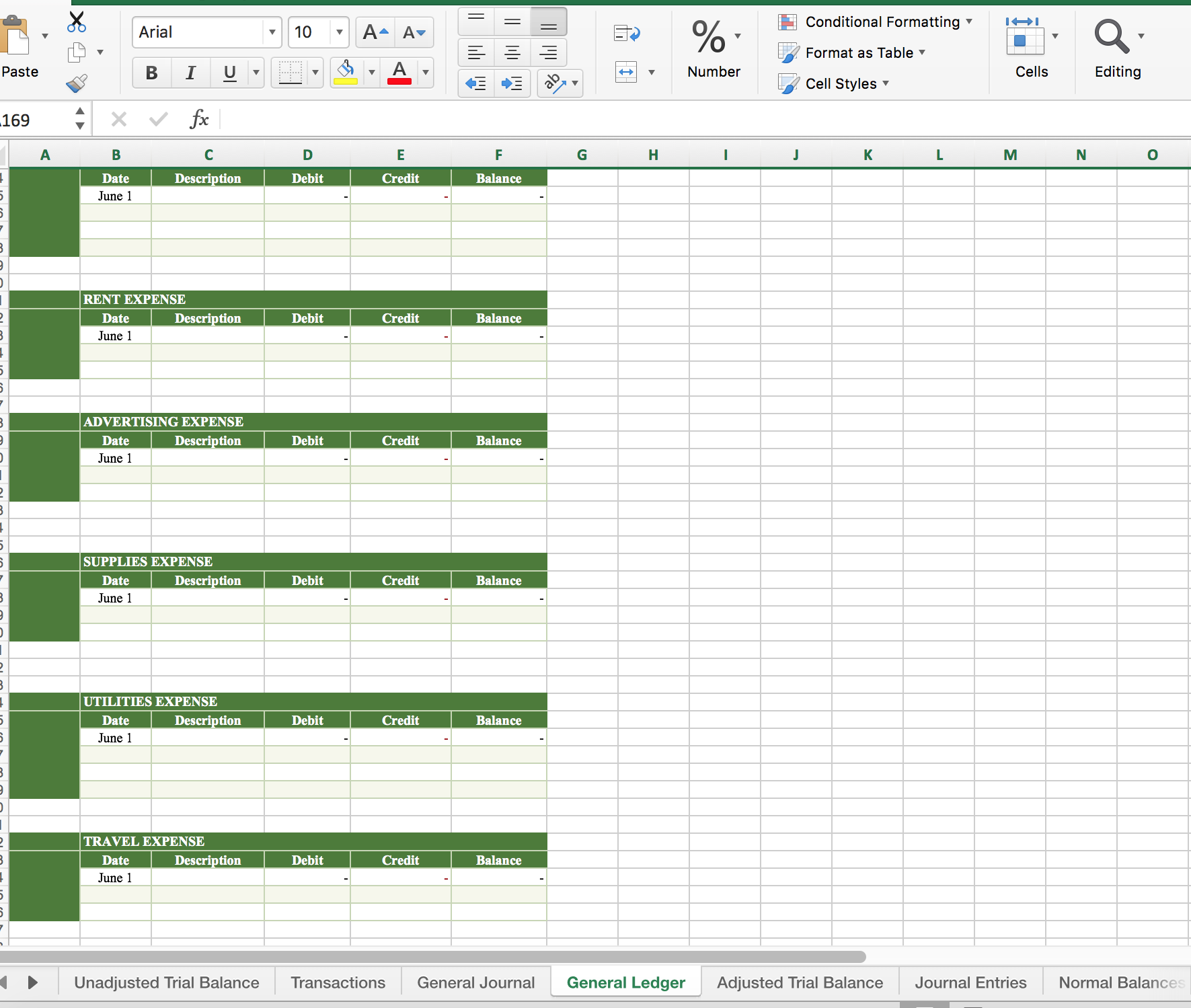

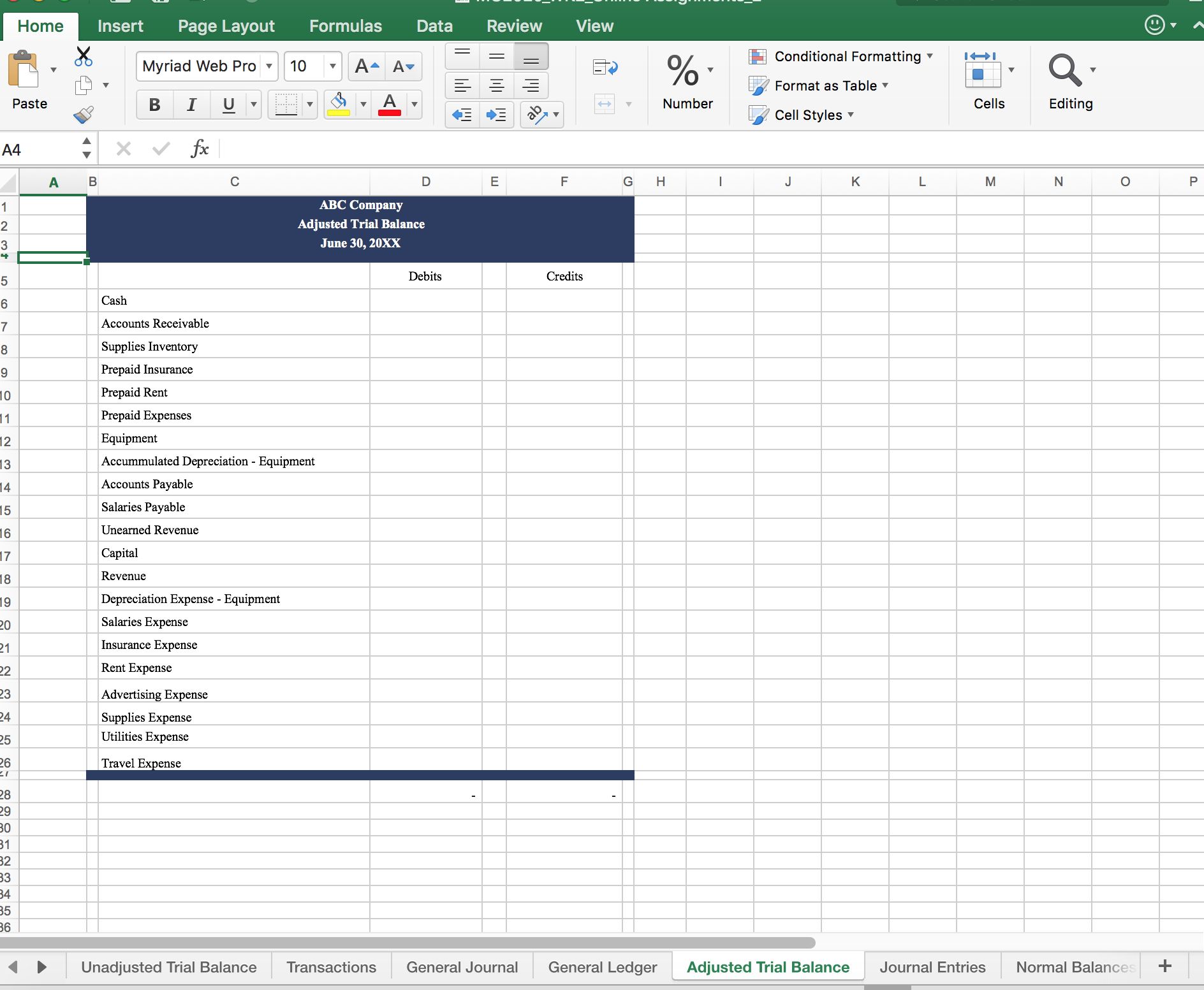

Accrual accounting indicates all expenses incurred and revenues earned during the period reflected on the financial statement. To arrive at the correct figures, a company will generate a Trial Balance based on the information recorded during regular operations. This gives the accountant a report to review so he or she can determine which accounts should be examined to determine if adjusting entries must be made. Once necessary adjusting entries are determined, those entries are created in the general journal, and the general ledger is updated to reflect the changes. The updated figures in the general ledger are then used to create an adjusted trial balance from which the financial statements will be generated.

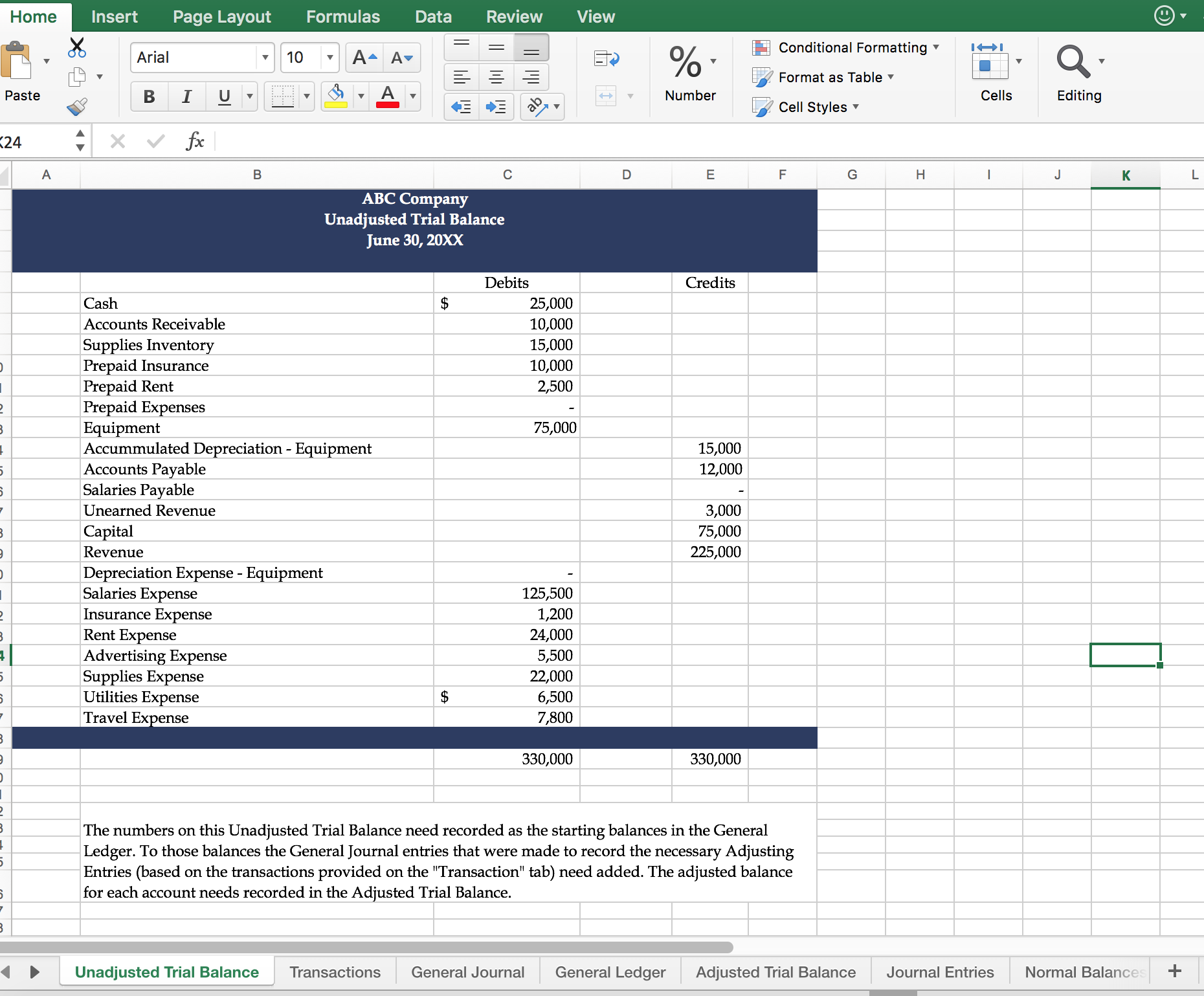

Home Insert Page Layout Formulas Data Review View Conditional Formatting" Format as Table Cell Styles Arial Paste Number Cells Editing 24 ABC Company Unadjusted Trial Balance June 30, 20xx Debits Credits Cash Accounts Receivable Supplies Inventor Prepaid Insurance Prepaid Rent Prepaid Expenses Equipment Accummula Accounts Payable Salaries Pavable Unearned Revenue Capital Revenue Depreciation Expense - Equipment Salaries Expense 25,000 10,000 15,000 10,000 2,500 75,000 15,000 12,000 ted Depreciation - Equipment 3,000 75,000 225,000 surance Expense Rent Expense Advertising Expense Supplies Expense Utilities Expense ravel Expense 125,500 1,200 24,000 5,500 22,000 6,500 7,800 330,000 330,000 The numbers on this Unadjusted Trial Balance need recorded as the starting balances in the General Ledger. To those balances the General Journal entries that were made to record the necessary Adjusting Entries (based on the transactions provided on the "Transaction" tab) need added. The adjusted balance for each account needs recorded in the Adiusted Trial Balance, Unadjusted Trial Balance Transactions General Journal General Ledger Adjusted Trial Balance Journal Entries Normal Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts