Question: Note: To do this problem use Part A is Periodic Direct Inventory methods and Part B is us Perpetual Allowance method P9-3 (LO 1) (LCNRV-Cost-of-Goods-Sold

Note: To do this problem use

Part A is Periodic Direct Inventory methods and

Part B is us Perpetual Allowance method

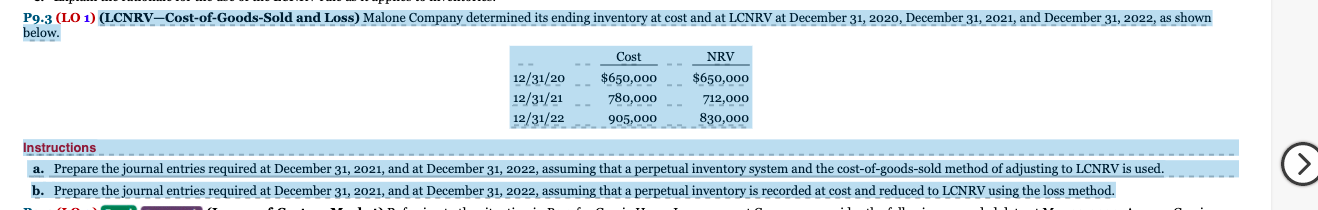

P9-3 (LO 1) (LCNRV-Cost-of-Goods-Sold and Loss) Malone Company determined its ending inventory at cost and at LCNRV at December 31, 2020, December 31, 2021, and December 31, 2022, as shown below. Cost NRV 12/31/20 $650,000 $650,000 12/31/21 780,000 712,000 12/31/22 905,000 Instructions a. Prepare the journal entries required at December 31, 2021, and at December 31, 2022, assuming that a perpetual inventory system and the cost-of-goods-sold method of adjusting to LCNRV is used. b. Prepare the journal entries required at December 31, 2021, and at December 31, 2022, assuming that a perpetual inventory is recorded at cost and reduced to LCNRV using the loss method. 830,000 > a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts