Question: Note to Instructor. The solutions to these problems are prepared using the tax law as of December 31, 2017. When 2018 forms and software become

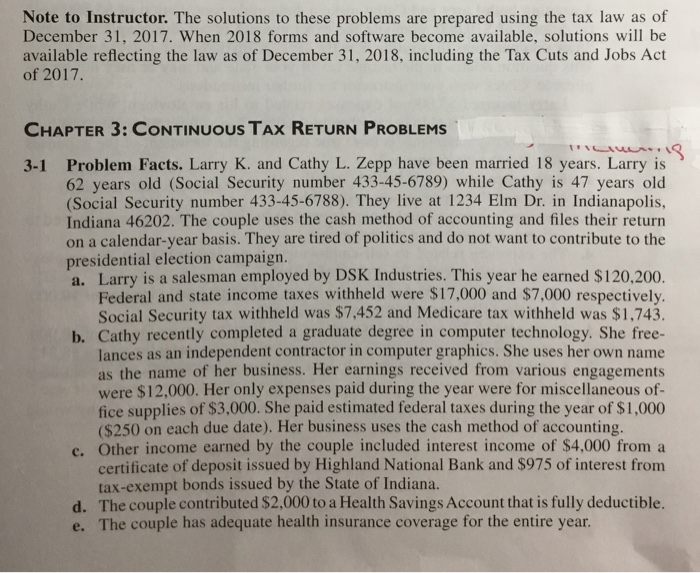

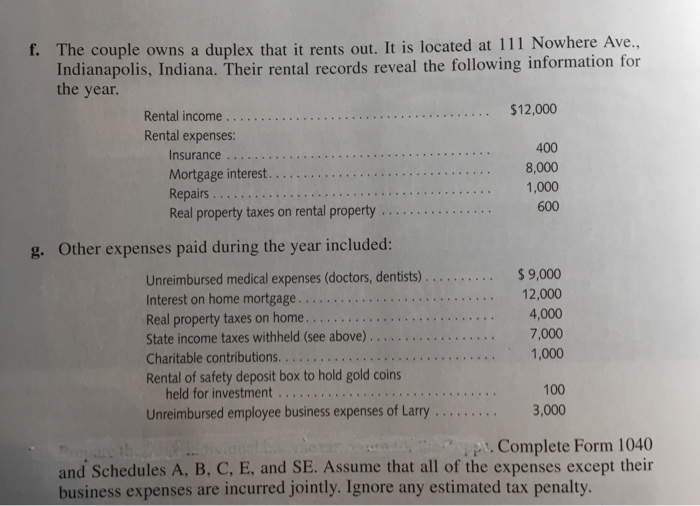

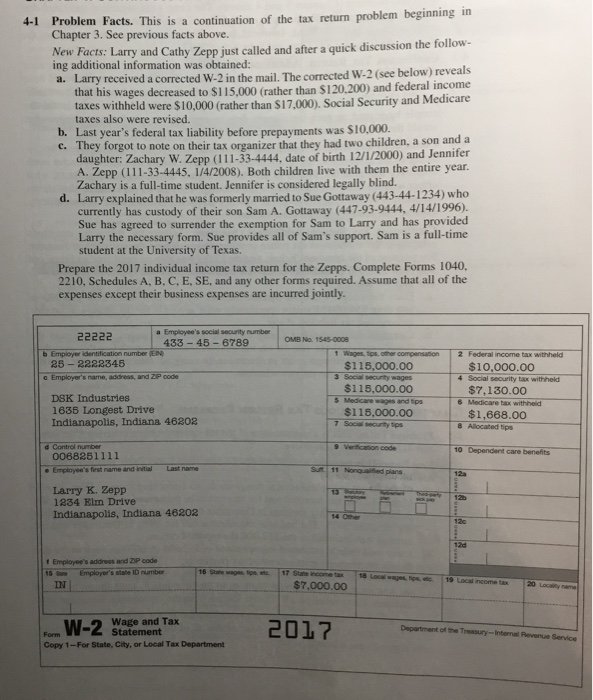

Note to Instructor. The solutions to these problems are prepared using the tax law as of December 31, 2017. When 2018 forms and software become available, solutions will be available reflecting the law as of December 31, 2018, including the Tax Cuts and Jobs Act of 2017 CHAPTER 3:CONTINUOUS TAx RETURN PROBLEMS Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry is 62 years old (Social Security number 433-45-6789) while Cathy is 47 years old Social Security number 433-45-6788). They live at 1234 Elm Dr. in Indianapolis Indiana 46202. The couple uses the cash method of accounting and files their returrn on a calendar-year basis. They are tired of politics and do not want to contribute to the 3-1 presidential election campaign. a. Larry is a salesman employed by DSK Industries. This year he earned $120,200. Federal and state income taxes withheld were S17,000 and $7,000 respectively Social Security tax withheld was $7,452 and Medicare tax withheld was $1,743 b. Cathy recently completed a graduate degree in computer technology. She free- lances as an independent contractor in computer graphics. She uses her own name as the name of her business. Her earnings received from various engagements ere $12,000. Her only expenses paid during the year were for miscellaneous of fice supplies of $3,000. She paid estimated federal taxes during the year of $1,000 50 on each due date). Her business uses the cash method of accounting. c. Other income earned by the couple included interest income of $4,000 from a certificate of deposit issued by Highland National Bank and S975 of interest from tax-exempt bonds issued by the State of Indiana The couple contributed $2,000 to a Health Savings Account that is fully deductible. d. e. The couple has adequate health insurance coverage for the entire year f. The couple owns a duplex that it rents out. It is located at 111 Nowhere Ave. Indianapolis, Indiana. Their rental records reveal the following information for the year $12,000 Rental expenses Insurance . 400 8,000 1,000 600 . . Real property taxes on rental property g. Other expenses paid during the year included: $9,000 12,000 Unreimbursed medical expenses (doctors, dentists) Real property taxes on home. State income taxes withheld (see above) Charitable contributions. Rental of safety deposit box to hold gold coins ...7,000 1,000 held for investment . Unreimbursed employee business expenses of Larry .. 100 3,000 i,'' Complete Form 1040 and Schedules A, B, C, E, and SE. Assume that all of the expenses except their business expenses are incurred jointly. Ignore any estimated tax penalty. Problem Facts. This is a continuation of the tax return problem begining in New Facts: Larry and Cathy Zepp just called and after a quick discussion the follow- 4-1 Chapter 3. See previous facts above. ing additional information was obtained: a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals his wages decreased to $115,000 (rather than $120.200) and federal income taxes withheld were $10,000 (rather than $17.000). Social Security and Medicare that taxes also were revised. b. Last year's federal tax liability before prepayments was $10,000 c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind. d. Larry explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040 2210, Schedules A, B, C, E, SE, and any other forms required. Assume that all of the expenses except their business expenses are incurred jointly a Employee's social security number 433 -45-6789 OMB No. 1545-0008 dentification number Wages, ips other compensaon 2 Federal income tax withheld $115,000.00 25-2222345 $10,000.00 Social security tax withheld $7,130.00 3 Social svecurity wages $115,000.00 5 Medicare wages and tips s name, address, and 2P code 4 DSK Industries 1635 Longest Drive Indianapolis, Indiana 46202 6 Medicare tax withheld $116,000.00 $1,668.00o 8 Allocated tips d Control number care benefits 0068251111 e Employee's fest name and initial Last name Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 14 Other 120 12d f Employee's address and ZP code 15 Se Employer's state ID number IN $7,000.00 W-2 State ment x and Tax 2017 Department of the Treasury-Intermal Revenue Service Form"Statement Copy 1-For State, City, or Local Tax Department

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts