Question: Note to Student: To answer this question, you may use the factor tables at the back of your textbook or the factor tables within the

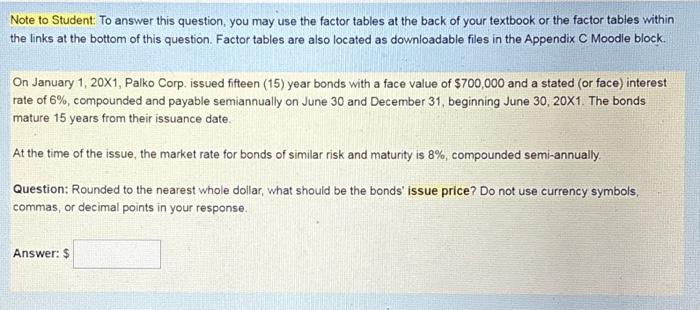

Note to Student: To answer this question, you may use the factor tables at the back of your textbook or the factor tables within the links at the bottom of this question. Factor tables are also located as downloadable files in the Appendix C Moodle block. On January 1,20X1, Palko Corp. issued fifteen (15) year bonds with a face value of $700,000 and a stated (or face) interest rate of 6%, compounded and payable semiannually on June 30 and December 31 , beginning June 30,201. The bonds mature 15 years from their issuance date. At the time of the issue, the market rate for bonds of similar risk and maturity is 8%, compounded semi-annually. Question: Rounded to the nearest whole dollar, what should be the bonds' issue price? Do not use currency symbols, commas, or decimal points in your response. Answer: \$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts