Question: Note to Students: Do not rely on Al models to find your answers, as they will provide only approximate results. You will not receive credit

Note to Students:

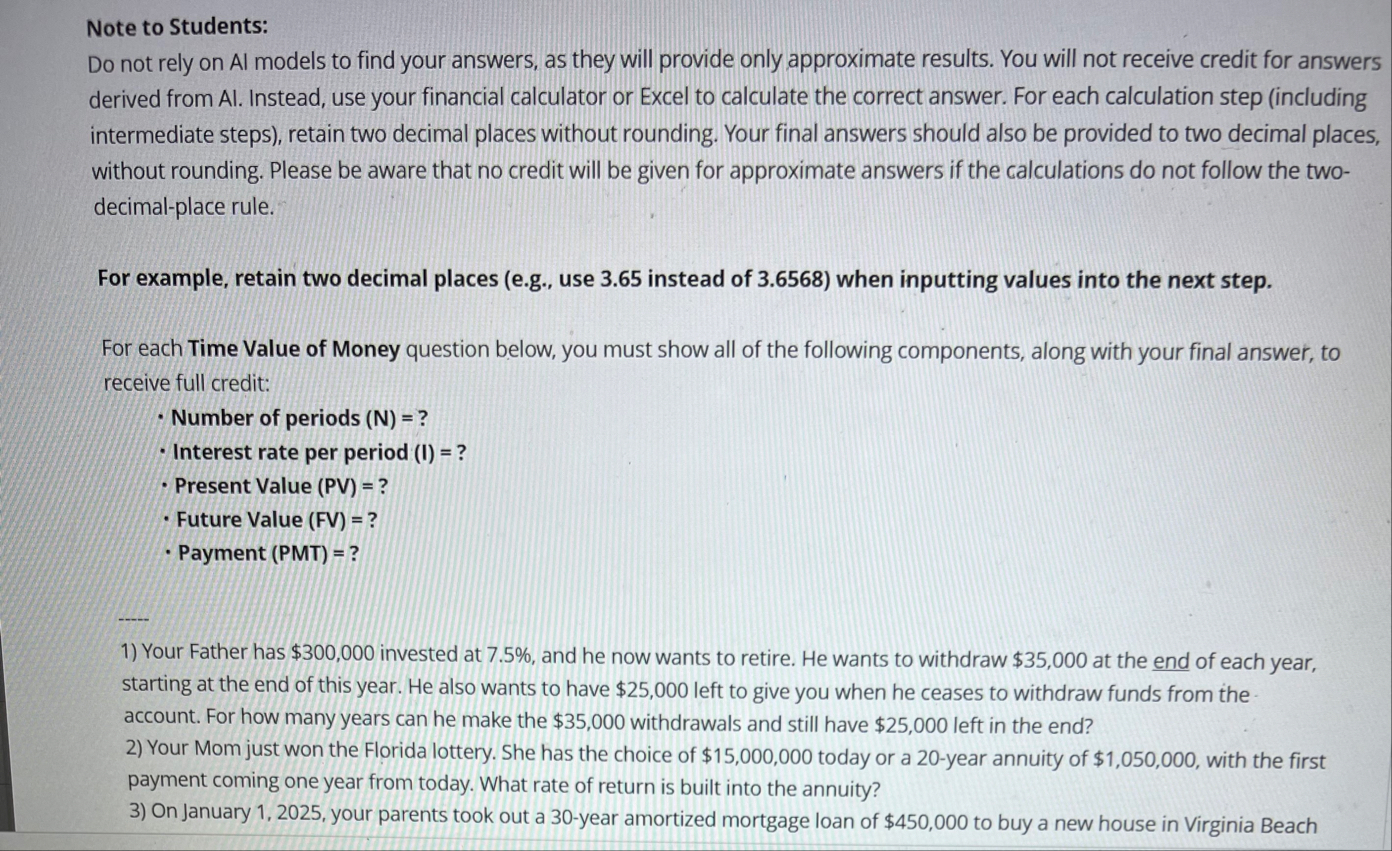

Do not rely on Al models to find your answers, as they will provide only approximate results. You will not receive credit for answers derived from Al Instead, use your financial calculator or Excel to calculate the correct answer. For each calculation step including intermediate steps retain two decimal places without rounding. Your final answers should also be provided to two decimal places, without rounding. Please be aware that no credit will be given for approximate answers if the calculations do not follow the twodecimalplace rule.

For example, retain two decimal places eg use instead of when inputting values into the next step.

For each Time Value of Money question below, you must show all of the following components, along with your final answer, to receive full credit:

Number of periods

Interest rate per period

Present Value PV

Future Value FV

Payment PMT

Your Father has $ invested at and he now wants to retire. He wants to withdraw $ at the end of each year, starting at the end of this year. He also wants to have $ left to give you when he ceases to withdraw funds from the account. For how many years can he make the $ withdrawals and still have $ left in the end?

Your Mom just won the Florida lottery. She has the choice of $ today or a year annuity of $ with the first payment coming one year from today. What rate of return is built into the annuity?

On January your parents took out a year amortized mortgage loan of $ to buy a new house in Virginia BeachPresent Value

Future Value FV

Payment PMT

Your Father has $ invested at and he now, wants to retire. He wants to withdraw $ at the end of each year, starting at the end of this year. He also wants to have $ left to give you when he ceases to withdraw funds from the account. For how many years can he make the $ withdrawals and still have $ left in the end?

Your Mom just won the Florida lottery. She has the choice of $ today or a year annuity of $ with the first payment coming one year from today. What rate of return is built into the annuity?

On January your parents took out a year amortized mortgage loan of $ to buy a new house in Virginia Beach at a nominal annual interest rate of with monthly payments made at the end of each month. What is the amount of your parents' monthly mortgage payment?

Suppose you borrow $ at an annual interest rate of to purchase a new car. The loan must be repaid in equal monthly installments over the next years, with payments made at the end of each month. What is your monthly payment amount?

Your child's orthodontist offers you two alternative payment plans. The first plan requires a $ immediate upfront payment. The second plan requires you to make monthly payments of $ payable at the end of each month for years. What nominal annual interest rate is built into the monthly payment plan?

Use the editor to format your answer

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock