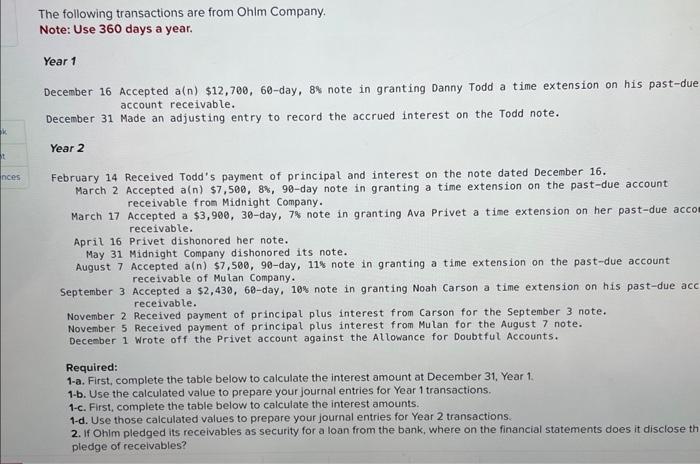

Question: Note: Use 360 days a year. Year 1 December 16 Accepted a(n)$12,700,60-day, 8% note in granting Danny Todd a time extension on his past-due account

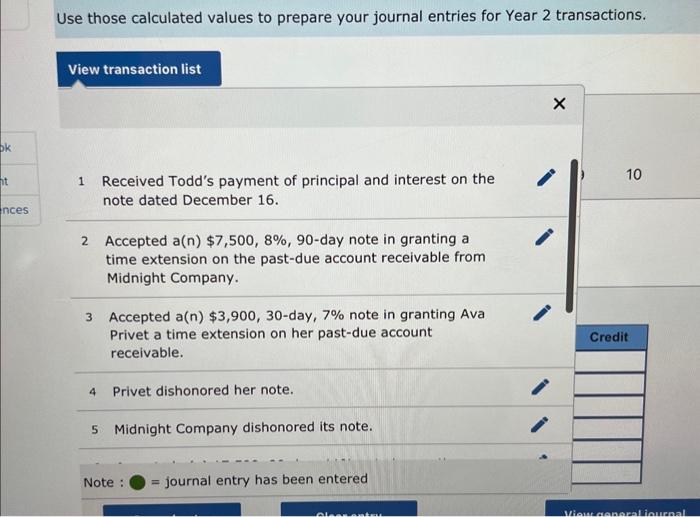

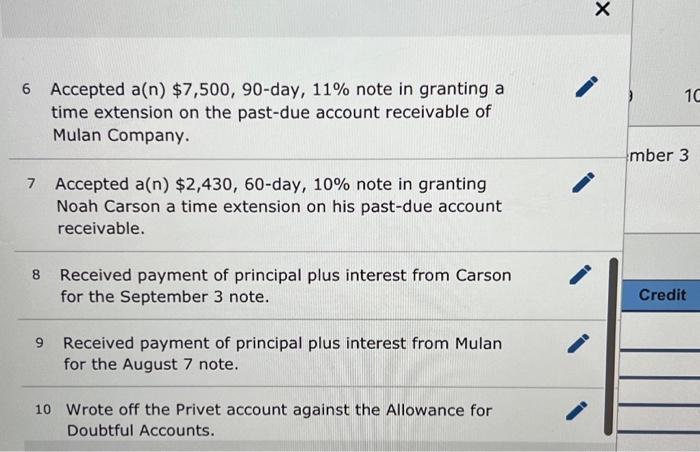

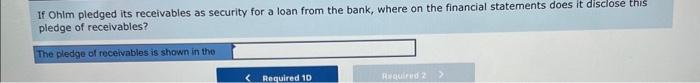

Note: Use 360 days a year. Year 1 December 16 Accepted a(n)$12,700,60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n)$7,500,8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900,30-day, 78 note in granting Ava Privet a time extension on her past-due acco receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n)$7,500,90-day, 11% note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $2,430,60-day, 10\% note in granting Noah Carson a time extension on his past-due acc receivable. November 2 Received payment of principal plus interest from Carson for the September 3 note. November 5 Received payment of principal plus interest from Mulan for the August 7 note. December 1 Wrote off the Privet account against the Allowance for Doubtful Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1 -b. Use the calculated value to prepare your journal entries for Year 1 transactions. 1 c. First, complete the table below to calculate the interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohim pledged its receivables as security for a loan from the bank, where on the financial statements does it disclose th pledge of recelvables? Use those calculated values to prepare your journal entries for Year 2 transactions. 1 Received Todd's payment of principal and interest on the note dated December 16 . 2 Accepted a(n)$7,500,8%,90-day note in granting a time extension on the past-due account receivable from Midnight Company. 3 Accepted a(n) $3,900,30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. 10 4 Privet dishonored her note. 5 Midnight Company dishonored its note. Note : = journal entry has been entered 6 Accepted a(n)$7,500,90-day, 11% note in granting a time extension on the past-due account receivable of Mulan Company. 7 Accepted a(n)$2,430,60-day, 10% note in granting Noah Carson a time extension on his past-due account receivable. 8 Received payment of principal plus interest from Carson for the September 3 note. 9 Received payment of principal plus interest from Mulan for the August 7 note. 10 Wrote off the Privet account against the Allowance for Doubtful Accounts. If OhIm pledged its receivables as security for a loan from the bank, where on the financial statements does it disciose this pledge of receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts