Question: NOTE: What I have so far is correct. I am looking for help filling in the blanks. Thank you. The Drysdale, Koufax, and Marichal partnership

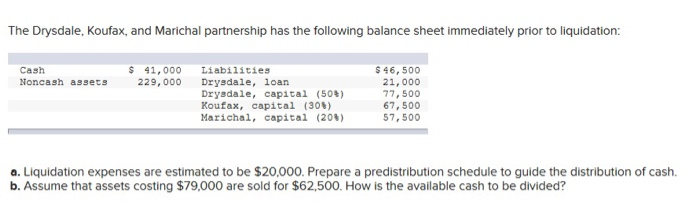

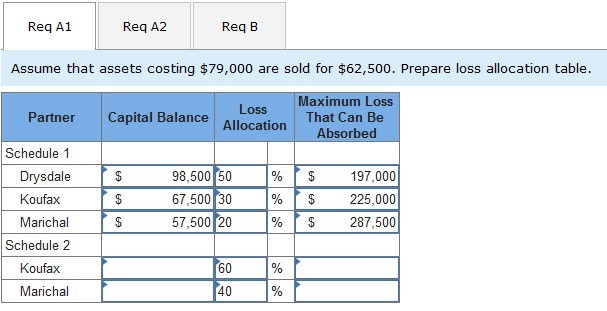

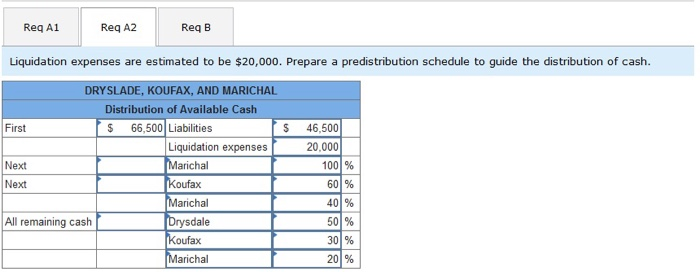

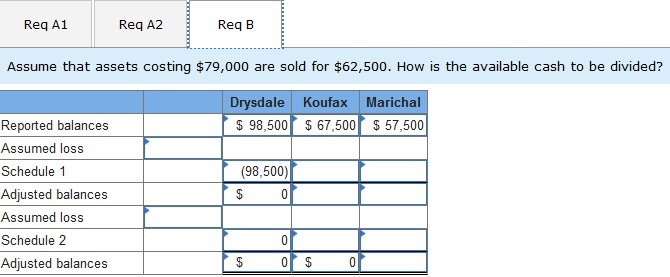

The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash Noncash assets $ 41.000 229,000 Liabilities Drysdale, loan Drysdale, capital (50%) Koufax, capital (30%) Marichal, capital (208) $ 46,500 21,000 77,500 67,500 57,500 a. Liquidation expenses are estimated to be $20,000. Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing $79,000 are sold for $62,500. How is the available cash to be divided? Req A1 Req A2 Red B Assume that assets costing $79,000 are sold for $62,500. Prepare loss allocation table. Partner Capital Balance Loss Allocation Maximum Loss That Can Be Absorbed Schedule 1 Drysdale Koufax Marichal Schedule 2 Koufax Marichal $ $ $ 98,500 50 67,500 30 57,500 120 % % % $ $ $ 197,000 225,000 287,500 60 40 % % Req A1 Reg A2 ReqB Liquidation expenses are estimated to be $20,000. Prepare a predistribution schedule to guide the distribution of cash. First DRYSLADE, KOUFAX, AND MARICHAL Distribution of Available Cash $ 66,500 Liabilities Liquidation expenses Marichal $ 46,500 20,000 100% 60 % Next Next Koufax All remaining cash Marichal Drysdale Koufax Marichal 30 29 Reg A1 Reg A2 Req B Assume that assets costing $79,000 are sold for $62,500. How is the available cash to be divided? Drysdale $ 98,500 Koufax Marichal $ 67,500 $ 57,500 Reported balances Assumed loss Schedule 1 Adjusted balances Assumed loss Schedule 2 Adjusted balances (98,500) $ 0 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts