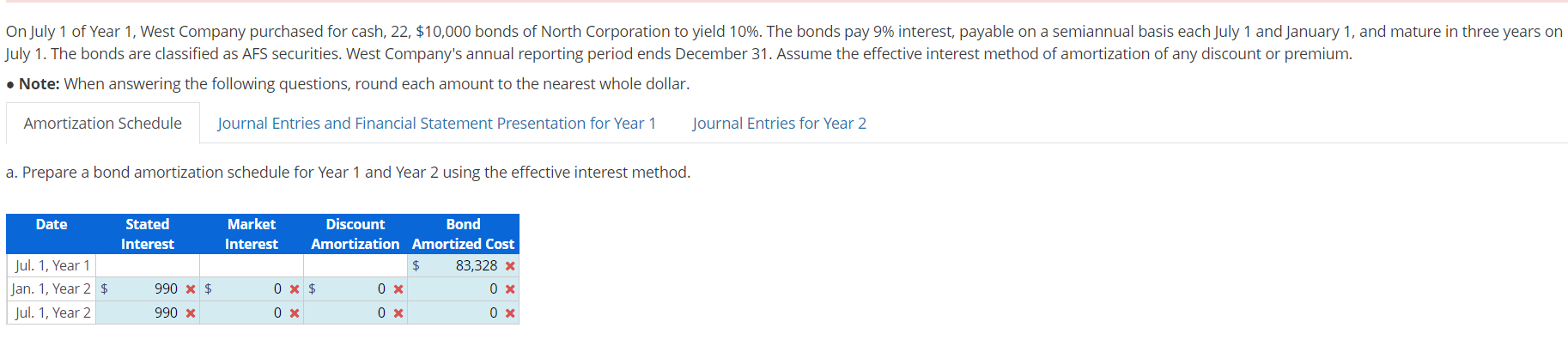

Question: - Note: When answering the following questions, round each amount to the nearest whole dollar. Amortization Schedule Journal Entries for Year 2 a. Prepare a

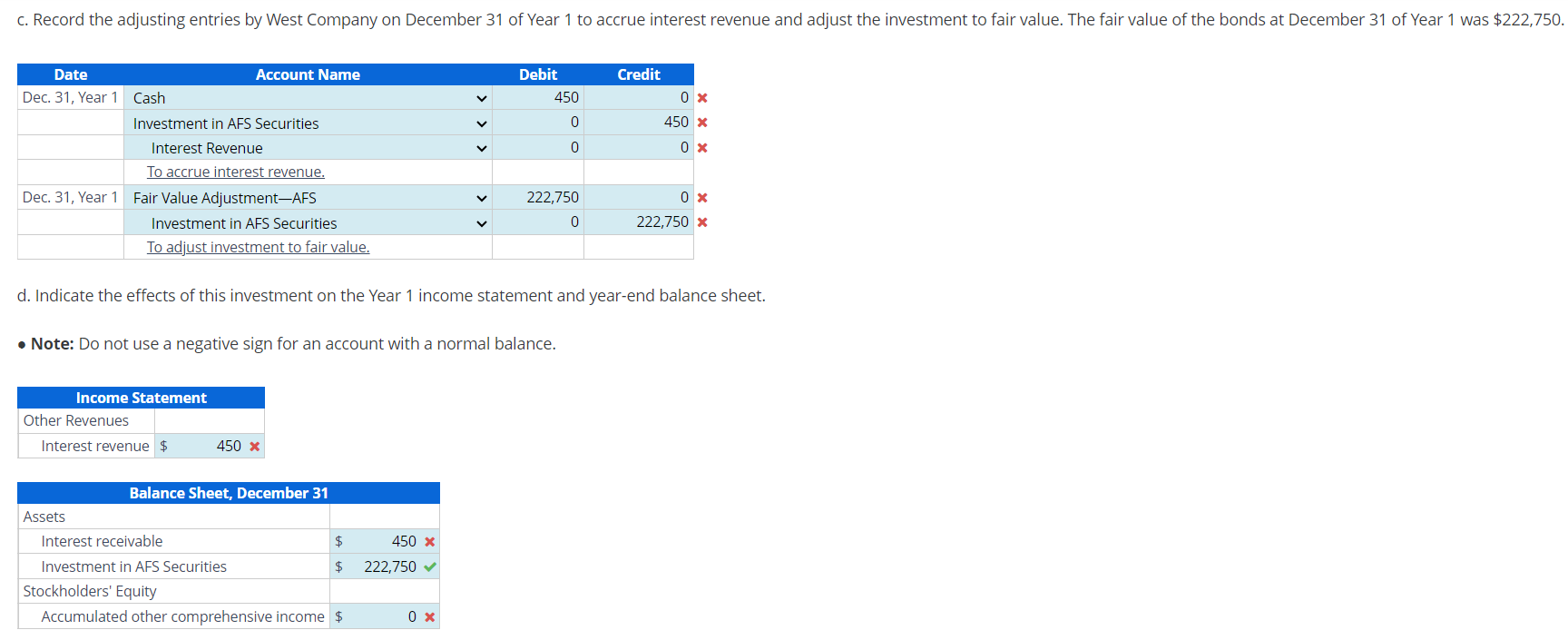

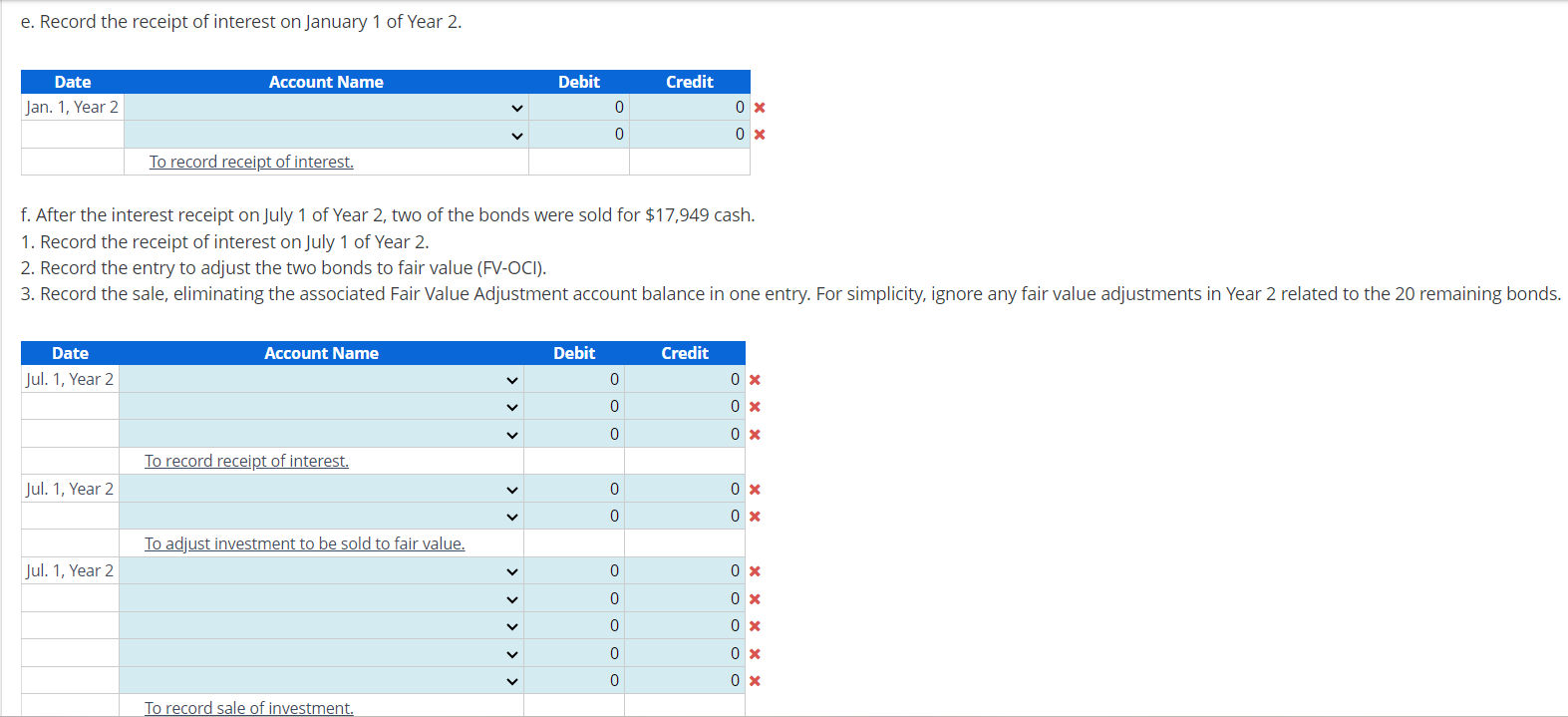

- Note: When answering the following questions, round each amount to the nearest whole dollar. Amortization Schedule Journal Entries for Year 2 a. Prepare a bond amortization schedule for Year 1 and Year 2 using the effective interest method. d. Indicate the effects of this investment on the Year 1 income statement and year-end balance sheet. - Note: Do not use a negative sign for an account with a normal balance. e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $17,949 cash. 1. Record the receipt of interest on July 1 of Year 2. 2. Record the entry to adjust the two bonds to fair value (FV-OCI). 3. Record the sale, eliminating the associated Fair Value Adjustment account balance in one entry. For simplicity, ignore any fair value adjustments in Year 2 related to the 20 remaining bonds. - Note: When answering the following questions, round each amount to the nearest whole dollar. Amortization Schedule Journal Entries for Year 2 a. Prepare a bond amortization schedule for Year 1 and Year 2 using the effective interest method. d. Indicate the effects of this investment on the Year 1 income statement and year-end balance sheet. - Note: Do not use a negative sign for an account with a normal balance. e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $17,949 cash. 1. Record the receipt of interest on July 1 of Year 2. 2. Record the entry to adjust the two bonds to fair value (FV-OCI). 3. Record the sale, eliminating the associated Fair Value Adjustment account balance in one entry. For simplicity, ignore any fair value adjustments in Year 2 related to the 20 remaining bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts