Question: Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Study the information given below

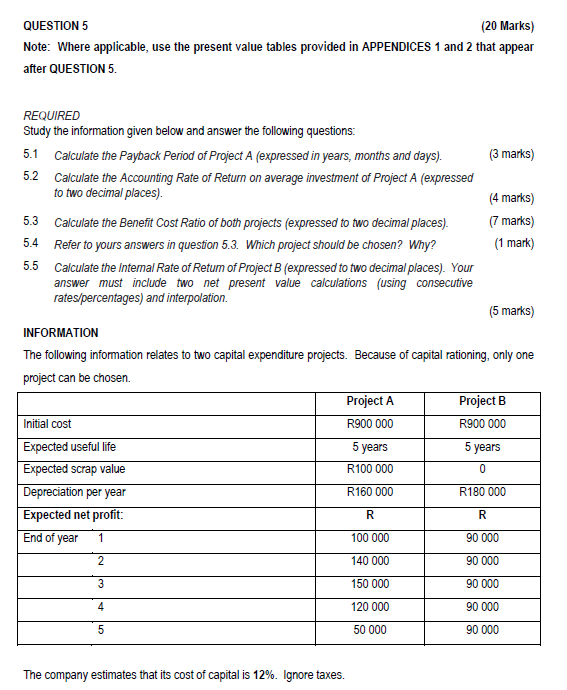

Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). (4 marks) 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). (7 marks) 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? (1 mark) 5.5 Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (5 marks) INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen.

Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). (4 marks) 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). (7 marks) 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? (1 mark) 5.5 Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (5 marks) INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen.

QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). (3 marks) 5.2 Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). (4 marks) 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). ( 7 marks) 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? ( 1 mark) 5.5 Calculate the Intemal Rate of Retum of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (5 marks) INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen. The company estimates that its cost of capital is 12%. Ignore taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts