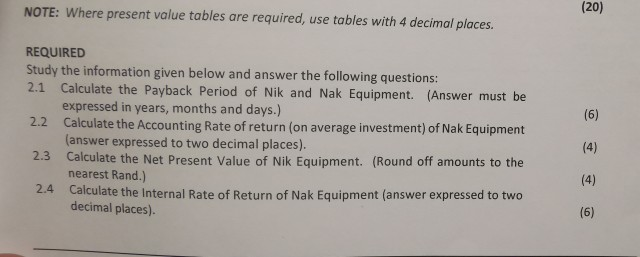

Question: NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED Study the information given below and answer the following questions: 2.1

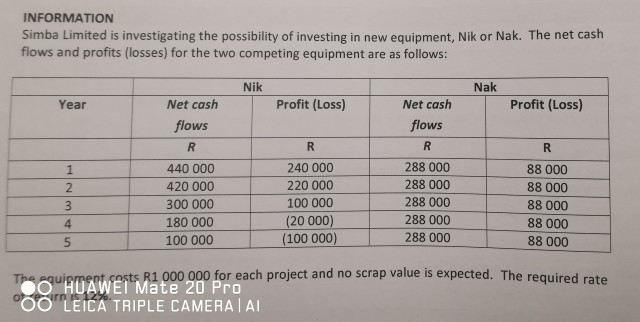

NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED Study the information given below and answer the following questions: 2.1 Calculate the Payback period of Nik and Nak Equipment. (Answer must be expressed in years, months and days.) 2.2 Calculate the Accounting Rate of return (on average investment) of Nak Equipment (answer expressed to two decimal places). Calculate the Net Present Value of Nik Equipment. (Round off amounts to the nearest Rand.) Calculate the Internal Rate of Return of Nak Equipment (answer expressed to two decimal places). 2.3 2.4 Caloo INFORMATION Simba Limited is investigating the possibility of investing in new equipment, Nik or Nak. The net cash flows and profits (losses) for the two competing equipment are as follows: Nik Nak Year Profit (Loss) Profit (Loss) Net cash flows Net cash flows 288 000 98000 440 000 420 000 300 000 180 000 100 000 240 000 220 000 100 000 (20 000) (100 000) R 88 000 88 000 88 000 88 000 88 000 288 000 288 000 288 000 ont costs R1 000 000 for each project and no scrap value is expected. The reamired OO HUAWEI Mate 20 Pro OO LEICA TRIPLE CAMERA AL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts