Question: Note whether the following phenomena would be consistent with or a violation of the efficient market hypothesis a. Nearly half of all professionally managed mutual

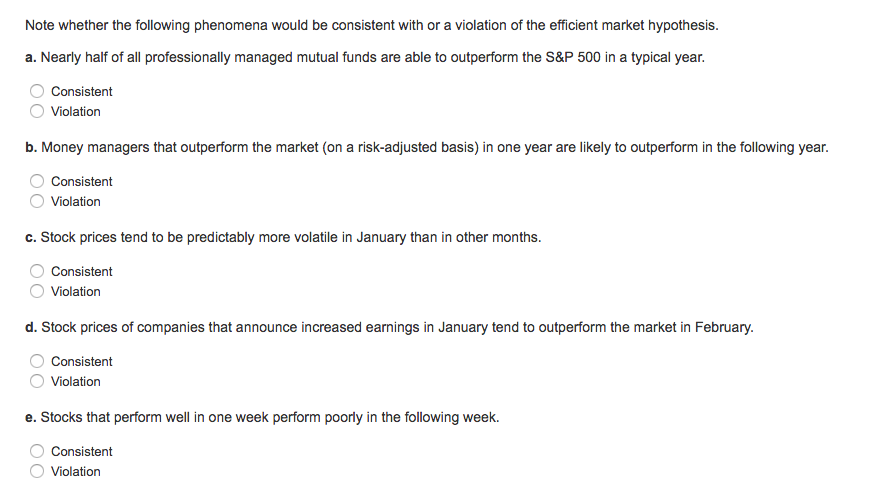

Note whether the following phenomena would be consistent with or a violation of the efficient market hypothesis a. Nearly half of all professionally managed mutual funds are able to outperform the S&P 500 in a typical year Consistent Violation b. Money managers that outperform the market (on a risk-adjusted basis) in one year are likely to outperform in the following year Consistent Violation c. Stock prices tend to be predictably more volatile in January than in other months Consistent Violation d. Stock prices of companies that announce increased earnings in January tend to outperform the market in February Consistent Violation e. Stocks that perform well in one week perform poorly in the following week. Consistent Violation Note whether the following phenomena would be consistent with or a violation of the efficient market hypothesis a. Nearly half of all professionally managed mutual funds are able to outperform the S&P 500 in a typical year Consistent Violation b. Money managers that outperform the market (on a risk-adjusted basis) in one year are likely to outperform in the following year Consistent Violation c. Stock prices tend to be predictably more volatile in January than in other months Consistent Violation d. Stock prices of companies that announce increased earnings in January tend to outperform the market in February Consistent Violation e. Stocks that perform well in one week perform poorly in the following week. Consistent Violation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts