Question: Notes from my class that may help? Exercise 19-18 (Algorithmic) (LO. 6) Mina, who is single, would like to contribute $6,000 to her Roth IRA.

Notes from my class that may help?

Notes from my class that may help?

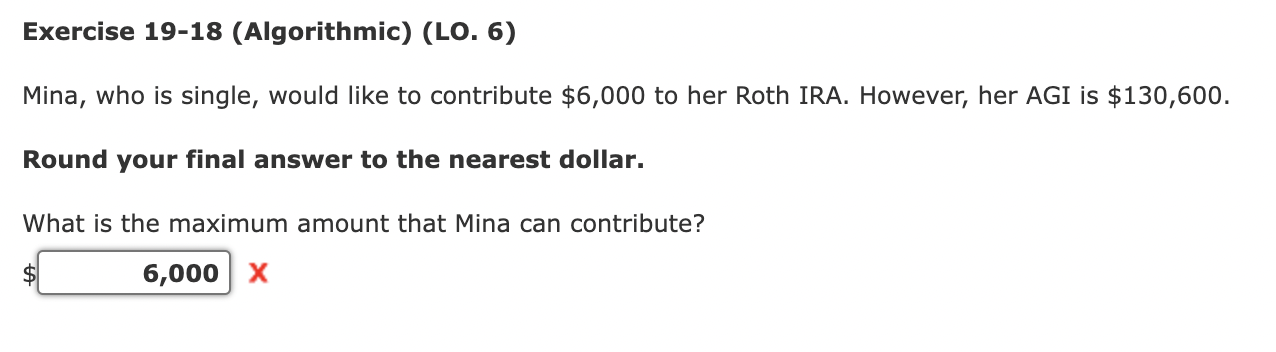

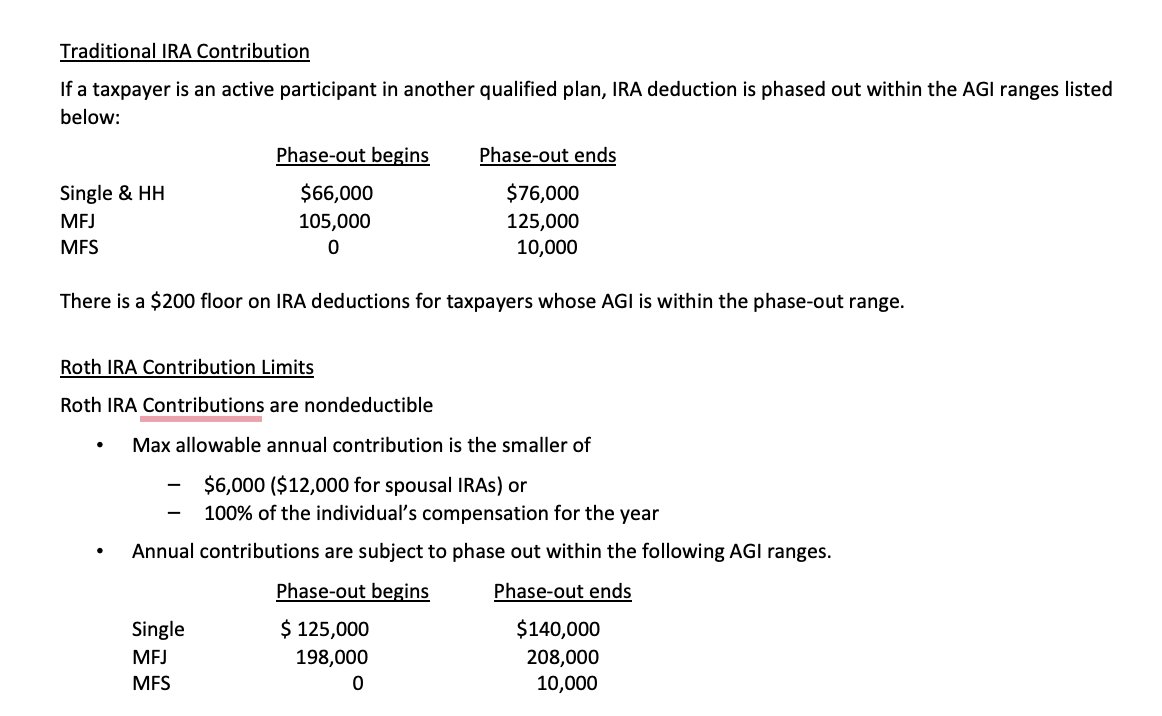

Exercise 19-18 (Algorithmic) (LO. 6) Mina, who is single, would like to contribute $6,000 to her Roth IRA. However, her AGI is $130,600. Round your final answer to the nearest dollar. What is the maximum amount that Mina can contribute? $ 6,000 X Traditional IRA Contribution If a taxpayer is an active participant in another qualified plan, IRA deduction is phased out within the AGI ranges listed below: Phase-out ends Single & HH MFJ MFS Phase-out begins $66,000 105,000 0 $76,000 125,000 10,000 There is a $200 floor on IRA deductions for taxpayers whose AGI is within the phase-out range. Roth IRA Contribution Limits Roth IRA Contributions are nondeductible . Max allowable annual contribution is the smaller of - . $6,000 ($12,000 for spousal IRAs) or 100% of the individual's compensation for the year Annual contributions are subject to phase out within the following AGI ranges. Phase-out begins Phase-out ends Single $ 125,000 $140,000 MFJ 198,000 208,000 MFS 0 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts