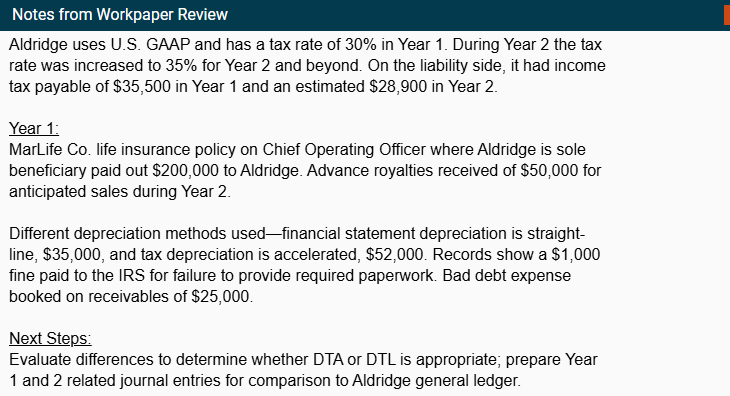

Question: Notes from Workpaper Review Aldridge uses U . S . GAAP and has a tax rate of 3 0 % in Year 1 . During

Notes from Workpaper Review Aldridge uses US GAAP and has a tax rate of in Year During Year the tax rate was increased to for Year and beyond. On the liability side, it had income tax payable of $ in Year and an estimated $ in Year Year : MarLife Co life insurance policy on Chief Operating Officer where Aldridge is sole beneficiary paid out $ to Aldridge. Advance royalties received of $ for anticipated sales during Year Different depreciation methods usedfinancial statement depreciation is straight line, $ and tax depreciation is accelerated, $ Records show a $ fine paid to the IRS for failure to provide required paperwork. Bad debt expense booked on receivables of $ Next Steps: Evaluate differences to determine whether DTA or DTL is appropriate; prepare Year and related journal entries for comparison to Aldridge general ledger. Scroll down to complete all parts of this task. Kent Wesley is a junior member of the external audit team hired to audit Aldridge Inc.s Year financial statements. Kent has been tasked with reviewing differences related to Aldridge's financial statements versus its tax forms from Year in order to prepare for the Year audit. After reading through the workpapers gathered from the company's financial reporting group, Wesley prepares notes shown in the exhibit to discuss with his manager. Use the information contained in the exhibit to fill out the tables below. Select the answers from the option lists provided. For each of the items listed above, populate the table below: ABC Item Temporary or Permanent Difference Deferred Tax Asset DTA or Deferred Tax Liability DTL Depreciation Life insurance payout Fine to the IRS Royalties received Bad debt expense What is the journal entry associated with the transactions above for Year Account Name Debit Credit Income Tax Expense Change in DTA Change in DTL Income Tax Payable What is the journal entry associated with the transactions above for Year Account Name Debit Credit Income Tax Expense Change in DTA Change in DTL Income Tax Payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock