Question: NOTES: https://drive.google.com/file/d/11cN87ySquChUOzsxPTrXdT-LKk4C6eRH/view?usp=sharing Nos. 17-20: Solve what is required for each of the following item. Show your solutions. 17. Mr. Mario wants to invest a sum

NOTES:https://drive.google.com/file/d/11cN87ySquChUOzsxPTrXdT-LKk4C6eRH/view?usp=sharing

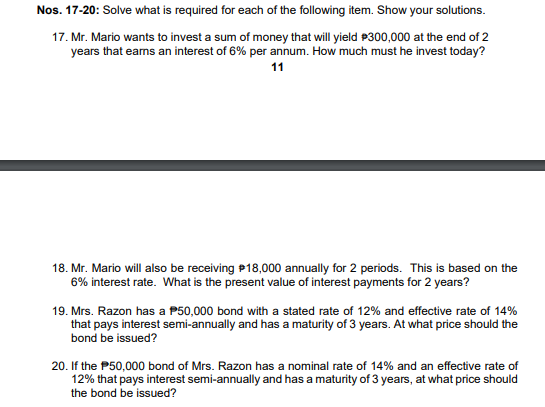

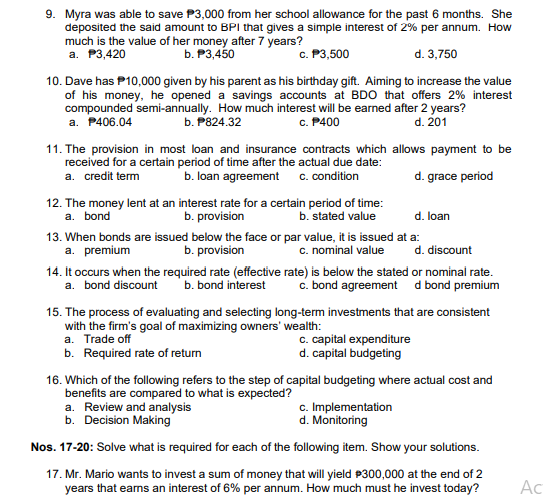

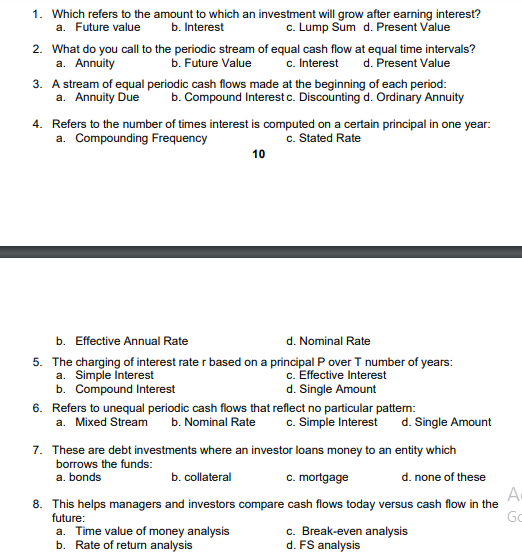

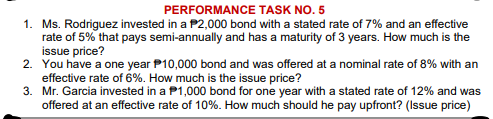

Nos. 17-20: Solve what is required for each of the following item. Show your solutions. 17. Mr. Mario wants to invest a sum of money that will yield $300,000 at the end of 2 years that eams an interest of 6% per annum. How much must he invest today? 11 18. Mr. Mario will also be receiving #18,000 annually for 2 periods. This is based on the 6% interest rate. What is the present value of interest payments for 2 years? 19. Mrs. Razon has a P50,000 bond with a stated rate of 12% and effective rate of 14% that pays interest semi-annually and has a maturity of 3 years. At what price should the bond be issued? 20. If the P50,000 bond of Mrs. Razon has a nominal rate of 14% and an effective rate of 12% that pays interest semi-annually and has a maturity of 3 years, at what price should the bond be issued?9. Myra was able to save P3,000 from her school allowance for the past 6 months. She deposited the said amount to BPI that gives a simple interest of 2% per annum. How much is the value of her money after 7 years? a. P3,420 b. P3,450 C. P3,500 d. 3,750 10. Dave has P10,000 given by his parent as his birthday gift. Aiming to increase the value of his money, he opened a savings accounts at BDO that offers 2% interest compounded semi-annually. How much interest will be earned after 2 years? a. P406.04 b. P824.32 c. P400 d. 201 11. The provision in most loan and insurance contracts which allows payment to be received for a certain period of time after the actual due date: a. credit term b. loan agreement c. condition d. grace period 12. The money lent at an interest rate for a certain period of time: a. bond b. provision b. stated value d. loan 13. When bonds are issued below the face or par value, it is issued at a: a. premium b. provision c. nominal value d. discount 14. It occurs when the required rate (effective rate) is below the stated or nominal rate. a. bond discount b. bond interest c. bond agreement d bond premium 15. The process of evaluating and selecting long-term investments that are consistent with the firm's goal of maximizing owners' wealth: a. Trade off c. capital expenditure b. Required rate of return d. capital budgeting 16. Which of the following refers to the step of capital budgeting where actual cost and benefits are compared to what is expected? a. Review and analysis c. Implementation b. Decision Making d. Monitoring Nos. 17-20: Solve what is required for each of the following item. Show your solutions. 17. Mr. Mario wants to invest a sum of money that will yield #300,000 at the end of 2 years that eams an interest of 6% per annum. How much must he invest today? Ac1. Which refers to the amount to which an investment will grow after earning interest? a. Future value b. Interest c. Lump Sum d. Present Value 2. What do you call to the periodic stream of equal cash flow at equal time intervals? a. Annuity b. Future Value c. Interest d. Present Value 3. A stream of equal periodic cash flows made at the beginning of each period: a. Annuity Due b. Compound Interest c. Discounting d. Ordinary Annuity 4. Refers to the number of times interest is computed on a certain principal in one year: a. Compounding Frequency c. Stated Rate 10 b. Effective Annual Rate d. Nominal Rate 5. The charging of interest rate r based on a principal P over T number of years: a. Simple Interest c. Effective Interest b. Compound Interest d. Single Amount 6. Refers to unequal periodic cash flows that reflect no particular pattern: a. Mixed Stream b. Nominal Rate c. Simple Interest d. Single Amount 7. These are debt investments where an investor loans money to an entity which borrows the funds: a. bonds b. collateral c. mortgage d. none of these 8. This helps managers and investors compare cash flows today versus cash flow in the A future: G a. Time value of money analysis c. Break-even analysis b. Rate of return analysis d. FS analysisPERFORMANCE TASK NO. 5 1. Ms. Rodriguez invested in a P2,000 bond with a stated rate of 7% and an effective rate of 5% that pays semi-annually and has a maturity of 3 years. How much is the issue price? 2. You have a one year P10,000 bond and was offered at a nominal rate of 8% with an effective rate of 6%. How much is the issue price? 3. Mr. Garcia invested in a P1,000 bond for one year with a stated rate of 12% and was offered at an effective rate of 10%. How much should he pay upfront? (Issue price)