Question: NOW Attempt story Current Attempt in Progress Your answer is partially correct. Vaughn Company produces small gasoline-powered engines for model airplanes. Mr. Taylor, Vaughn's CFO,

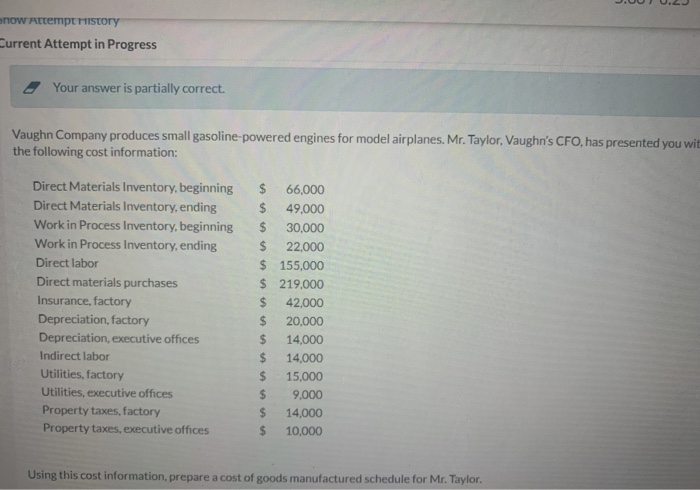

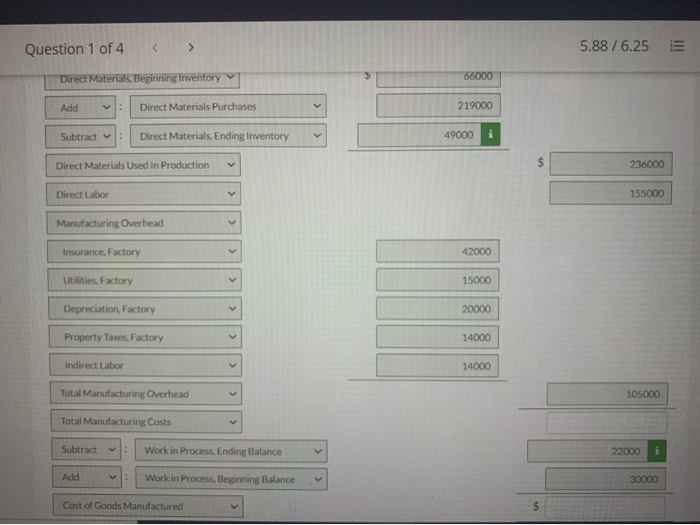

NOW Attempt story Current Attempt in Progress Your answer is partially correct. Vaughn Company produces small gasoline-powered engines for model airplanes. Mr. Taylor, Vaughn's CFO, has presented you wit the following cost information: Direct Materials Inventory, beginning Direct Materials Inventory, ending Work in Process Inventory, beginning Work in Process Inventory, ending Direct labor Direct materials purchases Insurance, factory Depreciation, factory Depreciation, executive offices Indirect labor Utilities, factory Utilities, executive offices Property taxes, factory Property taxes, executive offices $ 66,000 $ 49,000 $ 30,000 $ 22.000 $ 155,000 $ 219.000 $ 42,000 $ 20,000 $ 14,000 $ 14,000 $ 15,000 $ 9.000 $ 14,000 $ 10,000 Using this cost information, prepare a cost of goods manufactured schedule for Mr. Taylor. 5.88 / 6.25 Question 1 of 4 III Direct Materials, Beginning Inventory 66000 Add Direct Materials Purchases 219000 Subtract : Direct Materials, Ending Inventory 49000 Direct Materials used in Production $ 236000 Direct Labor 155000 Manufacturing Overhead Insurance, Factory 42000 Utilities, Factory 15000 Depreciation, Factory 20000 Property Taxes, Factory 14000 Indirect Labor 14000 Total Manufacturing Overhead 105000 Total Manufacturing Costs Subtract V: Work in Process, Ending Balance 22000 i Add : Work in Process, Beginning Balance 30000 Cost of Goods Manufactured $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts