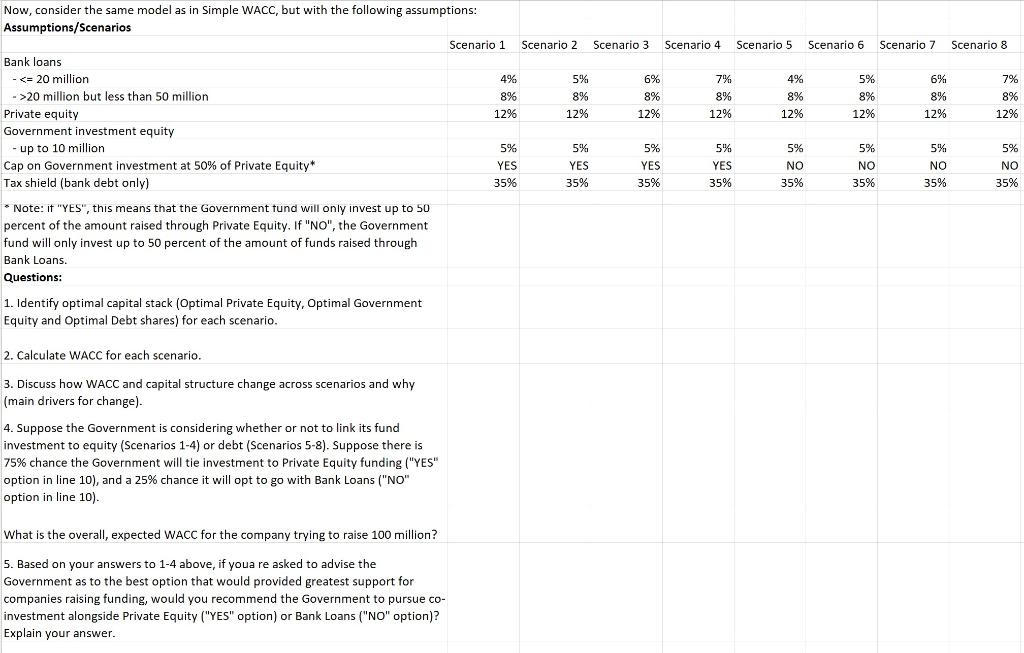

Question: Now, consider the same model as in Simple WACC, but with the following assumptions: Assumptions/Scenarios Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5

Now, consider the same model as in Simple WACC, but with the following assumptions: Assumptions/Scenarios Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7 6 Scenario 8 Bank loans - 20 million but less than 50 million 8% % 8% 8% 8% 8% 8% 8% 8% Private equity 12% 12% 12% 12% 12% % 12% 12% 12% Government investment equity - up to 10 million 5% 5% 5% 5% 5% 5% 5% 5% Cap on Government investment at 50% of Private Equity* YES YES YES YES NO NO NO NO Tax shield (bank debt only) 35% 35% 35% 35% 35% 35% 35% 35% * Note: it "YES", this means that the Government fund will only invest up to 50 percent of the amount raised through Private Equity. If "NO", the Government fund will only invest up to 50 percent of the amount of funds raised through Bank Loans. Questions: 1. Identify optimal capital stack (Optimal Private Equity, Optimal Government Equity and Optimal Debt shares) for each scenario. 2. Calculate WACC for each scenario. 3. Discuss how WACC and capital structure change across scenarios and why (main drivers for change). 4. Suppose the Government is considering whether or not to link its fund investment to equity (Scenarios 1-4) or debt (Scenarios 5-8). Suppose there is 75% chance the Government will tie investment to Private Equity funding ("YES" option in line 10), and a 25% chance it will opt to go with Bank Loans ("NO" option in line 10). What is the overall, expected WACC for the company trying to raise 100 million? 5. Based on your answers to 1-4 above, if youa re asked to advise the Government as to the best option that would provided greatest support for companies raising funding, would you recommend the Government to pursue co- investment alongside Private Equity ("YES" option) or Bank Loans ("NO" option)? Explain your answer. Now, consider the same model as in Simple WACC, but with the following assumptions: Assumptions/Scenarios Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7 6 Scenario 8 Bank loans - 20 million but less than 50 million 8% % 8% 8% 8% 8% 8% 8% 8% Private equity 12% 12% 12% 12% 12% % 12% 12% 12% Government investment equity - up to 10 million 5% 5% 5% 5% 5% 5% 5% 5% Cap on Government investment at 50% of Private Equity* YES YES YES YES NO NO NO NO Tax shield (bank debt only) 35% 35% 35% 35% 35% 35% 35% 35% * Note: it "YES", this means that the Government fund will only invest up to 50 percent of the amount raised through Private Equity. If "NO", the Government fund will only invest up to 50 percent of the amount of funds raised through Bank Loans. Questions: 1. Identify optimal capital stack (Optimal Private Equity, Optimal Government Equity and Optimal Debt shares) for each scenario. 2. Calculate WACC for each scenario. 3. Discuss how WACC and capital structure change across scenarios and why (main drivers for change). 4. Suppose the Government is considering whether or not to link its fund investment to equity (Scenarios 1-4) or debt (Scenarios 5-8). Suppose there is 75% chance the Government will tie investment to Private Equity funding ("YES" option in line 10), and a 25% chance it will opt to go with Bank Loans ("NO" option in line 10). What is the overall, expected WACC for the company trying to raise 100 million? 5. Based on your answers to 1-4 above, if youa re asked to advise the Government as to the best option that would provided greatest support for companies raising funding, would you recommend the Government to pursue co- investment alongside Private Equity ("YES" option) or Bank Loans ("NO" option)? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts