Question: Now, find one more 5-year bond that has the same feature as one of your 30-years bond, ic same rating and same coupon rate. Note:

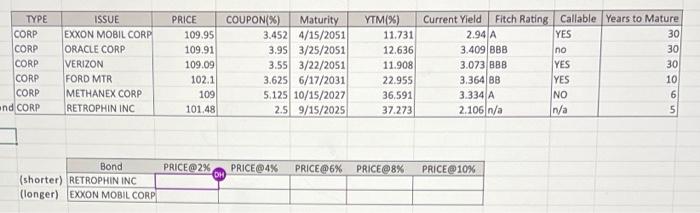

Now, find one more 5-year bond that has the same feature as one of your 30-years bond, ic same rating and same coupon rate. Note: You could use any bond with longer vs. shorter bond as well instead of 5 vs. 10 years. The coupon rate might not be the same but choose bonds with same rating and very close numbers in terms of coupon rate. Calculate the new price of bond at the new YTM of 2%, 4%, 6%, 8%, and 10% for both 5-years bond and 30-years bond. Plot the graph of the relationship between the price and YTM for each bond on the same graph. What did you find regarding the relationship TYPE CORP CORP CORP CORP CORP and CORP ISSUE EXXON MOBIL CORP ORACLE CORP VERIZON FORD MTR METHANEX CORP RETROPHIN INC PRICE 109.95 109.91 109.09 102.1 109 101.48 COUPON%) Maturity 3.452 4/15/2051 3.95 3/25/2051 3.55 3/22/2051 3.625 6/17/2031 5.125 10/15/2027 2.5 9/15/2025 YTM(%) Current Yield Fitch Rating Callable Years to Mature 11.731 2.94 A YES 30 12.636 3,409 BBB no 30 11.908 3.073 BBB 30 22.955 3.364 BB YES 10 36.591 3.334 A INO 6 37.273 2.106 n/a n/a 5 YES PRICE@4% PRICE@6% PRICE@8% PRICE@10% DH Bond PRICE2% (shorter) RETROPHIN INC (longer) EXXON MOBIL CORP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts