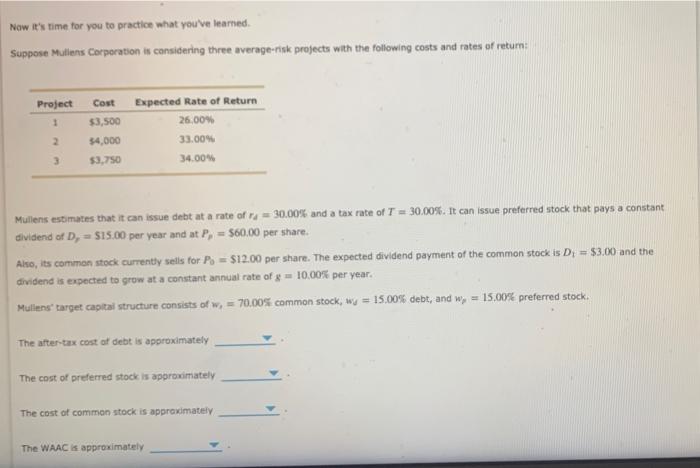

Question: Now it's time for you to practice what you've learned Suppose Mutlens Corporation is considering three average-risk projects with the following costs and rates of

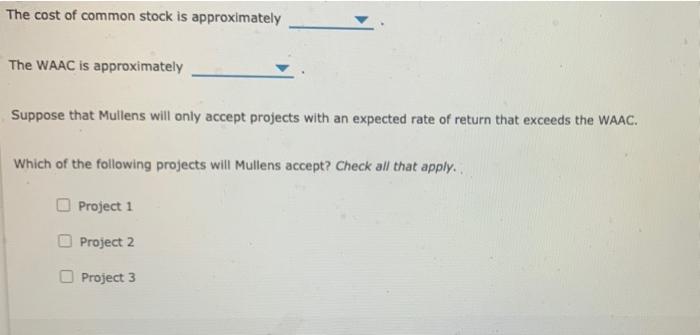

Now it's time for you to practice what you've learned Suppose Mutlens Corporation is considering three average-risk projects with the following costs and rates of return; Project Cost Expected Rate of Return . $3,500 26,00% 2 $4,000 33.00% 3 $3,750 34.00 Mullens estimates that it can issue debt at a rate of ra = 30.00% and a tax rate of T = 30.00%. It can issue preferred stock that pays a constant dividend of D, = $15.00 per year and at P, = $60,00 per share. Also, its common stock currently sells for P = $12.00 per share. The expected dividend payment of the common stock is D1 = $3.00 and the dividend is expected to grow at a constant annual rate of g = 10.00% per year. Mullens" target capital structure consists of w, = 70.00% common stock, wy = 15.00% debt, and w, = 15.00% preferred stock. The after-tax cost of debt is approximately The cost of preferred stock is approximately The cost of common stock is approximately The WAAC is approximately The cost of common stock is approximately The WAAC is approximately Suppose that Mullens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the following projects will Mullens accept? Check all that apply. Project 1 Project 2 Project 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts