Question: Now it's time to make some adjusting journal entries. Based on what you learned from the text using the sample company, you are to make

Now it's time to make some adjusting journal entries. Based on what you learned from the text using the sample company, you are to make the following changes to the case 3 company you modified in chapter 8.

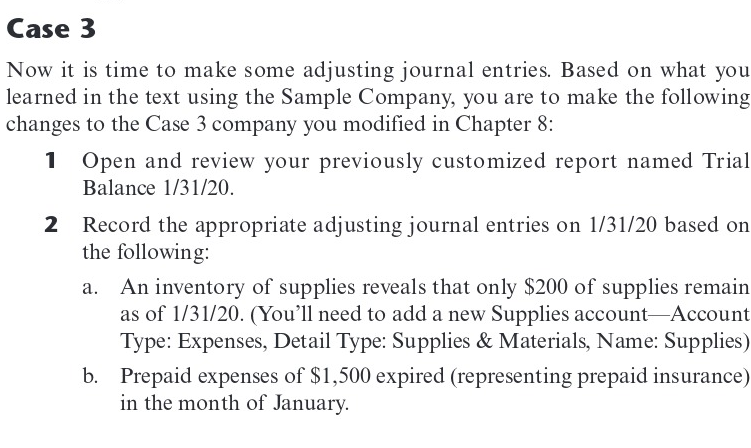

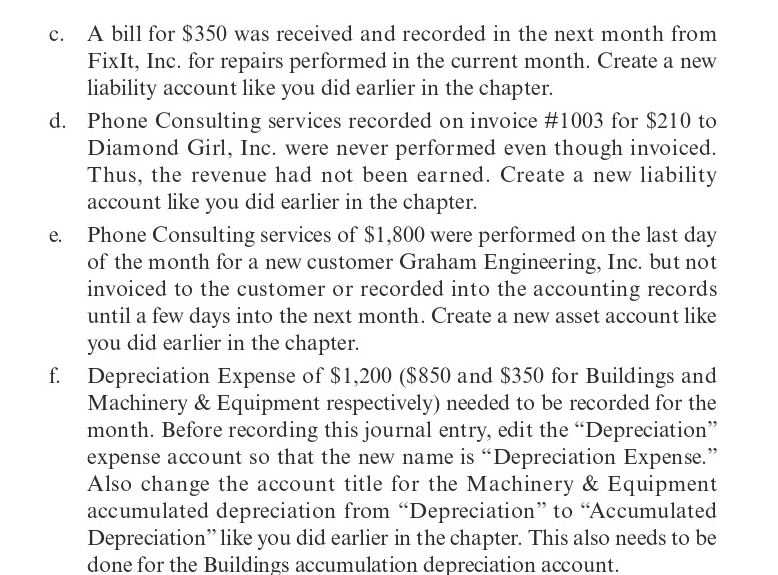

Case 3 Now it is time to make some adjusting journal entries. Based on what you learned in the text using the Sample Company, you are to make the following changes to the Case 3 company you modified in Chapter 8: 1 Open and review your previously customized report named Trial Balance 1/31/20. 2 Record the appropriate adjusting journal entries on 1/31/20 based on the following: a. An inventory of supplies reveals that only $200 of supplies remain as of 1/31/20. (You'll need to add a new Supplies account-Account Type: Expenses, Detail Type: Supplies & Materials, Name: Supplies) . b. Prepaid expenses of $1,500 expired (representing prepaid insurance) in the month of January. e. c. A bill for $350 was received and recorded in the next month from FixIt, Inc. for repairs performed in the current month. Create a new liability account like you did earlier in the chapter. d. Phone Consulting services recorded on invoice #1003 for $210 to Diamond Girl, Inc. were never performed even though invoiced. Thus, the revenue had not been earned. Create a new liability account like you did earlier in the chapter. Phone Consulting services of $1,800 were performed on the last day of the month for a new customer Graham Engineering, Inc. but not invoiced to the customer or recorded into the accounting records until a few days into the next month. Create a new asset account like you did earlier in the chapter. . f. Depreciation Expense of $1,200 ($850 and $350 for Buildings and Machinery & Equipment respectively) needed to be recorded for the month. Before recording this journal entry, edit the Depreciation expense account so that the new name is Depreciation Expense." Also change the account title for the Machinery & Equipment accumulated depreciation from Depreciation to Accumulated Depreciation like you did earlier in the chapter. This also needs to be done for the Buildings accumulation depreciation account. Case 3 Now it is time to make some adjusting journal entries. Based on what you learned in the text using the Sample Company, you are to make the following changes to the Case 3 company you modified in Chapter 8: 1 Open and review your previously customized report named Trial Balance 1/31/20. 2 Record the appropriate adjusting journal entries on 1/31/20 based on the following: a. An inventory of supplies reveals that only $200 of supplies remain as of 1/31/20. (You'll need to add a new Supplies account-Account Type: Expenses, Detail Type: Supplies & Materials, Name: Supplies) . b. Prepaid expenses of $1,500 expired (representing prepaid insurance) in the month of January. e. c. A bill for $350 was received and recorded in the next month from FixIt, Inc. for repairs performed in the current month. Create a new liability account like you did earlier in the chapter. d. Phone Consulting services recorded on invoice #1003 for $210 to Diamond Girl, Inc. were never performed even though invoiced. Thus, the revenue had not been earned. Create a new liability account like you did earlier in the chapter. Phone Consulting services of $1,800 were performed on the last day of the month for a new customer Graham Engineering, Inc. but not invoiced to the customer or recorded into the accounting records until a few days into the next month. Create a new asset account like you did earlier in the chapter. . f. Depreciation Expense of $1,200 ($850 and $350 for Buildings and Machinery & Equipment respectively) needed to be recorded for the month. Before recording this journal entry, edit the Depreciation expense account so that the new name is Depreciation Expense." Also change the account title for the Machinery & Equipment accumulated depreciation from Depreciation to Accumulated Depreciation like you did earlier in the chapter. This also needs to be done for the Buildings accumulation depreciation account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts