Question: Now that Joe has calculated his weights, he is calculating his return/cost on each type of funding. He has the following Facts for his equity

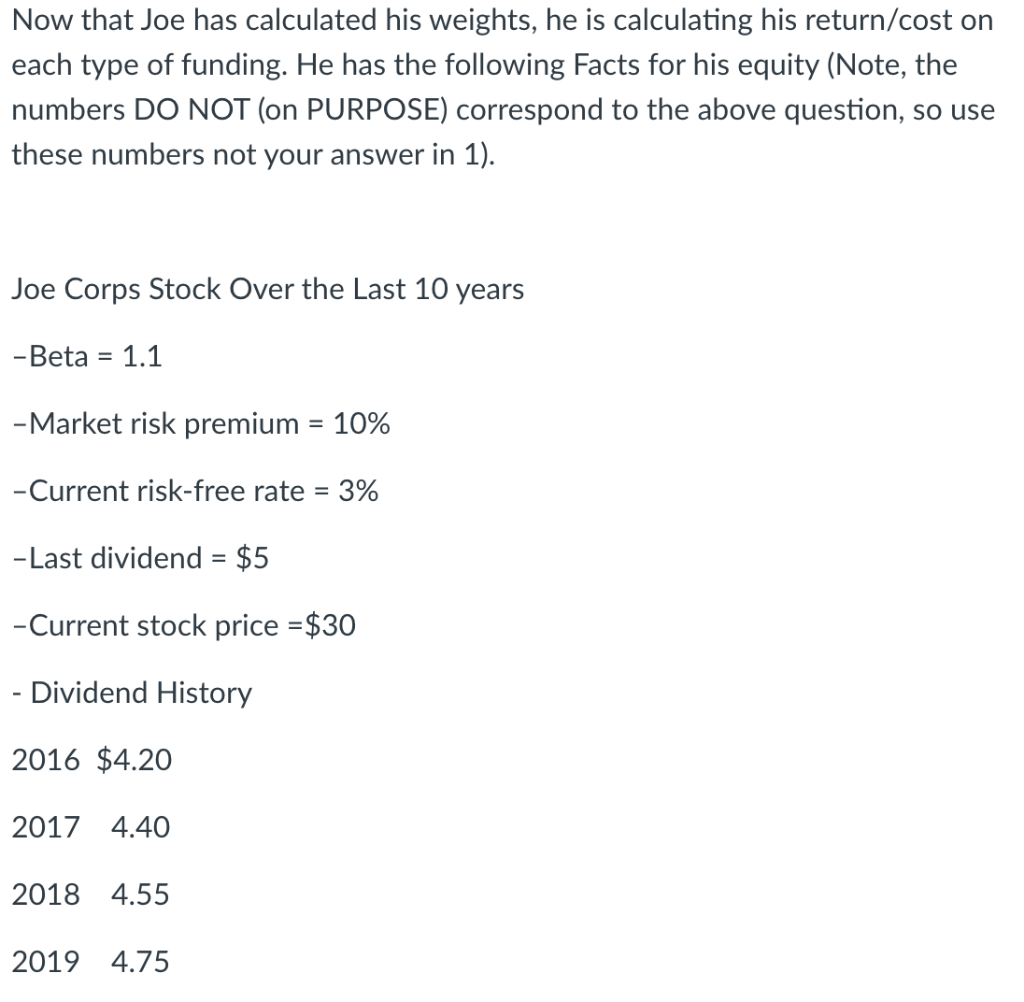

Now that Joe has calculated his weights, he is calculating his return/cost on each type of funding. He has the following Facts for his equity (Note, the numbers DO NOT (on PURPOSE) correspond to the above question, so use these numbers not your answer in 1). Joe Corps Stock Over the Last 10 years -Beta = 1.1 - Market risk premium = 10% -Current risk-free rate = 3% -Last dividend = $5 -Current stock price =$30 - Dividend History 2016 $4.20 2017 4.40 2018 4.55 2019 4.75 2020 5.00 ALL ANSWERS MUST SHOW WORK 1.Calculate the cost of Equity using SML (1 pt) 2. Calculate the Dividend Growth Rate (1 pt) 3. Use the rate you calculated in 2 and calculate the cost of equity using the DGM (1 PT) 4. Which of the two models are correct? (.5 pts) JHL Tabi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts