Question: = NPV ( 0 . 0 8 , B 2 : B 7 ) - NPVIO . 0 8 , B 3 :B 7 )

NPV B: B

NPVIO B:B B

Question

pts

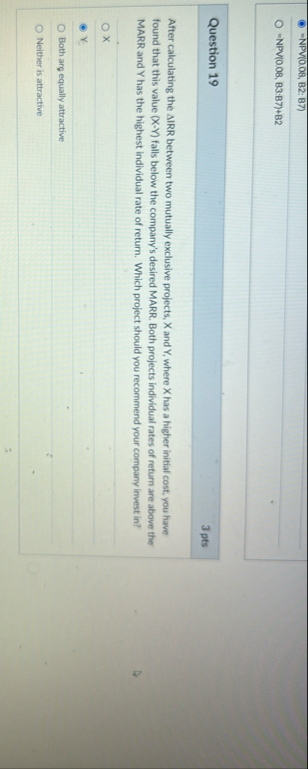

After calculating the AIRR between two mutually exclusive projects, and where has a higher initial cost, you have found that this value falls below the company's desired MARR. Both projects individual rates of return are above the MARR and has the highest individual rate of return. Which project should you recommend your company invest in

X

Both arg equally attractive

Neither is attractive

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock