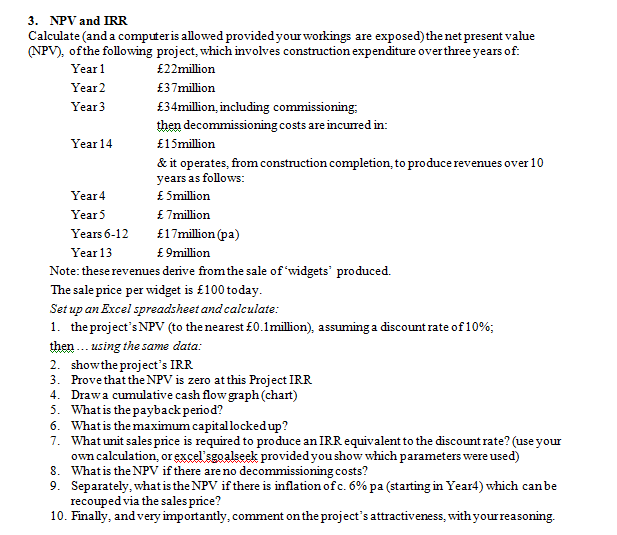

Question: NPV and IRR Calculate (and a computer is allowed provided your workings are exposed) the net present value (NPV), of the following project, which involves

NPV and IRR Calculate (and a computer is allowed provided your workings are exposed) the net present value (NPV), of the following project, which involves construction expenditure over three years of: Note: these revenues derive from the sale of 'widgets' produced. The sale price per widget is pound sign 100 today. Setup an Excel spreadsheet and calculate: the project's NPV (to the nearest pound sign0.1 million), assuming a discount rate of 10%; then--- using the same data: show the project's IRR Prove that the NPV is zero at this Project IRR Draw a cumulative cash flow graph (chart) What is the payback period? What is the maximum capital locked up? What unit sales price is required to produce an IRR equivalent to the discount rate? (use your own calculation, or excel's go alseek provided you show which parameters were used) What is the NPV if there are no decommissioning costs? Separately, what is the NPV if there is inflation of c. 6% pa (starting in Year4) which can be recouped via the sales price? Finally, and very importantly, comment on the project's attractiveness, with your reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts