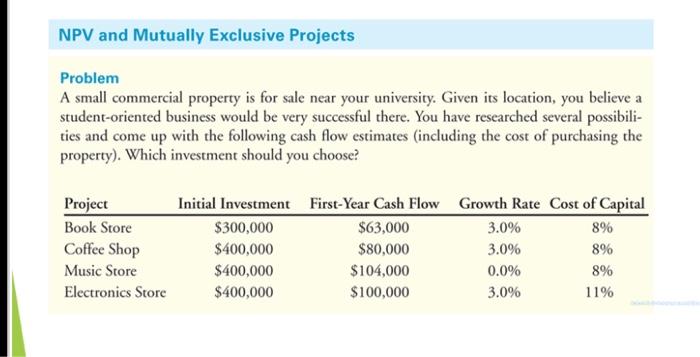

Question: NPV and Mutually Exclusive Projects Problem A small commercial property is for sale near your university. Given its location, you believe a student-oriented business would

NPV and Mutually Exclusive Projects Problem A small commercial property is for sale near your university. Given its location, you believe a student-oriented business would be very successful there. You have researched several possibili- ties and come up with the following cash flow estimates (including the cost of purchasing the property). Which investment should you choose? Project Book Store Coffee Shop Music Store Electronics Store Initial Investment First-Year Cash Flow Growth Rate Cost of Capital $63,000 $80,000 $104,000 $100,000 $300,000 $400,000 $400,000 $400,000 3.0% 3.0% 0.0% 3.0% 8% 8% 8% 11%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts