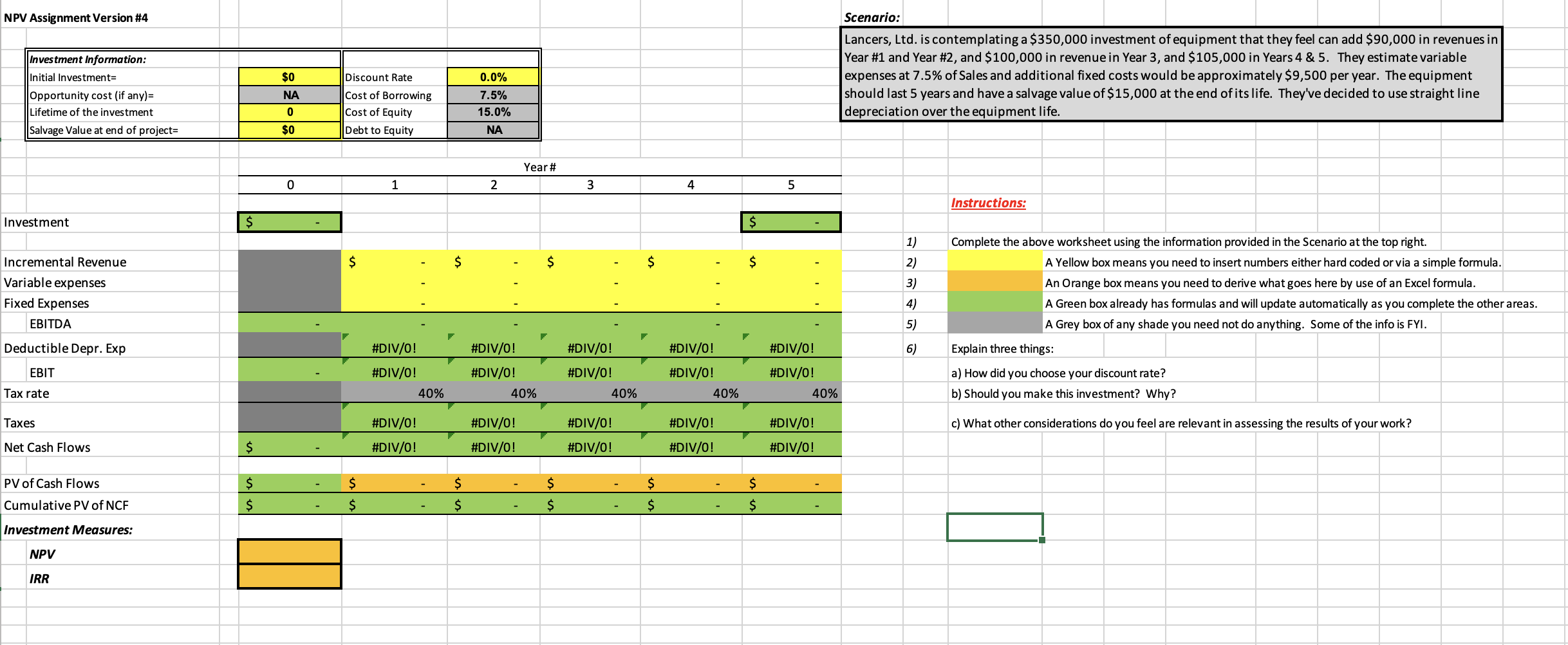

Question: NPV Assignment Version #4 Scenario: Discount Rate Investment Information: Initial Investments Opportunity cost (if any)= Lifetime of the investment Salvage Value at end of projects

NPV Assignment Version #4 Scenario: Discount Rate Investment Information: Initial Investments Opportunity cost (if any)= Lifetime of the investment Salvage Value at end of projects $0 NA Lancers, Ltd. is contemplating a $350,000 investment of equipment that they feel can add $90,000 in revenues in Year #1 and Year #2, and $100,000 in revenue in Year 3, and $105,000 in Years 4 & 5. They estimate variable expenses at 7.5% of Sales and additional fixed costs would be approximately $9,500 per year. The equipment should last 5 years and have a salvage value of $15,000 at the end of its life. They've decided to use straight line depreciation over the equipment life. 0.0% 7.5% 15.0% NA Cost of Borrowing Cost of Equity Debt to Equity 0 $0 Year# 0 1 2 3 4 5 Instructions: Investment $ $ $ $ $ $ 1) 2) 3) Incremental Revenue Variable expenses Fixed Expenses EBITDA Complete the above worksheet using the information provided in the Scenario at the top right. A Yellow box means you need to insert numbers either hard coded or via a simple formula. An Orange box means you need to derive what goes here by use of an Excel formula. A Green box already has formulas and will update automatically as you complete the other areas. A Grey box of any shade you need not do anything. Some of the info is FYI. Explain three things: 4) 5) Deductible Depr. Exp 6) EBIT #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% a) How did you choose your discount rate? b) Should you make this investment? Why? Tax rate Taxes #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! c) What other considerations do you feel are relevant in assessing the results of your work? Net Cash Flows $ #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! $ PV of Cash Flows Cumulative PV of NCF $ $ $ $ $ $ $ $ $ $ $ Investment Measures: NPV IRR NPV Assignment Version #4 Scenario: Discount Rate Investment Information: Initial Investments Opportunity cost (if any)= Lifetime of the investment Salvage Value at end of projects $0 NA Lancers, Ltd. is contemplating a $350,000 investment of equipment that they feel can add $90,000 in revenues in Year #1 and Year #2, and $100,000 in revenue in Year 3, and $105,000 in Years 4 & 5. They estimate variable expenses at 7.5% of Sales and additional fixed costs would be approximately $9,500 per year. The equipment should last 5 years and have a salvage value of $15,000 at the end of its life. They've decided to use straight line depreciation over the equipment life. 0.0% 7.5% 15.0% NA Cost of Borrowing Cost of Equity Debt to Equity 0 $0 Year# 0 1 2 3 4 5 Instructions: Investment $ $ $ $ $ $ 1) 2) 3) Incremental Revenue Variable expenses Fixed Expenses EBITDA Complete the above worksheet using the information provided in the Scenario at the top right. A Yellow box means you need to insert numbers either hard coded or via a simple formula. An Orange box means you need to derive what goes here by use of an Excel formula. A Green box already has formulas and will update automatically as you complete the other areas. A Grey box of any shade you need not do anything. Some of the info is FYI. Explain three things: 4) 5) Deductible Depr. Exp 6) EBIT #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% #DIV/0! #DIV/0! 40% a) How did you choose your discount rate? b) Should you make this investment? Why? Tax rate Taxes #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! c) What other considerations do you feel are relevant in assessing the results of your work? Net Cash Flows $ #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! $ PV of Cash Flows Cumulative PV of NCF $ $ $ $ $ $ $ $ $ $ $ Investment Measures: NPV IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts