Question: NPV Calculate the net present value (NPV) for a 15-year project with an initial investment of $15,000 and a cash inflow of $5,000 per year.

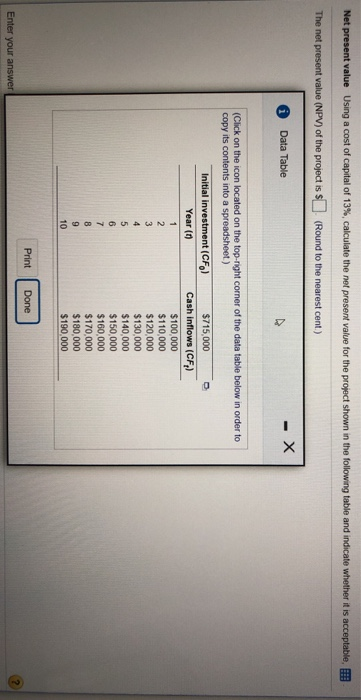

NPV Calculate the net present value (NPV) for a 15-year project with an initial investment of $15,000 and a cash inflow of $5,000 per year. Assume that the firm has an opportunity cost of 16% Comment on the acceptability of the project The projects net present value is (Round to the nearest cent) Net present value Using a cost of capital of 13% ca late the net present value for the prop ct shown n the follo ng table and indicate whether t is acceptable The net present value (NPV) of the project is $ (Round to the nearest cent) Data Table (Click on the icon located on the top-right corner of the data table below in order to y its contents into a spreadsheet) $715,000 Initial investment (CFo) Year (t Cash inflows (CF) $100,000 $110,000 $120,000 $130,000 $140,000 $150,000 $160,000 $170,000 $180,000 $190,000 10 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts