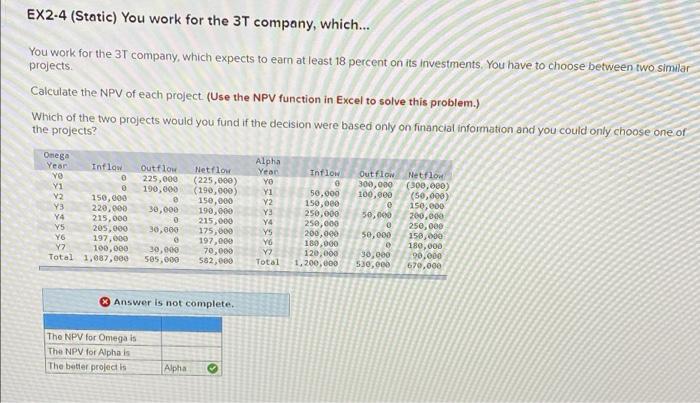

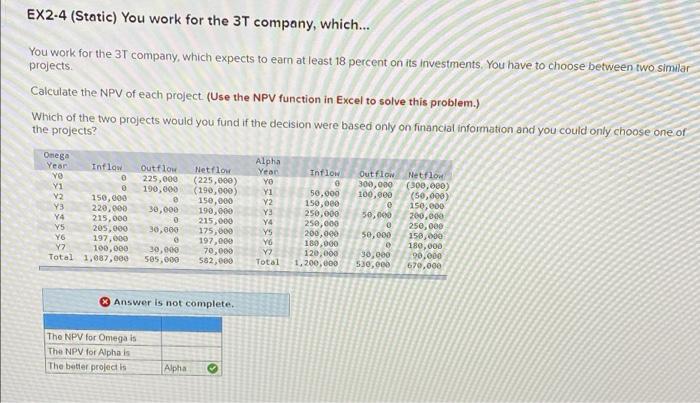

Question: NPV for Omega and Alpha EX2-4 (Static) You work for the 3T company, which... You work for the 3T company, which expects to earn at

NPV for Omega and Alpha

EX2-4 (Static) You work for the 3T company, which... You work for the 3T company, which expects to earn at least 18 percent on its investments. You have to choose between two similar projects Calculate the NPV of each project (Use the NPV function in Excel to solve this problem.) Which of the two projects would you fund if the decision were based only on financial information and you could only choose one of the projects? Outflow 225,000 190,000 Inflow Outflow 300,000 100,000 Onega Year Inflow YO 0 Y1 V2 150,000 Y3 220,000 Y4 215,000 Y5 205,000 Y6 197,000 Y2 100,000 Total 1,087,000 30,000 0 30,000 0 30,000 505,000 Netflou (225,000) (190,000) 150,000 190,000 215,000 175,000 197,009 70,000 582,000 Alpha Year YO Yi V2 Y3 Y4 YS YO Y? Total 50.000 150,000 250,000 250,000 200,000 180,000 120,000 1,200,000 50,000 0 50,000 Netflow (300,000) (50,000) 150,000 200,000 250,000 158,000 180,000 90.000 670,000 30,000 530,000 Answer is not complete. The NPV for Omega is The NPV for Alpha is The better project is Alpha

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock