Question: npv is the correct answer. payback is not 5.19. can you please show calculations so i can follow he val ex 34 Requirements PO EM

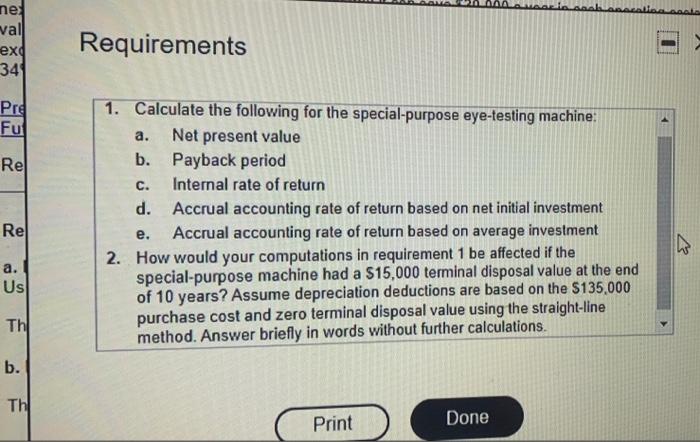

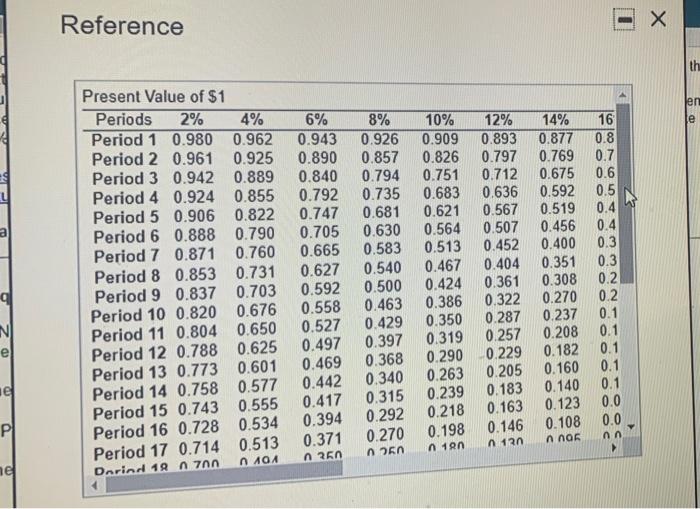

he val ex 34 Requirements PO EM Re C. Re 1. Calculate the following for the special purpose eyeling machine Not present value b. Payback period Internal rate of return d. Accrual accounting rate of return based on neil investment e. Accrual accounting rate of return based on average Investment 2. How would your computations in requirement betected at the special purpose machine had a $15.000 mil disposal value the end of 10 years? Assume depreciation deductions are based on the $135.000 purchase cost and zero terminal disposal value using the straight method. Answer briefly in words without further calculations SP TH b. THE Print Done Chicago Hospital taxpaying only estimates that can save $30,000 a year in tash next 10 years buys a special purpose eye testing machine at a cost $135.000. Nominal Gape Value is expected Chicago Hospitals required rate of return is 125 Asunt chines courant except for at investment amounts Chicago Hospitales straight line in the cost 34% for all transactions that affect income Presentatale Presentatie Estate Alable Read the Requirement 1. Calculate the following for the special pretendime s. Net pretant al (NPR) (Round werin calculation and your final to the new Use amus signor preses for rental) The represent was $2.041 b. Payback period (Round your answer to decimal places) The number of years for the payback periots Reference 0575 Present Value of 51 Periods 2 4% Period 1 090 0962 Perlod 2 0.961 0925 Period 3 09420889 Period 4 0.924 0.855 Period 5 09060822 Period 6 0.888 0790 Period 7 0.871 0.760 Period 8 0.853 0.731 Period 9 0.837 0.703 Period 10 0 820 0676 Period 11 0 8040650 Period 12 0.788 0625 Period 13 0.773 0601 Period 14 0.758 0577 Period 15 0.743 0.555 Period 16 0.728 0.534 Perlod 17 0.714 0513 DATA 6% 0943 0 890 0.840 0.792 0747 0.705 0 665 0627 0.592 0558 0527 0497 0.469 0442 0.417 0394 0 371 ASA 3% 10% 125 16 16 0526 0505 009 0017 0.857 0797 0769 07 0.794 0.751 0.712 DC 735 0.683 0636 55205 0681 0621 567 05132 0630 0564 SOT 0.456 0583 0.513 0052 0.400 03 0540 0.667 404 0351 03 0500 0.424 361 300 02 0366 01220270 02 009 0350 0207 0237 01 03970319 0257 0200 01 368 02900229 00 03400263 0205 O. 01 0315 0239 0183 0.10001 0292 0218 0.16301230D 270 0190 0165 0.100 00 0663 AM ne: val exd 34 Requirements Pre Fu Rel C. Re 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value b. Payback period Internal rate of return d. Accrual accounting rate of return based on net initial investment Accrual accounting rate return based on average investment 2. How would your computations in requirement 1 be affected if the special-purpose machine had a $15,000 terminal disposal value at the end of 10 years? Assume depreciation deductions are based on the $135,000 purchase cost and zero terminal disposal value using the straight-line method. Answer briefly in words without further calculations. e. a. Us 3 Thl E b. Th Print Done Chicago Hospital, a taxpaying entity, estimates that it can save $30,000 a year in cash operating costs for the next 10 years if it buys a special-purpose eye-testing machine at a cost of $135,000. No terminal disposal value is expected. Chicago Hospital's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. Chicago Hospital uses straight-line depreciation. The income tax rate is 34% for all transactions that affect income taxes. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the feauirements ... Requirement 1. Calculate the following for the special-purpose eye-testing machine: a. Net present value (NPR) (Round interim calculations and your final answers to the nearest whole dollar Use a minus sign or parentheses for a negative net present value.) The net present value is $ 2,804 b. Payback period (Round your answer to two decimal places.) The number of years for the payback period is Reference th len je 6% Present Value of $1 Periods 2% 4% 8% 10% 12% 14% Period 1 0.980 0.962 0.943 0.926 0.909 0.893 0.877 Period 2 0.961 0.925 0.890 0.857 0.826 0.797 0.769 Period 3 0.942 0.889 0.840 0.794 0.751 0.712 0.675 Period 4 0.924 0.855 0.792 0.735 0.683 0.636 0.592 Period 5 0.906 0.822 0.747 0.681 0.621 0.567 0.519 Period 6 0.888 0.790 0.705 0.630 0.564 0.507 0.456 Period 7 0.871 0.760 0.665 0.583 0.513 0.452 0.400 Period 8 0.853 0.731 0.627 0.540 0.467 0.404 0.351 Period 9 0.837 0.703 0.592 0.500 0.424 0.361 0.308 Period 10 0.820 0.676 0.558 0.463 0.386 0.322 0.270 Period 11 0.804 0.650 0.527 0.429 0.350 0.287 0.237 0.497 Period 12 0.788 0.625 0.397 0.319 0.257 0.208 0.368 0.290 0.229 0.182 Period 13 0.773 0.601 0.469 0.340 0.263 0.205 0.160 Period 14 0.758 0.577 0.442 0.239 0.183 0.140 Period 15 0.743 0.555 0.417 0.315 0.218 0.163 0.123 Period 16 0.728 0.534 0.394 0.292 0.108 Period 17 0.714 0.513 0.371 0.270 0.198 0.146 18n n6n n 250 Dorind 1970 16 0.8 0.7 0.6 0.5 0.4 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.0 0.0 N e el PI nn06 ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts