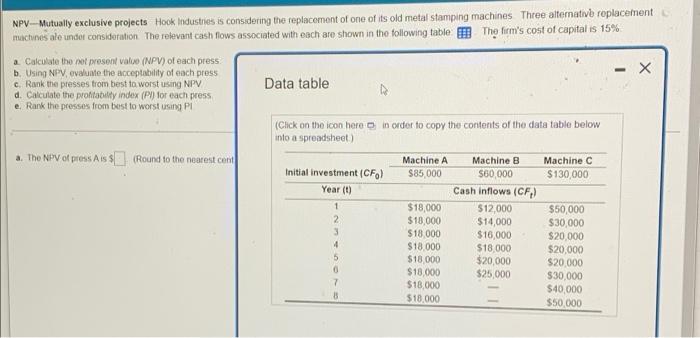

Question: NPV Mutually exclusive projects Hook Industries is considering the replacement of one of its old metal stamping machines Three alternative roplacement machunes ale under consideration

NPV Mutually exclusive projects Hook Industries is considering the replacement of one of its old metal stamping machines Three alternative roplacement machunes ale under consideration The relevant cash flows associated with each are shown in the following table. The firm's cost of capital is 15% a Calculate the sot present value (MPV) of each press. b. Using NPV evaluate the acceptability of each press c. Rank the presses from best to worst using NPV Data table d. Calculate the profitability index (Pl) for each press e. Rank the presses from best to worst using Pi (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) a. The NPV of press Ais (Round to the nearest cont Machine A Machine B Machine C Initial investment (CF) $85,000 $60,000 $130,000 Year (t) Cash inflows (CF) $18,000 $12,000 $50,000 $18,000 $14,000 $30,000 $18.000 $16,000 $20,000 4 $18.000 $18.000 $20,000 5 $18,000 $20,000 $20,000 $18.000 $25,000 $30,000 $18,000 $40,000 $18.000 $50.000 1 2 0 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts