Question: NPV: Mutually exclusive projects The BMW Group is considering the replacement of one of its car-manufacturing robot lines. Three alternative replacement robot lines are under

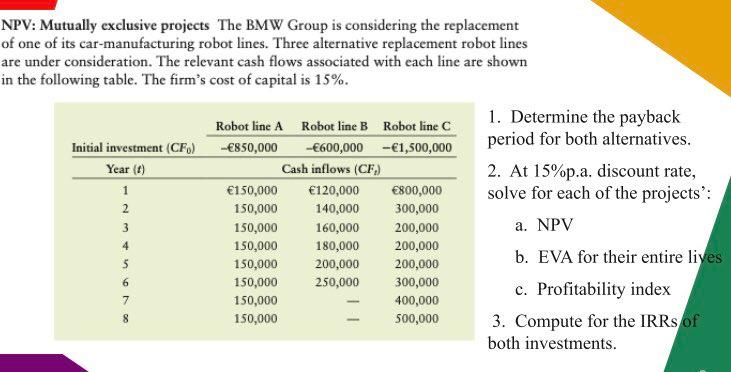

NPV: Mutually exclusive projects The BMW Group is considering the replacement of one of its car-manufacturing robot lines. Three alternative replacement robot lines are under consideration. The relevant cash flows associated with each line are shown in the following table. The firm's cost of capital is 15%. 1. Determine the payback period for both alternatives. 2. At 15% p.a. discount rate, solve for each of the projects': a. NPV b. EVA for their entire lives c. Profitability index 3. Compute for the IRRs of both investments. NPV: Mutually exclusive projects The BMW Group is considering the replacement of one of its car-manufacturing robot lines. Three alternative replacement robot lines are under consideration. The relevant cash flows associated with each line are shown in the following table. The firm's cost of capital is 15%. 1. Determine the payback period for both alternatives. 2. At 15% p.a. discount rate, solve for each of the projects': a. NPV b. EVA for their entire lives c. Profitability index 3. Compute for the IRRs of both investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts