Question: NPV (Replacing an Asset) Practice Problem With his experience at Jo-Jo's Psychic Network, Matthew Barrett returned to banking at Barclay's Capital, earning six million pounds

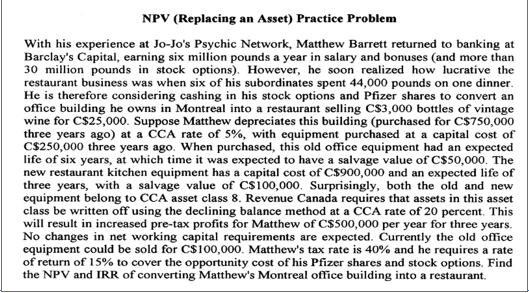

NPV (Replacing an Asset) Practice Problem With his experience at Jo-Jo's Psychic Network, Matthew Barrett returned to banking at Barclay's Capital, earning six million pounds a year in salary and bonuses (and more than 30 million pounds in stock options). However, he soon realized how lucrative the restaurant business was when six of his subordinates spent 44,000 pounds on one dinner. He is therefore considering cashing in his stock options and Pfizer shares to convert an office building he owns in Montreal into a restaurant selling C$3,000 bottles of vintage wine for C$25,000. Suppose Matthew depreciates this building (purchased for C$750,000 three years ago) at a CCA rate of 5%, with equipment purchased at a capital cost of C\$250,000 three years ago. When purchased, this old office equipment had an expected life of six years, at which time it was expected to have a salvage value of C\$50,000. The new restaurant kitchen equipment has a capital cost of C$900,000 and an expected life of three years, with a salvage value of C$100,000. Surprisingly, both the old and new equipment belong to CCA asset class 8 . Revenue Canada requires that assets in this asset class be written off using the declining balance method at a CCA rate of 20 percent. This will result in increased pre-tax profits for Matthew of C$500,000 per year for three years. No changes in net working capital requirements are expected. Currently the old office equipment could be sold for C$100,000. Matthew's tax rate is 40% and he requires a rate of return of 15% to cover the opportunity cost of his Pfizer shares and stock options. Find the NPV and IRR of converting Matthew's Montreal office building into a restaurant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts