Question: NPV: Should it be accepted or rejected? ACCEPTED. Suppose your firm is considering investing in a project with the cash flows shown below, that the

NPV:

NPV:

Should it be accepted or rejected? ACCEPTED.

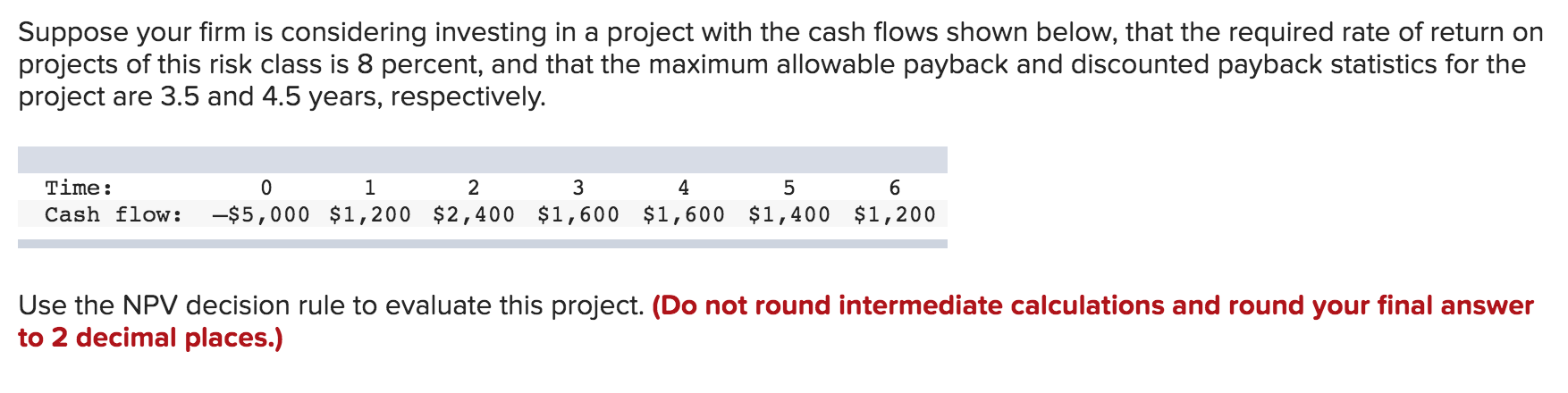

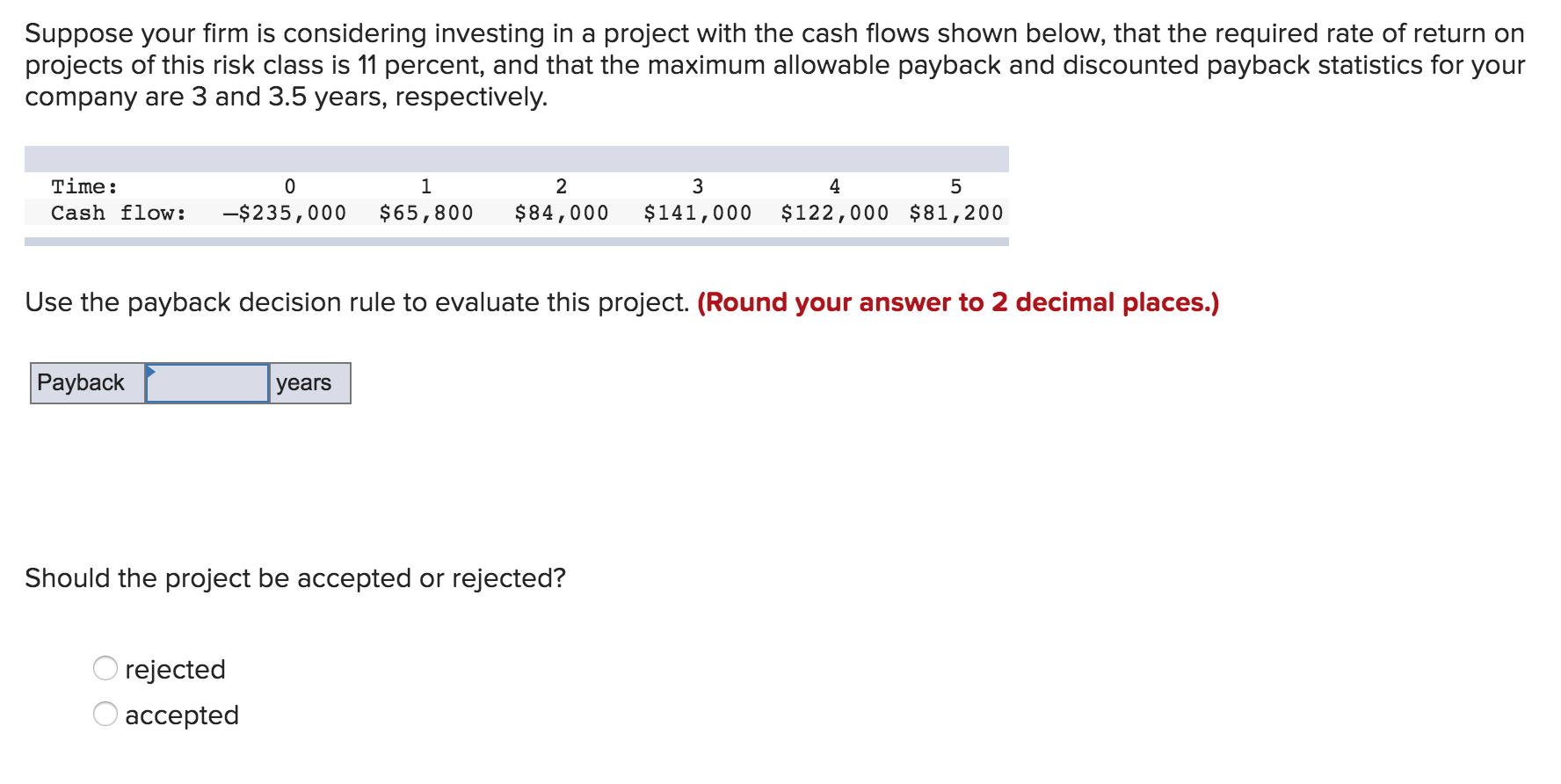

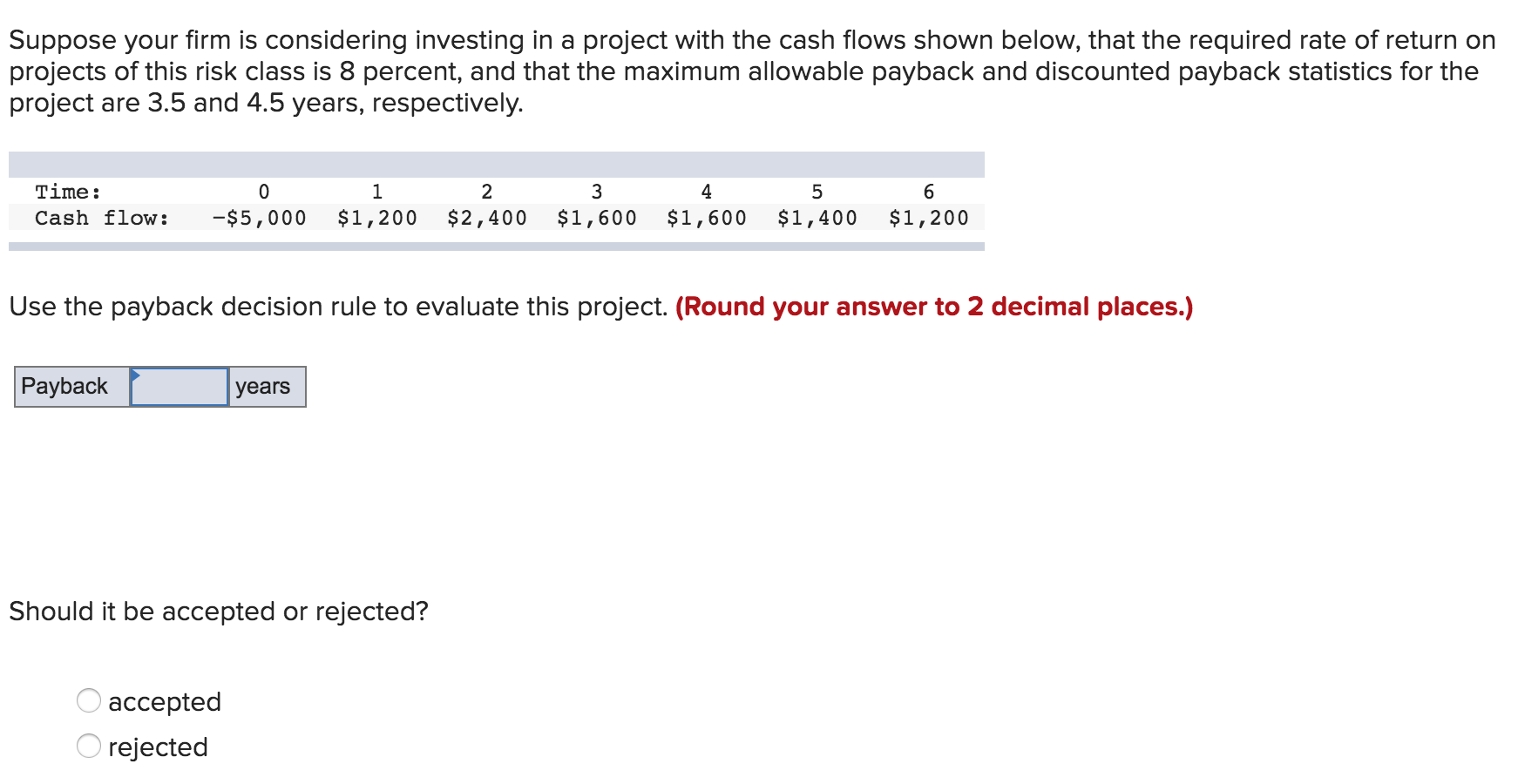

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: 3 Cash flow: 1 2 - 4 5 6 $5,000 $1,200 $2,400 $1,600 $1,600 $1,400 $1,200 Use the NPV decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistics for your company are 3 and 3.5 years, respectively. 0 2 Time: Cash flow: -$235,000 1 $65,800 $ 84,000 $141,000 4 5 $122,000 $81,200 Use the payback decision rule to evaluate this project. (Round your answer to 2 decimal places.) Payback years Should the project be accepted or rejected? O rejected O accepted Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: Cash flow: o 2 3 -$5,000 $1,200 $2,400 $1,600 4 $1,600 5 $1,400 6 $1,200 Use the payback decision rule to evaluate this project. (Round your answer to 2 decimal places.) Payback years Should it be accepted or rejected? O accepted O rejected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts