Question: NPV versus IRR [LO1, 5] Consider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow ( $23,000 12,000 9,360 10,400 Y) 0

![NPV versus IRR [LO1, 5] Consider the following two mutually exclusive](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe7ba04e9f6_82366fe7b9fa0d9e.jpg)

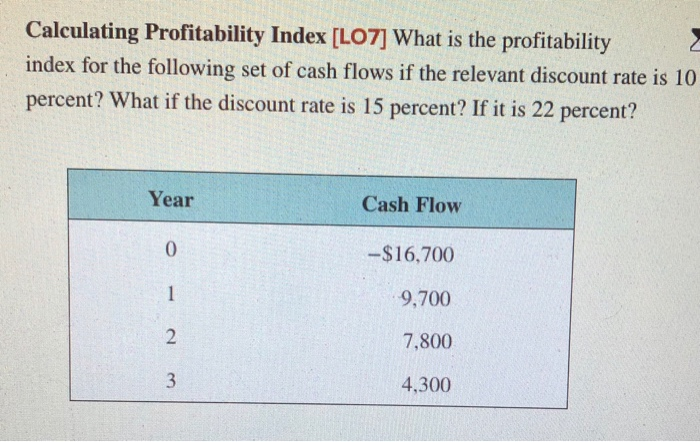

NPV versus IRR [LO1, 5] Consider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow ( $23,000 12,000 9,360 10,400 Y) 0 -$23,000 10,490 10,900 10,500 Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? Calculating Profitability Index [LO7] What is the profitability index for the following set of cash flows if the relevant discount rate is 10 percent? What if the discount rate is 15 percent? If it is 22 percent? Cash Flow -$16,700 9,700 7,800 4,300 Year 2 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock