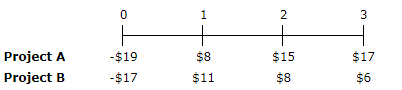

Question: NPV Your division is considering two projects with the following cash flows (in millions): a. What are the projects' NPVs assuming the WACC is 5%?

NPV Your division is considering two projects with the following cash flows (in millions):

a. What are the projects' NPVs assuming the WACC is 5%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

What are the projects' NPVs assuming the WACC is 10%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

What are the projects' NPVs assuming the WACC is 15%? Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative value should be indicated by a minus sign.

b. What are the projects' IRRs assuming the WACC is 5%? Round your answer to two decimal places. Do not round your intermediate calculations.

What are the projects' IRRs assuming the WACC is 10%? Round your answer to two decimal places. Do not round your intermediate calculations.

What are the projects' IRRs assuming the WACC is 15%? Round your answer to two decimal places. Do not round your intermediate calculations.

0) $15 Project A$19 Project B-$17 $8 $11 $17 $6 $8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts