Question: NSTRUCTIONS: Choo the answer that best completes the statement or answers the question. 1. Which of the following is (are) among the probable disadvantages of

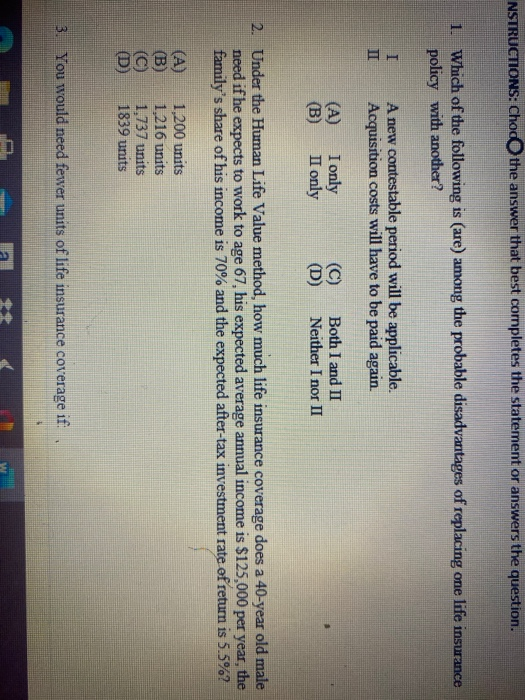

NSTRUCTIONS: Choo the answer that best completes the statement or answers the question. 1. Which of the following is (are) among the probable disadvantages of replacing one life insurance policy with another? I II A new contestable period will be applicable. Acquisition costs will have to be paid again. (A) I only II only (C) (D) Both I and II Neither I nor II (B) 2. Under the Human Life Value method, how much life insurance coverage does a 40-year old male need if he expects to work to age 67, his expected average annual income is $125,000 per year, the family's share of his income is 70% and the expected after-tax investment rate of return is 5.5%? (A) (B) (C) (D) 1,200 units 1,216 units 1,737 units 1839 units 3. You would need fewer units of life insurance coverage if

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts