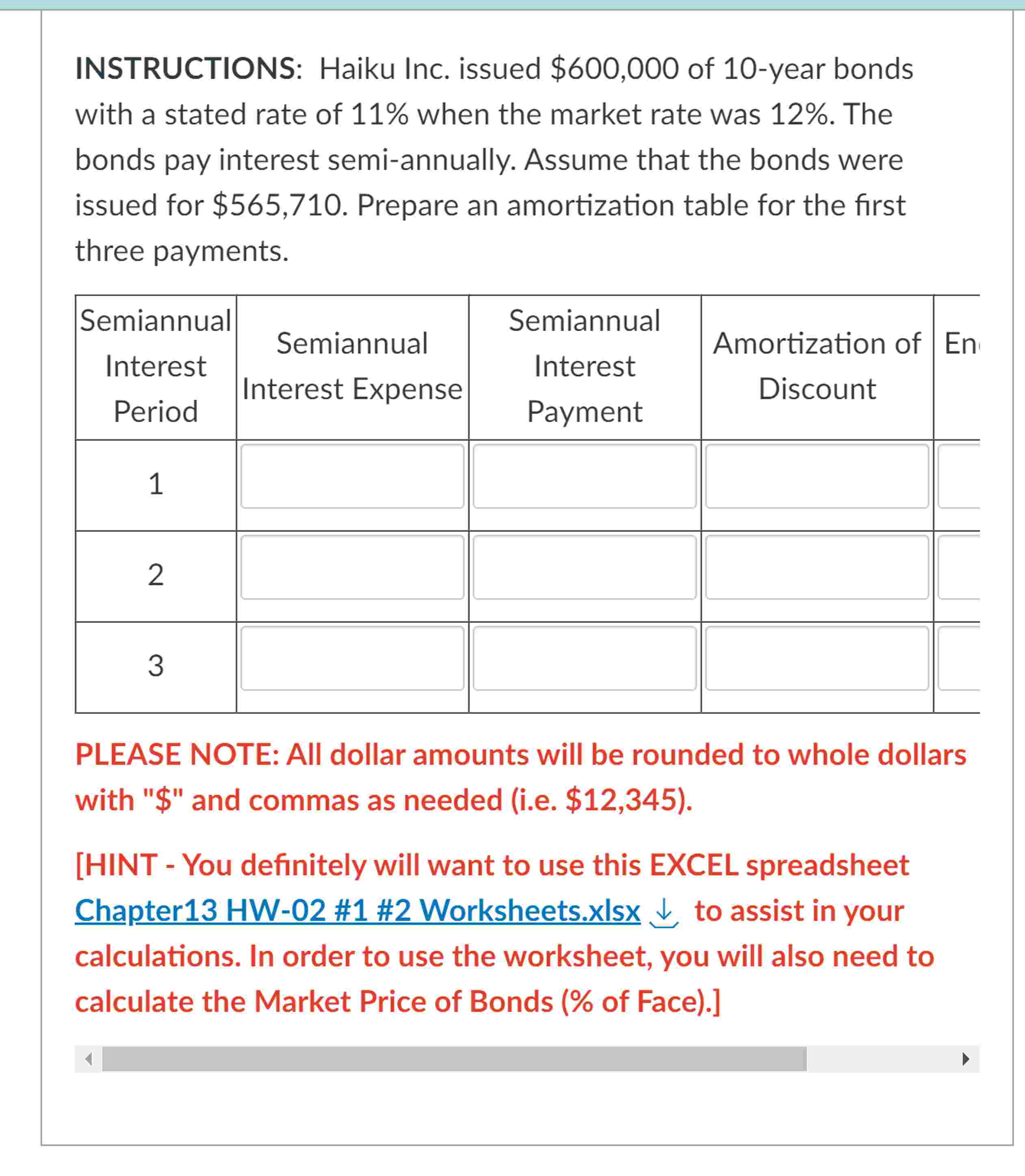

Question: NSTRUCTIONS: Haiku Inc. issued $ 6 0 0 , 0 0 0 of 1 0 - year bonds vith a stated rate of 1 1

NSTRUCTIONS: Haiku Inc. issued $ of year bonds vith a stated rate of when the market rate was The sonds pay interest semiannually. Assume that the bonds were ssued for $ Prepare an amortization table for the first hree payments.INSTRUCTIONS: Haiku Inc. issued $ of year bonds with a stated rate of when the market rate was The bonds pay interest semiannually. Assume that the bonds were issued for $ Prepare an amortization table for the first three payments.

tabletableSemiannualInterestPeriodtableSemiannualInterest ExpensetableSemiannualInterestPaymenttableAmortization ofDiscountEn

PLEASE NOTE: All dollar amounts will be rounded to whole dollars with $ and commas as needed ie $

HINT You definitely will want to use this EXCEL spreadsheet calculations. In order to use the worksheet, you will also need to calculate the Market Price of Bonds of Face

tabletableSemiannualInterestPeriodtableSemiannualInterest ExpensetableSemiannualInterestPaymenttableAmortization ofDiscountEnc

'LEASE NOTE: All dollar amounts will be rounded to whole dollars vith $ and commas as needed ie $

HINT You definitely will want to use this EXCEL spreadsheet hapter # # Worksheets.xlsx darr to assist in your :alculations. In order to use the worksheet, you will also need to :alculate the Market Price of Bonds of FaceINSTRUCTIONS: Haiku Inc. issued $ of year bonds with a stated rate of when the market rate was The bonds pay interest semiannually. Assume that the bonds were issued for $ Prepare an amortization table for the first three payments.

Semiannual Interest Period Semiannual Interest Expense Semiannual Interest Payment Amortization of Discount Ending Carrying Value

PLEASE NOTE: All dollar amounts will be rounded to whole dollars with $ and commas as needed ie $

HINT You definitely will want to use this EXCEL spreadsheet Chapter HW # # Worksheets.xlsx Download Chapter HW # # Worksheets.xlsx to assist in your calculations. In order to use the worksheet, you will also need to calculate the Market Price of Bonds of Face

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock