Question: nstructions Note: This problem is for the 2 0 2 3 tax year. Daniel B . Butler and his spouse Freida C . Butler file

nstructions

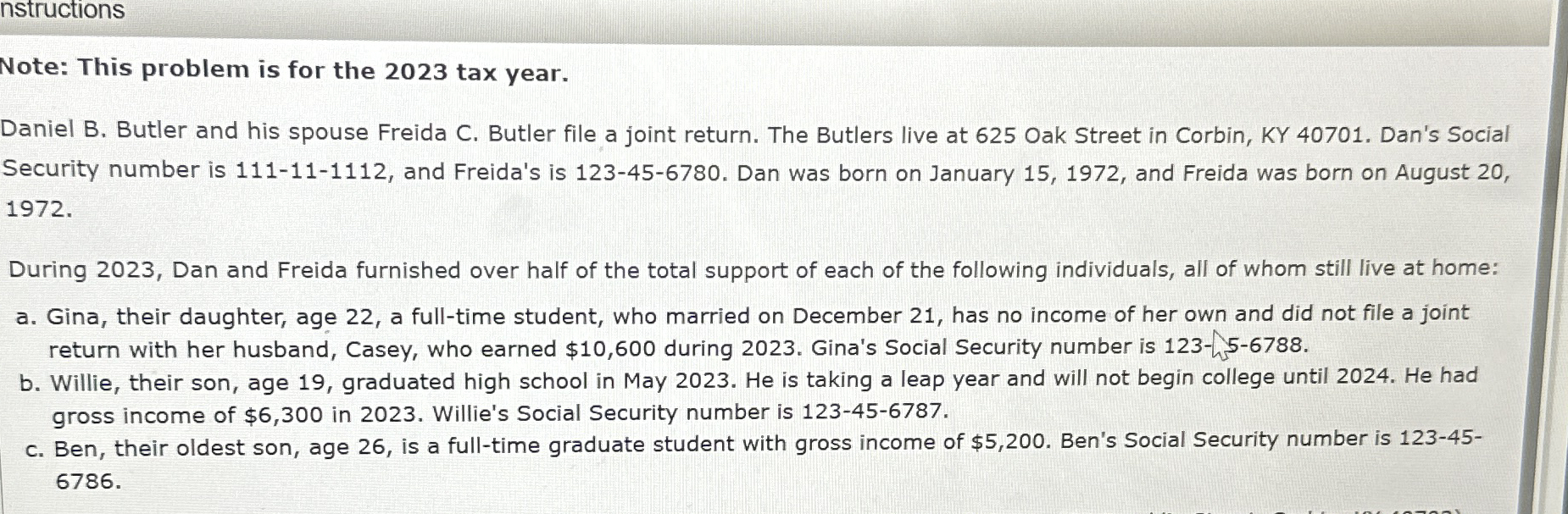

Note: This problem is for the tax year.

Daniel B Butler and his spouse Freida C Butler file a joint return. The Butlers live at Oak Street in Corbin, KY Dan's Social

Security number is and Freida's is Dan was born on January and Freida was born on August

During Dan and Freida furnished over half of the total support of each of the following individuals, all of whom still live at home:

a Gina, their daughter, age a fulltime student, who married on December has no income of her own and did not file a joint

return with her husband, Casey, who earned $ during Gina's Social Security number is h

b Willie, their son, age graduated high school in May He is taking a leap year and will not begin college until He had

gross income of $ in Willie's Social Security number is

c Ben, their oldest son, age is a fulltime graduate student with gross income of $ Ben's Social Security number is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock