Question: nt: Chapter 20 Hybrid Financing Assignment Score: S0.53% Save Exit Submit Assignment for Grading Problem 20.04 Question 8 ot 9 Check My Work (No more

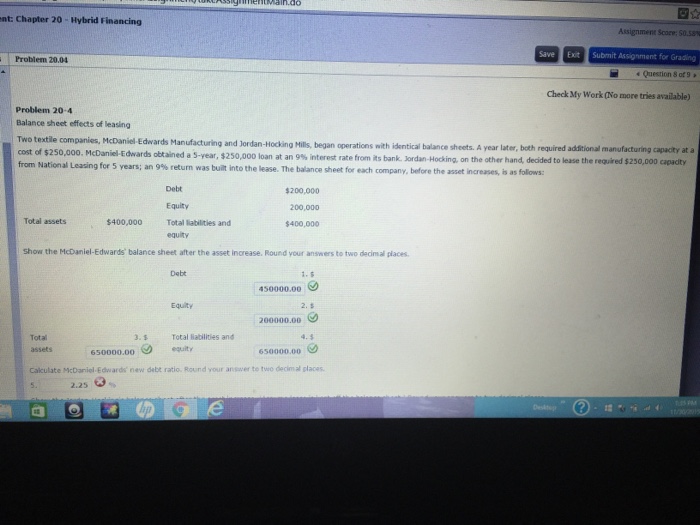

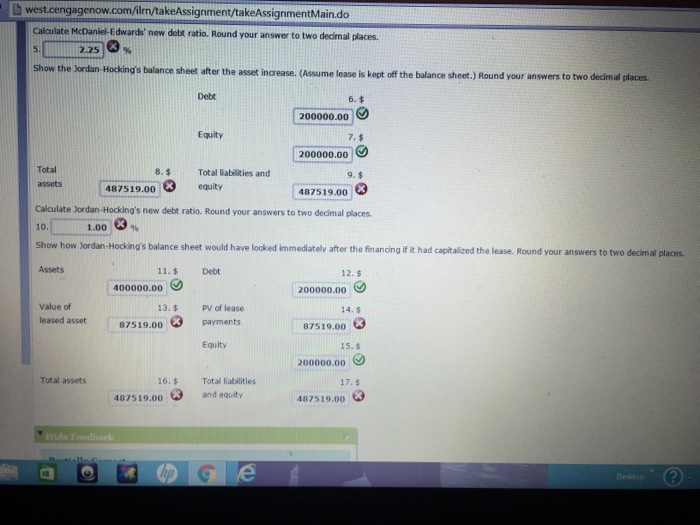

nt: Chapter 20 Hybrid Financing Assignment Score: S0.53% Save Exit Submit Assignment for Grading Problem 20.04 Question 8 ot 9 Check My Work (No more tries available) Problem 20-4 Balance sheet effects of leasing Two textile companies, M cost of $250,000. McDaniel-Edwards obtained a 5-year, $250,000 loan at an 9% interest rate from its bank. Jordan-Hocking, on the ather hand, decided to from National Leasing for 5 years; an 9% return was built into the lease. The balance sheet for each company, before the set ia McDaniel- Edwards Manufacturing and Jordan-Hocking Hills, began operations with identical balance sheets. A year later, both required additional manufacturing capacity at a lease the requred $250,000 capacity The balance sheet for each company, before the asset increases, is as follows Debt $200,000 200,000 400,000 Equity Total assets $400,000 Total labilities and equity show the McDaniel-Edwards' balance sheet after the asset increase. Round your answers to two decim al places. Debt 450000.00 Equity 2.s 200000.00 Total 3.$ Total Babilities and 3.s Total assets 65.0 equity 650000.00 egrity 650000.00 Calculate McDaniel-Edwards new debt ratio, Round your answer to two decimal glaces 5. 2.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts