Question: nt: HW - Uny Assignment Score: 0.00% Save Submit Assignment for Grading MC.09.033 Question 3 of 16 A-Z Check My Work go Which of the

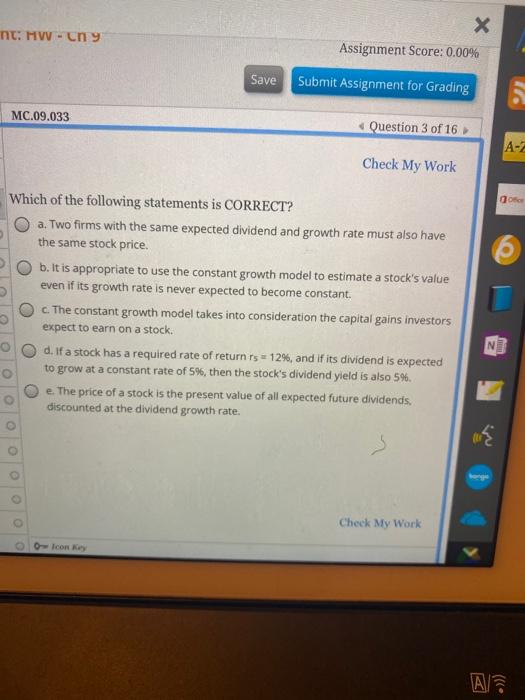

nt: HW - Uny Assignment Score: 0.00% Save Submit Assignment for Grading MC.09.033 Question 3 of 16 A-Z Check My Work go Which of the following statements is CORRECT? a. Two firms with the same expected dividend and growth rate must also have the same stock price. b. It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant. c. The constant growth model takes into consideration the capital gains investors expect to earn on a stock. d. If a stock has a required rate of return rs = 12%, and if its dividend is expected to grow at a constant rate of 5%, then the stock's dividend yield is also 5%. e. The price of a stock is the present value of all expected future dividends. discounted at the dividend growth rate. N Check My Work Icon AS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts